Who Is the Amex EveryDay Preferred Credit Card Good For?

The Amex EveryDay Preferred card is designed to reward frequent spenders rather than the usual big spenders associated with American Express.

The more casual name (Amex, rather than American Express) and the lower number of perks and points awarded initially reflect this demographic shift. Still, the Amex EveryDay Preferred has become known as one of the most powerful credit cards for funneling points into American Express’ versatile Membership Rewards program, the oldest point transfer program around, and the one with the most partners.

| AIRLINE PARTNERS | Aeromexico, Air Canada, Air France KLM, Alitalia, ANA, Asia Miles, British Airways, Delta, El AL, Emirates, Etihad Guest, Frontier, Hawaiian Airlines, Iberia, jetBlue, Singapore Airlines, Virgin Atlantic |

| ANNUAL FEE | $95 |

| APR | 0% for 12 months; subsequently 13.24-23.24% based on credit |

| RECOMMENDED CREDIT SCORE | 750+ |

| TYPE OF CARD | American Express |

| ISSUER | American Express |

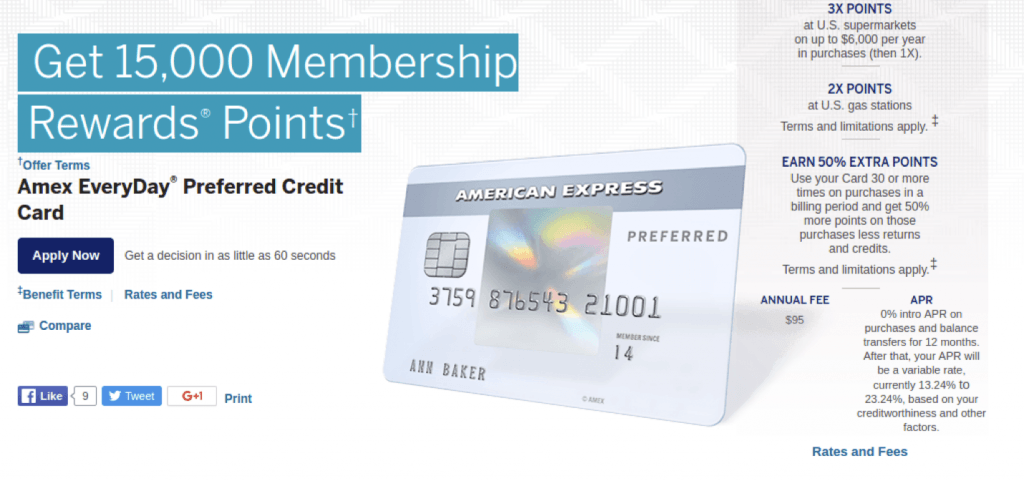

Sign-Up Bonuses:

A sign-up bonus of 15,000 American Express Membership Rewards points after a $1,000 spend in 90 days.

Points Earned:

- 3 points per dollar spent on groceries (up to $6,000 per year)

- 2 points per dollar spent on gas

- 1 point per dollar on everything else

- 50 percent bonus points each month the card is used more than 30 times

What Do Your American Express Membership Reward Points Get You?

The American Express Membership Rewards program offers a somewhat dizzying array of redemption options. Unsurprisingly, many aren’t a great deal, particularly the ones that don’t have to do with travel.

If you book directly through the Membership Rewards portal, you get a 1-cent-per-point or less value. Thankfully, Membership Rewards has one of the widest selections of point transfer partners, including members of all three major alliances and a number of non-alliance airlines, such as domestic carriers Hawaiian, JetBlue and Virgin America.

Redemption Perks:

- After 30 transactions, you receive a 50 percent bump on points earned in that billing period

- Ability to link other individuals’ frequent flyer accounts to your Membership Rewards account for transfers to family and friends

- Option to pay for travel directly with points or convert to miles

- Monthly transfer bonuses on select airlines

- Most transfers are instantaneous

Redemption Quirks:

- Points transfer at only a 1:1 ratio

- Pay with Points option gives a value of only 1 cent per point

How Far Do Your Dollars Go?

Though the grocery bonus maxes out, the gas bonus does not, so in a year (assuming you fill the tank every week at $50 per fill-up), you can easily rack up:

- $6,000 for groceries = 18,000 Membership Rewards bonus points

- $200 for gas for 52 weeks = 10,400 Membership Rewards bonus points

- Total category bonus points (on top of your regular spending) + sign-up bonus =43,400 Membership Rewards bonus points

Even more powerfully, the Amex EveryDay Preferred gives you a 50 percent bonus on all spending anytime you use your card more than 30 times in one billing period. If you already pick up a coffee every morning, you’re all set.

When you combine this earning with American Express Membership Rewards frequent transfer bonuses, which are typically around 30 percent for one specific partner each month, you can get nearly six airline miles per dollar right off the bat without even maximizing your miles with high value awards.

Additional Cardholder Benefits:

- American Express Global Assistance hotline

- Car rental loss and damage insurance (not available in Australia, Ireland, Israel, Italy, Jamaica or New Zealand)

- Extended warranties

- Purchase protection

- Return protection