While many people struggle to improve their credit scores, there are some super prime consumers who have earned a perfect credit score of 850. The higher your credit score, the better terms you’ll get on loans and perks on your credit cards. But do you really need the highest credit score possible to get the best loan interest rates and credit card benefits? And what steps can you take to improve your credit score?

This article will cover

- What Exactly Is a Credit Score?

- What are the Credit Score Ranges?

- Which Credit Bureau Gives the Highest Score?

- Credit Score Statistics

- How Much can you Save with a Better Credit Score?

- You don’t Need Perfect Credit Score, just a Good One

- Who Has the Highest Credit Score

- How to Get the Highest Credit Score

- Ways to Improve Credit Score Beyond Paying on Time

- Best Credit Cards for any Credit

- Watch Our Video to See if You Really Need an 850 FICO Score

What Exactly Is a Credit Score?

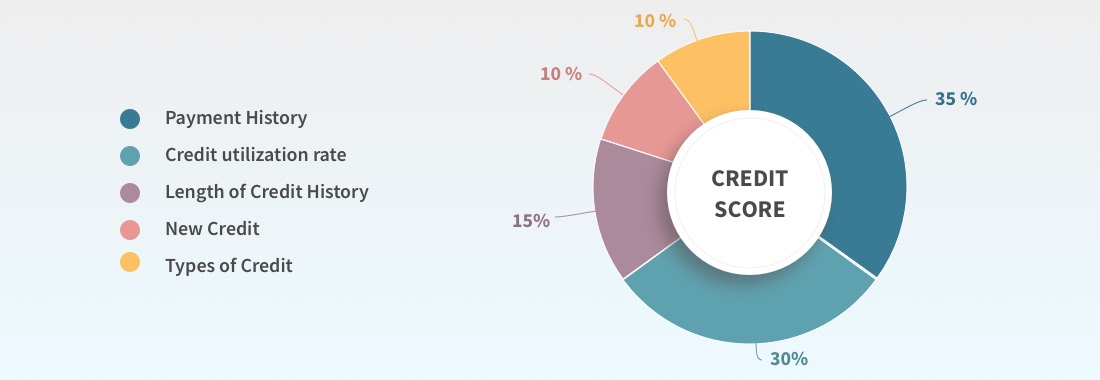

A credit score is similar to the grades you received in school. It is a cumulative score that is supposed to reflect how responsible you are with credit. Just like in school, some results weigh more heavily in your overall score.

Payment History

Your payment history is the largest factor in your credit score at 35%. This shows that lenders believe that your ability to pay your bills on time is the most critical thing you can do.

