But like all credit, it takes time — and wise decisions — to build a respectable credit score.

Make no mistake, though – establishing business credit is as important to your business as a phone number or website. A high credit score gives your business access to loans and lines of credit necessary for growth, payroll or the acquisition of supplies, lower interest rates and cheaper insurance premiums. And, because business credit reports are public records, clients, suppliers and others rely on them to make decisions on firms they do businesses with.

So, learning how to build business credit – or to build business credit fast – is a primary goal of the small-business owner looking to grow.

This article will cover

- Step 1: Getting Started Building Business Credit

- Step 2: Apply for a Business Credit Card

- Step 3: Check Your Business Credit Report Regularly

- Step 4: Always Pay Your Creditors on Time

- Step 5: Improve Your Credit Score to Build Business Credit Fast

When you see to establish a

Let’s consider five steps in building business credit that can help you build credit fast by establishing a business credit card, and then using it strategically and paying it off quickly:

Step 1: Getting Started Building Business Credit

First step: Establish your business and either incorporate it or form a limited liability company, an LLC.

Once you have that, you’ll need a federal Employer Identification Number (EIN) for tax purposes. It’s basically the equivalent of a Social Security number, only for your business.

Once you have your EIN in hand, apply to Dun & Bradstreet for your free DUNS Number. It establishes your company’s D&B credit file and is necessary for any business that hopes to contract with the U.S. government. Even if you don’t have any plans of contracting with federal agencies, a DUNS number can be helpful when it comes to other companies researching you as a potential customer or supplier.

Finally, open business checking and savings accounts, since you will obviously need them for salaries, purchases, and other expenses. A business bank account might require incorporation/LLC documents, so check with your chosen bank first before you show up.

Step 2: Apply for a Business Credit Card

The primary reason you want a business credit card is to build your business credit history since card issuers will report positive and negative information on your payment history and credit usage to the various credit bureaus.

You don’t need to run a multi-million-dollar company to obtain a business credit card. Based on your own, personal credit history, you can apply for a business credit card even if you don’t yet have revenue, which, by the way, is a great reason to maintain excellent, personal credit. (For more information on requirements for obtaining a business credit card, click here.)

A business credit card that you use wisely is a great way to establish and build credit that can, then, help you grow your company over time.

Pros of Business Credit Cards

- Earn extra

rewards andsignup bonuses High credit limits - Cards without credit limits, or

0% intro APRs , can help you launch your business - A financial safety net, and allows you to better manage your cash flow

- Build business credit fast for future expansion

Collect points earned on cards for employees- Avoid high personal credit utilization due to business expenses

Cons of Business Credit Cards

- Potentially high annual fee

- Personal liability for business charges

- Could negatively affect your personal credit scores

Often come with high interest rates. The CARD Act of 2009 that protects consumers from retroactive rate increases and fees, doesn’t apply to business cards, though many still offer these guarantees — so read the fine print.

How Business Credit Cards Affect Personal Credit Scores

Business cards don’t always impact personal credit scores, though they certainly can. Either way, missing payments will typically incur late fees and interest charges that you – or your business – is on the hook for. So spend wisely.

Here’s a look at the business-card credit-reporting practices of major card issuers:

- American Express: Reports if your account isn’t in good standing.

- Bank of America: Reports if the account is delinquent.

- Barclays: May choose to report, depending on the situation.

- Capital One: Reports account activity.

- Chase: Reports if the account is more than 60 days delinquent.

- Citi: May not report account activity.

- Wells Fargo: May not report account activity.

If you are worried that a business card could impact your personal credit score, talk to the bank where you are applying to understand its rules of operation when reporting card activity to the credit-scoring agencies.

One of our favorite business credit cards is the Capital One Spark Cash for Business /Capital One Spark Cash Select for Business.

Here are the ones we think are the best for 2019:

| Capital One Spark Cash for Business | Best for simple cash back rewards |

| Ink Business Cash Credit Card | Best business card with no annual fee |

| Capital One Spark Miles for Business | Best for frequent business travelers |

| CitiBusiness/ AAdvantage Platinum Select World MasterCard | Best business card for airline miles |

| Capital One Spark Classic for Business | Best for fair or average credit |

Step 3: Check Your Business Credit Report Regularly

Just as you should regularly check your personal credit report, you should regularly check your business credit as well, once you have established business credit or a business credit card.

You want to correct any errors immediately since those errors can result in higher interest rates and other negative impacts. Or they can be evidence of fraud that you will want to catch early.

Federal law requires the credit bureaus give you access to your personal credit report, for free, once a year. That’s not the case with business credit, You’ll pay a fee.

