To increase your credit score, you want to focus on what you can change the quickest. Credit utilization is the second largest factor in your credit score. And it is the one you have the most control over on a monthly basis. Simply put, the lower your balances versus the amount of credit you have, the better your score will be. We’re going to discuss everything you need to know to increase your credit score by controlling your credit utilization rate.

What Is Credit Utilization Ratio?

Credit utilization ratio is a fancy term for saying how much of your credit limits are you using. This number is the second biggest factor in calculating your credit score. In fact, it makes up 30 percent of your FICO score, so you need to pay attention to this ratio.

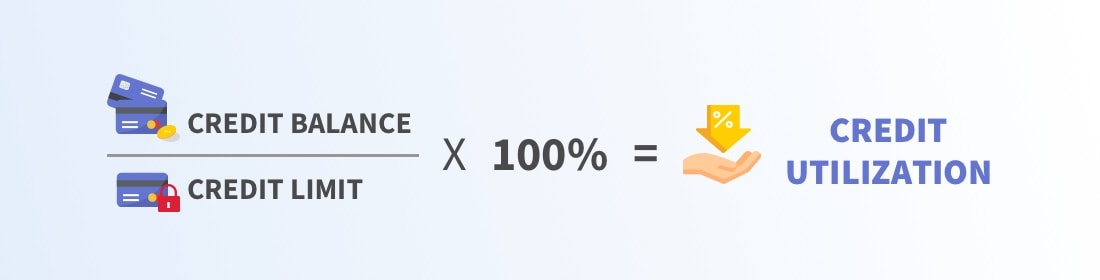

How Do You Calculate Credit Utilization Rate?

To calculate the credit card utilization rate, take the balance you have on each credit card and divide by that credit card’s credit limit, then multiply by 100.

For example, if you have $2,000 balance on a credit card with a $10,000 limit, you would have a 20 percent credit utilization ratio ($2,000 / $10,000 x 100 = 20 percent).

The Types of Credit Accounts

When calculating your credit score, the credit bureaus look at the credit utilization rate of each credit card and across all of your revolving credit accounts.

Revolving credit accounts are accounts that do not have a fixed payment each month, such as credit cards, charge cards and lines of credit.

Installment debt is the other type of credit account. These would be loans such as a mortgage, car loan, student loan or consolidation loan.

How Does Credit Card Utilization Ratio Affect My Credit Score?

The more of the credit limit that you use, the lower your credit score will be. To increase your credit score, you want your credit card utilization ratio to be as low as possible.

The reason why credit utilization ratio has such a dramatic impact on your credit score is that banks are worried about you not paying your bills. As your credit utilization ratio goes higher, so do the minimum payments on that debt. If this trend continues, at some point you will have a hard time making the payment and could default on the debt. Defaulting is the technical term for saying “sorry, I can’t pay you.”

Credit card utilization rate and your credit score have an inverse (or seesaw) relationship. If credit utilization goes up, your credit goes down. If credit utilization goes down, your score goes higher.

But I Pay Off My Credit Cards Each Month…

If you’re like me and pay off your credit cards in full each month, congratulations! You are avoiding paying the banks any more interest than you need to. And, hopefully, you are earning some awesome rewards from your credit cards. If not, check out our list of

Just because you pay your credit cards off each month, that doesn’t mean that you have a low credit utilization ratio. Banks often report the balance from your statement to the credit bureaus. If your statement shows a balance from this month’s purchases, that will reflect in your credit utilization.

For example, say your statement balance on August 1st is $2,000 and the due date is August 28th. Your credit limit is $10,000. For the month of August, your utilization will be 20 percent. During the month, you charge another $4,000, but you pay off the $2,000 balance on August 28th. When your statement closes and the bank updates the credit bureaus, you now have a 40 percent credit utilization ratio even though you paid your statement balance in full.

Paid in Full vs. Carrying a Balance

When you look at your credit report, there is no way to tell whether you pay off your balance in full each month or if you carry a balance.

These two people look identical on a credit report:

- Larry is employed and charges $2,000 a month on his $10,000 credit card and pays off the balance in full on the due date.

- Sam lost his job and no longer uses his credit cards. He is carrying a $2,000 balance and only pays the minimum due each month until he can find a new job.

Crazy, right?

But, when banks update the credit bureaus, the main information provided is:

- The current balance

- The credit limit

- When the account was opened

- The minimum payment due

- Whether the account is current

Technically, there is some additional information, but these are the main facts. Nowhere does it differentiate if the borrower is carrying a balance or paying in full. I understand that the credit bureaus are looking to make this change, but it hasn’t been implemented just yet.

Should I Aim for 0% Credit Utilization Ratio?

Well, that means that you should aim for a 0% credit card utilization, right? Should I just switch to paying everything with cash, debit cards and checks, or pay off my credit card immediately after every use?

No and no.

There’s a saying that “there can be too much of a good thing.” In this case, if you keep your credit card balances at zero, it will seem as if you never use your credit cards. The banks (right or wrong) will assume that you don’t use them because you cannot handle the responsibility. And because of that, a person with a 1% credit utilization ratio will have a higher credit score than someone that has 0%.

So What is a Good Credit Utilization Ratio?

Fact or Fiction: Keeping Credit Utilization Under 30% Is Ideal

The rule of thumb is that you should keep your credit utilization below 30 percent to have the best credit score. In reality, there is no set number for the ideal credit utilization.

However, your credit score will increase the lower you keep your credit utilization.

Think of it as an airplane taking off at the airport. With utilization high, your score will bounce around the bottom (the runway). As you pay off debt, your credit utilization ratio shrinks and your score begins to increase (the plane lifting off). Once you get to a low utilization, your score will hover in the clouds.