Credit Utilization

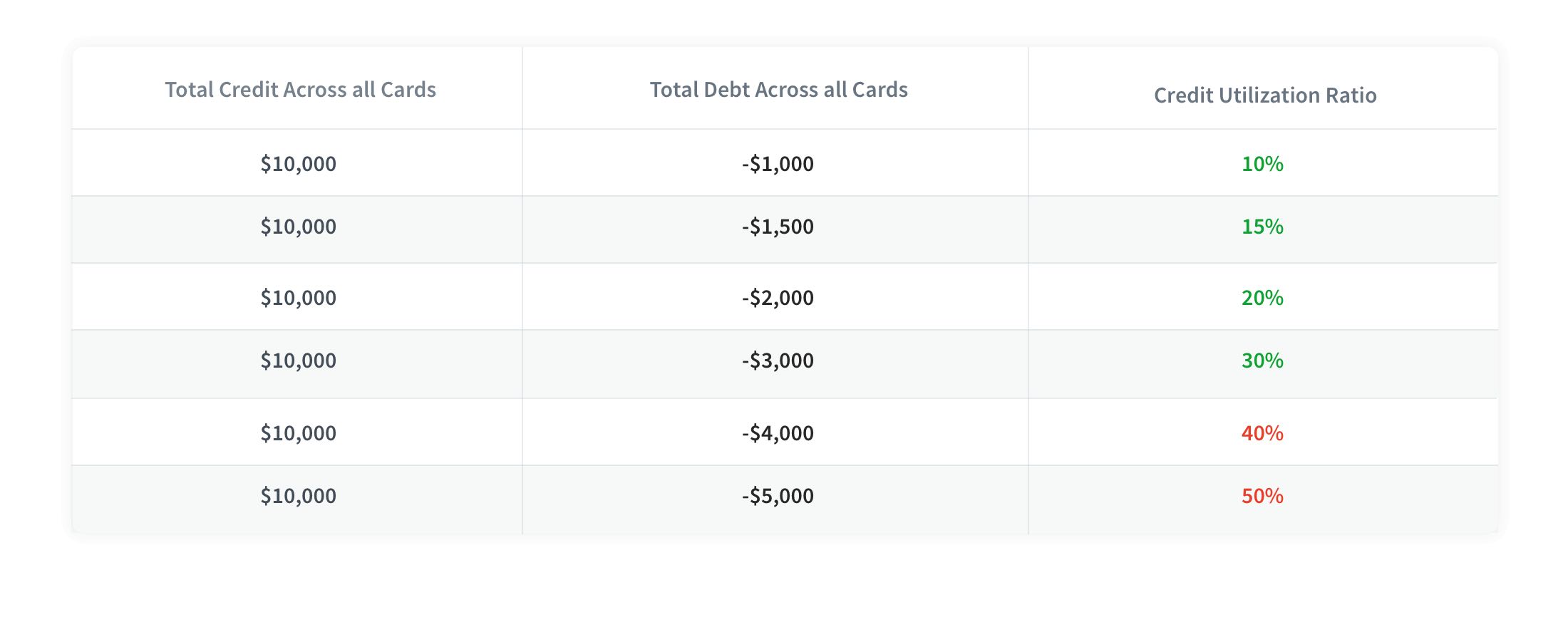

While some people believe that having a lot of debt reduces your credit score, that isn’t always true. What is more important is the ratio of the amount that you owe on credit cards and lines of credit compared to the credit lines that the banks have granted you. This is known as credit utilization and it is worth 30% of your credit score.

When calculating your credit utilization score, the credit bureaus look at both your overall debt vs. credit limit, but also how much of the credit line you are using on each credit card individually.

The utilization rate is calculated based on all credit cards you have, not just one. If you have three credit cards with a $1,000 limit each card and the outstanding balance on one of these cards is $300, your rate is 10% ($3,000/$300.) If your credit utilization is over 30%, you would need to get a credit card with a higher credit limit that the balance you are going to transfer in order to keep the utilization low.

As you can see, these two factors are 2/3 of your credit score. You cannot ignore the other pieces of the puzzle, but you need to focus the majority of your effort on your payment history and credit utilization to earn the max credit score.

Credit History

The average length of your credit history contributes 15% to your credit score. The longer that you have credit, the higher this number becomes. If you close your oldest accounts and apply for a bunch of new credit, those actions will reduce this portion of your credit score.

New Credit

New credit is a way of keeping track of how many credit inquiries you have made recently. Every time you apply for a new loan or credit card, you should expect your credit score to drop 3 to 5 points. If a lender sees that you’ve been applying for a lot of new credit recently, they may be cautious in approving your application.

The good thing is that credit inquiries only stay on your credit report for 24 months and generally only affect your credit score for 6 to 12 months.

Credit Mix

Lenders like to see that you have a diverse credit profile. They want to know that you can handle a fixed payment over time (like a mortgage or car loan) and that you’ll be responsible with a variable credit line (like a credit card or line or credit).

I’m focused on paying off all of my debt as quickly as possible. It was ironic that each time I paid off a fixed payment loan (i.e.: car loan, student loan, and rental property mortgages) over the lasts few years, my credit score actually dropped a little. My score has since recovered, but it felt like I was being punished for eliminating debt.

What are the Credit Score Ranges?

With the FICO model, credit scores range from 300 to 850. The more responsible you are with your credit, the higher your credit score will be.

To be approved for the best credit cards and receive the best loan terms, you should have a credit score of 740 or above. Having a credit score of at least 660 is required to get credit cards with good benefits.