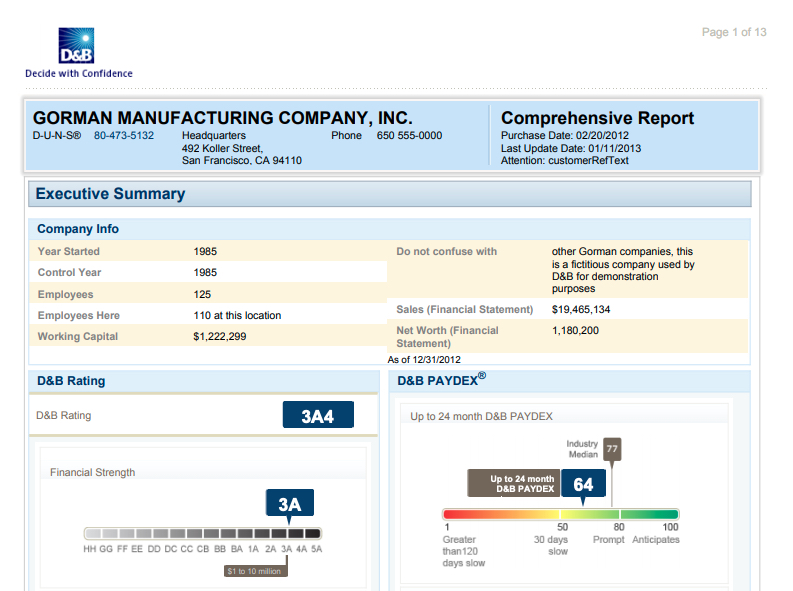

Here’s an example of a Dun & Bradstreet risk-assessment report, similar to a personal credit report:

Along with information similar to a personal credit report, business credit reports also include public records such as bankruptcies and tax liens. Business credit scores range from zero to 100.

A score near 75 is ideal, though Experian says the average business credit score is 62.

You can check your business credit report as often as you’d like, but you’ll typically have to pay a fee.

Experian offers a credit report starting at $39.95, while Dun & Bradstreet offers unlimited access to your business credit report and score starting at $149 per month.

Step 4: Always Pay Your Creditors on Time

When it comes to a business credit score, Experian says the No. 1 factor is:

“Pay your creditors on time. Historical payment behavior with previous creditors plays a major role in determining your business credit score.”

So don’t miss payments, even if you can only afford the minimum.

Other factors include:

- Negative public records, such as collections, liens, judgments and bankruptcies

- The status, frequency and dollar amounts of any liens, judgments, or bankruptcies

- A trend toward increasingly slow repayment of debts

- An increasing number of business credit applications

The number of trade experiences, balances outstanding, payment habits, credit utilization, and trends over time. Years in business, line of business or Standard Industrial Classification (SIC), size of the business and other demographic data.

Negative marks can remain on your business credit report for some time.

For example:

- Bankruptcies remain for 10 years

- Judgments for seven years

- Tax liens for seven years

- Collections for six years and nine months

- UCC filings for five years

- Bank, government and leasing data for 36 months

- Trade data for 36 months

- Credit inquiries for nine months

Step 5: Improve Your Credit Score to Build Business Credit Fast

Business credit scores fluctuate for all sorts of reasons beyond on-time payments.

The best — and only — way to improve your business credit score, and to build business credit fast, is by paying your bills on time, and by decreasing your credit utilization. You can do that by either paying down existing balances, by opening a new line of credit (which increases the amount of credit you have relative to the debt you owe) or by asking your business credit-card company for a larger credit line.

The best way to build credit fast: Obtain any business credit card you can, then make small purchases you can easily repay … and repay those purchases on time, every month. Soon your credit score will be stellar and climbing.

Ask Suppliers to Report Your Payment History

Vendors you work with will typically provide “trade credit,” that is they extend you credit from time you take delivery of supplies until you pay.

So, when talking to your potential or existing vendors, ask if they report your payment history to a business credit bureau. Some don’t always do so, but generally will if you request it.

Use a Business Credit Card for Day-to-Day Expenses

Put printer ink, internet service and other day-to-day payments for running your business on your

Choose Business Lenders that Report to Credit Bureaus

A business loan can give your business credit a boost, so long as you pay it back on time and in full.

Banks and online lenders routinely report borrowers’ repayment histories. So, a quick way to build your credit fast, or to quickly improve your credit history is to take out a small loan, for a short period, then stick the cash in an account and use it to repay the loan over just a few months. You’ll pay a little bit of interest, but consider that the cost of building your credit history, or improving your credit.

Summary

Business credit is crucial for managing and growing a small business. And just as good credit is in important for maintaining strong personal finances in your daily life, maintaining good business credit is important to the health of your business.

By following the five steps we’ve laid out, you can establish a business credit card and begin to build strong credit that will solidify you as a reputable company when it comes to dealing with customers and suppliers.

Let us know in the comments below the tricks you’ve used to improve your business’ credit history.