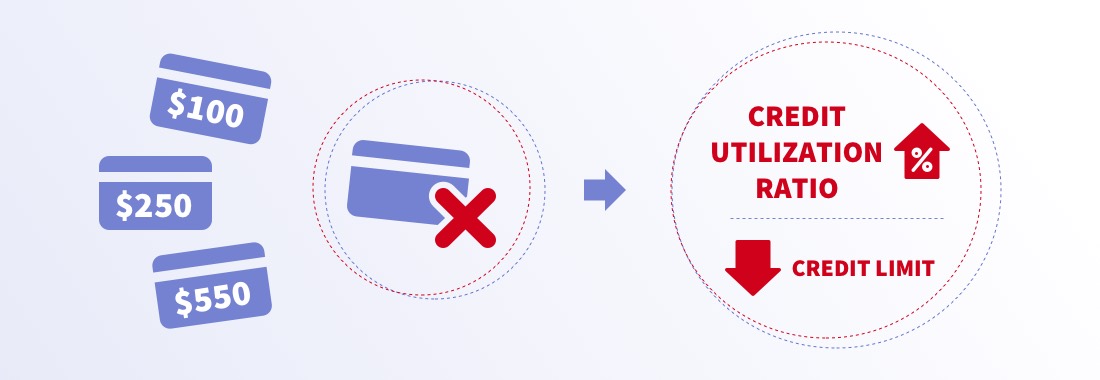

What Happens If I Close a Credit Card?

Closing a credit card can really hurt your credit utilization and credit score. Seems really counter-intuitive, right?

When you close a credit card and reduce your available credit limits, it increases your utilization.

When I was in college, I made the mistake of closing several credit cards that I was no longer going to use. I had paid off those credit cards and I didn’t want to make the mistake of getting into debt again. The customer service person warned me, but I didn’t listen. Sure enough, 4 to 6 weeks later when I checked my credit score, it had dropped!

Downgrade to a No Annual Fee Credit Card

Now, if I have a credit card that I don’t plan on using and don’t want to pay the annual fee, I will switch it a

As a bonus, when you change from one credit card to another, this won’t affect your ability to earn the bonus from that credit card. The only exception is Citibank, which prohibits you from earning the bonus if you’ve opened or closed a credit card within a family of cards (i.e., American Airlines or ThankYou points cards) within the last 24 months. But, you were going to close the card anyway, so it would have still been affected by their 24-month rule.

Transfer the Credit Limit

Some banks won’t allow you to downgrade a credit card you are looking to close. Or, sometimes, there just aren’t any that seem appealing. In this case, what I do is ask to transfer the credit limit from the credit card you are closing to one that you are keeping open.

This will help your credit utilization in two ways:

- You don’t lose the available credit in your overall portfolio

- If you have a balance on the credit card you are transferring to, that card’s utilization ratio will decrease.

The Best Ways to Improve Credit Utilization

Here are the best ways to improve credit utilization to increase your credit score.

Pay Down Your Balances

Take a look at all of your credit cards and select the ones with the highest credit utilization. Pay those down first. This will help reduce your overall debt load and it will improve the utilization of that specific card giving an extra boost to your score.

Make Payments Mid-Month

This is especially helpful if you are carrying balances from month-to-month and paying interest on the debt. Whenever you make additional payments mid-month, not only are you lowering your credit utilization ratio, you are also reducing the average daily balance upon which interest charges are calculated.

Even if you only have an extra $25, $50 or $100, the additional payments will add up and make a big improvement over time.

When I am getting ready to apply for a loan for one of my rental properties, I will pay down all of my credit cards as close to zero as possible. This will lower my utilization, boost my credit score and reduce my debt-to-income ratio (DTI). DTI is the ratio of the minimum payments I have to make on all loans and credit cards versus my income. The lower this number is, the easier it is to get approved for a new loan.

Request a Credit Limit Increase

Even if you aren’t able to pay off your balances right away, there’s still a way you can reduce your credit utilization and improve your credit score. Contact your bank and request a credit limit increase. If you’re approved, you’ll immediately reduce your credit utilization.

For example, if you owe $5,000 on a $10,000 credit card, you would have a 50 percent credit utilization. By receiving a credit limit increase to $12,500, you have now reduced your credit utilization to 40 percent.

Consolidate Your Debt

By consolidating your credit card debt with a

As we talked about, don’t close your credit cards because that will lower your available credit and reduce your credit score. To ensure that you don’t get into trouble with debt by charging on those credit cards again, lock them up in a safe, bank safety deposit box or even freeze them in a glass of water so that they are not easy to gain access to.

Apply For a New Credit Card

Just like increasing the credit limit on an existing credit card can improve your credit utilization and credit score, so can applying for a new credit card. When you apply for a new credit card, your credit score will temporarily go down by 3 to 5 points due to the new inquiry. It will quickly start to go up, though, because you’ve now reduced your credit utilization thanks to the new credit limit.

Here is a list of the

Credit Utilization Changes All of the Time

Your credit score is a living and breathing number. It doesn’t stay still for long because banks are updating the credit bureaus on a regular basis.

Your credit utilization can change throughout the month based on when the banks report updated information to the credit bureaus. Just because your score is good or bad today, it doesn’t mean that it will be the same a couple weeks from now.

What Are My Next Steps?

The first thing you should do is take an inventory of all of the credit cards that you have. Make a list of the credit cards, each cards’ current balance and their credit limits. Calculate your credit utilization for each credit card individually. Then add up all of the balances and all of the credit limits to calculate the credit utilization across all of your credit cards.

Now you’ll want to pick out which credit cards are hurting your credit score the most. In other words, which credit cards have the highest utilization? These are the cards you want to focus on first! Consider one (or more) of these options: pay down the balances, ask for a credit limit increase, apply for a debt consolidation loan or