If you want to know what is the highest credit score possible, it depends upon who you’re asking. FICO is not the only credit score that banks and others use to evaluate your credit history. Here are the credit score ranges used by major credit scoring models:

- FICO Score range: 300-850

- VantageScore 3.0 range: 300–850

- Experian’s PLUS Score: 330-830

- TransUnion New Account Score 2.0: 300-850

- Equifax Credit Score: 280–850

As you can see, the max credit score is 850 in most scoring models and credit scores start around 300. But the basic rule still applies… the higher your credit score, the better off you are.

Which Credit Bureau Gives the Highest Score?

It is tough to say which credit bureau gives the highest score because each of three main credit bureaus – Transunion, Equifax, and Experian – applies their own methodology to the pieces of your credit history. My credit score may be highest with Transunion, while somebody else’s could be highest with Experian. There is no right answer to this question. It all depends on your personal payment history, utilization ratio, average age, credit mix, and new inquiries.

Credit Score Statistics

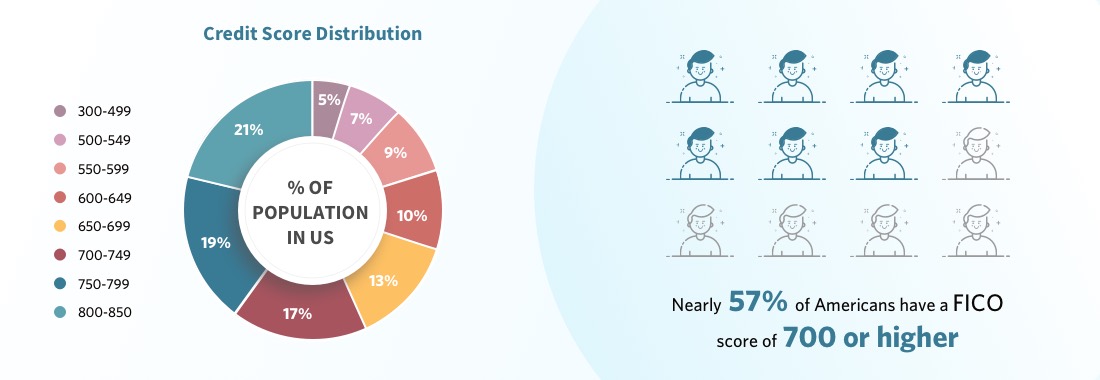

Consumers are taking the information available online and using it to improve their credit scores. According to FICO, for the first time ever, the average credit score reached 700 in 2017.

This is fantastic news that credit scores are recovering better than ever coming out of the Great Recession. However, the information is a little misleading. Here’s why.

Homeownership Rates Down

According to the St Louis Federal Reserve, homeownership rates peaked at 69.2% in 2004. Then the Great Recession hit in 2008 leading to foreclosures, short sales, and bankruptcies. Homeownership rates have declined for over a decade and the number of people who own their homes bottomed out in 2016 at 62.9%. That was the lowest rate since 1965! We have increased the rate to 64.3%, but we have a long way to go.

From that terrible economic cycle, people’s credit scores are still recovering. A lot of bad mortgage debt has been eliminated, but many consumers are still fearful of debt.

Unfortunately, foreclosures, short sales, and bankruptcies stay on a credit report for 7 to 10 years. Even though the Great Recession started over a decade ago, many people are just now starting to feel the relief from those negative items falling off of their credit report.

Retirees don’t Borrow as Much

As people retire, they don’t have as great of a need for debt as someone who is just starting out in their career or building a family.

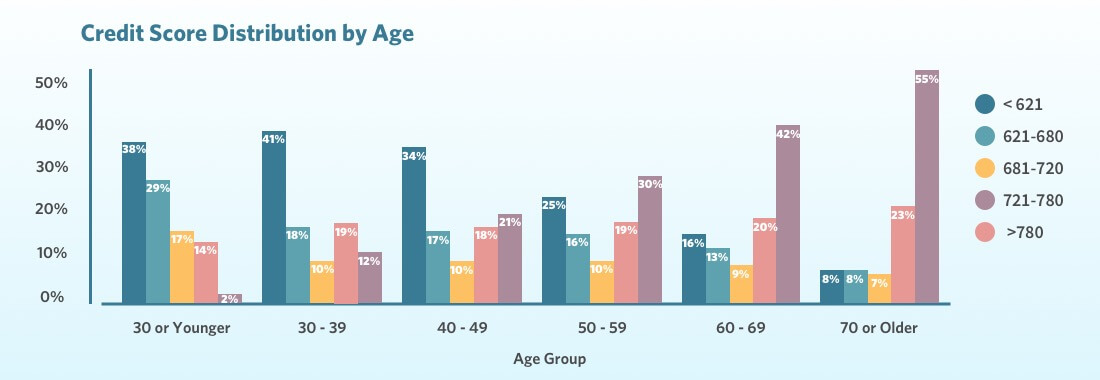

CreditKarma is a free credit score website that tracks consumer behaviors. As you can see from this chart, as you get older the average credit score increases. In fact, people 55+ and older have an average credit score that is 50 points higher than the next highest age group (ages 45-54).

This makes a lot of sense. While I have mortgage debt and use my credit cards every month to pay bills and earn rewards, my Mom (who is 74) has no debt and isn’t applying for new credit cards. She probably has a higher credit score than any of my friends.

And that people who are starting out in their careers, paying off student loans, buying homes, and starting families have the lowest average credit scores (ages 25-44). Their credit scores are even lower than people who are in college and have a limited credit history (ages 18-24).

Delinquencies are Rising

The St Louis Federal Reserve reports that real estate delinquencies are shrinking over the last 2 years. That’s great news, but how much of that is because of the hot real estate market?

Looking a little further into the statistics will show a different picture. Auto loans and bank credit cards with serious delinquencies (90+ days late) has been rising the past 2 years. Auto loan delinquencies have risen from 4.4% to 5.1% and credit card late payments have increased from 7.4% to 7.6% the past two years. The credit card increase is misleading because rates went down to 7.1% and have increased by 0.5% over the last 18 months.

How Much can you Save with a Better Credit Score?

Statistics show that nearly 57% of Americans have a FICO credit score of 700 or higher. But how much does your credit score really matter? Can you save money by having a better credit score?

Does a Better Credit Score Matter?

Obviously, your credit score is used when applying for a loan, mortgage, or credit card. But credit scores are used in other areas of life, including some you may not think about. Here are some other uses of credit scores:

- Auto insurance to determine rates

- Landlords or property managers when renting a home or apartment

- Utility companies

- Cell phone service providers

- Employers (especially in the banking and financial services industries)

- Government for security clearance

If your credit report is showing negative items or if your score is too low, bad things can happen. You may be declined for insurance or for an apartment. The utility company or cell phone provider may require a larger security deposit. Or you may not get the job or promotion that you have been wanting.

Can a Better Score Save you Money?

The simple answer is yes. A better score means that you are viewed as less of a credit risk.

When borrowing money, higher credit scores translate into lower interest rates and the opportunity to get approved for

When starting utilities for your home or getting a new cell phone, not having to pay a large security deposit means that money can be used to pay down debt or invest in your future.

A Consumer Reports study found that single drivers with good credit scores paid $68 to $526 more per year than drivers with excellent credit score. In fact, they found that your credit score has more an impact to auto insurance rates than any other single factor!

You don’t Need Perfect Credit Score, Just a Good One

The reality is that you don’t need a highest credit score to get the lowest interest rates, best loan terms, and fanciest credit card perks. If your credit score is above 660, then you’ll get average loan rates and credit card benefits.

To get the best loan terms and nicest credit card perks, shoot for a score of 740 or higher. Putting in a lot of effort to boost your credit score even higher won’t result in any additional financial benefits. The only thing you get with an 800+ FICO score is the ability to brag to your friends.

If you’re applying for a mortgage, speak with your banker or mortgage broker about “breakpoints” that are just above your current credit score. Often, loan programs with the best terms have minimum required credit scores to qualify. For people who are close to the next breakpoint, it could be worth it to pay down a balance, close an account, or take another action to give your credit score the boost it needs to qualify and save a lot of money over the life of your mortgage.

Who Has the Highest Credit Score

A 2011 study by SubscriberWise, a credit analytics and risk management company, found that less than 1% of Americans have achieved the highest credit score of 850.

Of their findings, the average person with an 850 FICO credit score was 61 years old with an average of 30 years of credit history. Unfortunately for those of us who are young, there’s nothing we can do but wait on this category. We can’t go back in time and apply for credit when we were a child to lengthen our credit profile.

The point here is that you can do everything right, but there are still some factors that are beyond your control in your pursuit of the perfect credit score.

How to Get the Highest Credit Score

There are many ways to improve your credit score. But, if you want to know how to get the highest credit score, that requires more focus and effort. The image below shows what you’ll need to have to get an 850 FICO score.

Ways to Improve Credit Score Beyond Paying on Time

Breaking this down further, there are steps you can take immediately to move your credit score towards perfection today, while others will take time.

Actions to Take Today

First off, you need to keep your credit report clean, so don’t get sued, miss payments, or default on any debts.

Set up automatic payments of at least the minimum amount due so that you’ll never miss a required payment. Once you have a late payment, it can take 7 to 10 years for it to fall off your credit report.

Pay down your credit cards as much as possible. Every dollar you pay down reduces any interest you are paying and gives your credit score a boost. Notice that these guidelines don’t say 0% utilization, they say 1% to 10%. Pay off your credit cards in full each month to avoid interest charges. Ideally, you’ll keep your utilization ratio to less than 30% on each card and below 10% across all cards throughout the month.

Consider asking for a higher credit limit. If you cannot pay off or reduce the balances on your credit cards right away, when you increase the credit limits on your credit cards, that will reduce your credit utilization. When this number goes down, your credit score goes up!

Don’t apply for new credit. Credit inquiries fall off your credit report after 2 years. So, if you have more than 3 credit inquiries, give it a little time. This will happen before you know it.

Avoid opening store credit cards. Yes, I know the savings offer when opening a new store card is enticing. But opening these store cards will impact your credit score in two ways – the credit inquiry and by reducing your average account age. Think about what you want more: a higher credit score or a one-time savings on a purchase?

If you do need to take on debt, mix it up a little. Have a diverse credit history consisting of mortgages, personal loans, and credit cards. People who have multiple types of credit borrowing have the best credit scores.

Actions that Take Longer

Other actions require a longer effort, similar to a marathon. If you want the best credit score, you have to put in the work.

Pay off debt to reach the 28% debt-to-income ratio (DTI). None of us have a magic bottle with a genie that can erase the debt for us. Instead, we need to resist taking on new debt, while being focused on paying off existing debt as quickly as possible.

There are two ways to reach an average age of 9 years in your credit history. One of them takes time, while the other requires closing new accounts. If you have two accounts that are 10 years old and one that is 1 year old, you have an average age of 7 years. That’s below the goal of 9 years. But, if you close the new account, your average age will now be 10 years. Voila!

The other way is to wait it out. Keep accounts that are older and let them mature. If the old credit cards have fees that you don’t want to pay, instead of closing the account, ask to convert it to a no-fee version and hold onto the account to help you boost your average age.

Best Credit Cards for any Credit

To inspire you to improve your credit score, we’ll show you the different types of credit cards that you can expect to be approved for based on the type of credit score that you have. As you can see below, people with the best credit scores will receive the best perks.

Credit Cards for Excellent Credit

People that have excellent credit score can expect to receive the highest sign-up bonuses and best benefits, such as the lowest interest rates and free hotel stays every year.

| Bank | Sign-Up Bonus | Annual Fee | Min Credit Score Needed | |

|---|---|---|---|---|

| Capital One Venture Rewards card | Capital One | 50,000 miles | $95 | EXCELLENT, GOOD |

| Savor Credit Card from Capital One | Capital One | $500 cash bonus | $0 first year, then $95 | EXCELLENT, GOOD |

| HSBC Cash Rewards Mastercard® credit card | HSBC Bank | $150 cash rewards | $0 | 680 |

| Citi Simplicity Card | Citi | - | $0 | 700 |

| Citi ThankYou Premier Card | Citi | 60,000 bonus points | $0 first year, then $95 | 745 |

| Quicksilver from Capital One | Capital One | $150 cash bonus | $0 | EXCELLENT, GOOD |

| Citi Diamond Preferred Card | Citi | - | $0 | 690 |

| Capital One VentureOne Rewards card | Capital One | 20,000 bonus miles | $0 | EXCELLENT, GOOD |

| HSBC Gold Mastercard® credit card | HSBC Bank | - | $0 | 680 |

| SavorOne Credit Card from Capital One | Capital One | $150 cash bonus | $0 | EXCELLENT, GOOD |

| Barclaycard Arrival Plus World Elite | Barclays | 60,000 bonus miles | $89 | 700 |

Credit Cards for Good Credit

What is a good credit score? A good credit score is one that falls between 670 and 739.

When you have a good credit score, you’ll get some great perks like sign-up bonuses that will pay for a couple of flights or a few nights in a hotel for free. The interest rates and fees won’t be as good, but your benefits will be worth any annual fees you may pay.

| Bank | Sign-Up Bonus | Annual Fee | Min Credit Score Needed | |

|---|---|---|---|---|

| HSBC Cash Rewards Mastercard® credit card | HSBC Bank | $150 cash rewards | $0 | 680 |

| Capital One VentureOne Rewards card | Capital One | 20,000 bonus miles | $0 | EXCELLENT, GOOD |

| HSBC Gold Mastercard® credit card | HSBC Bank | - | $0 | 680 |

| Quicksilver from Capital One | Capital One | $150 cash bonus | $0 | EXCELLENT, GOOD |

| Barclaycard Arrival Plus World Elite | Barclays | 60,000 bonus miles | $89 | 700 |

| SavorOne Credit Card from Capital One | Capital One | $150 cash bonus | $0 | EXCELLENT, GOOD |

Credit Cards for Fair Credit

Your credit is improving, but you still need a little help. Keep up the good work and your efforts will be recognized by the banks. At this stage, it is a combination of putting negative items further back in the rearview mirror, while making positive credit behaviors today. For example, there are credit cards that reward you with a higher limit after you’ve paid on time for several months.

| Bank | Sign-Up Bonus | Annual Fee | Min Credit Score Needed | |

|---|---|---|---|---|

| Capital One® Platinum Credit Card | Capital One | - | $0 | AVERAGE, FAIR, LIMITED |

| First PREMIER® Bank Credit Card | First Premier Bank | - | See Issuer Website | 550 |

| QuicksilverOne Cash Rewards Credit Card Capital One | Capital One | - | $39 | AVERAGE, FAIR, LIMITED |

Credit Cards for Limited/No Credit

Everyone has to start somewhere. Even the people with a perfect credit score started out where you are today. Getting the right starter credit card is key so that you can build upon it as a foundation of your future credit success.

| Bank | Sign-Up Bonus | Annual Fee | Minimum Credit Score Needed | |

|---|---|---|---|---|

| Capital One® Platinum Credit Card | Capital One | - | $0 | AVERAGE, FAIR, LIMITED |

| QuicksilverOne Cash Rewards Credit Card Capital One | Capital One | - | $39 | AVERAGE, FAIR, LIMITED |

| Capital One® Secured Mastercard® | Capital One | - | $0 | LIMITED, BAD |

Watch Our Video to See if You Really Need an 850 FICO Score

Having a perfect credit score sounds amazing, but the reality is that someone with a 740 FICO can get approved for the same loan terms and credit cards as that guy. We should all take steps to improve our credit scores by paying on time, reducing our credit utilization, and strategically applying for credit at the right times. By making small tweaks to your daily behaviors, your credit score will increase in no time.

What steps are you taking to improve your credit score? What’s the highest credit score that you’ve received and what were you doing to make that happen? We’d love to hear your tips and stories in the comment section below.