This is the way it too often goes: A consumer is overambitious with her credit card, accumulates a worrisome amount of debt, and then looks to transfer her debt to a

It seems a wise move.

But is it really?

Sometimes yes; sometimes no. It all depends on the card you’re considering, the balance-transfer fee it imposes, and the balance transfer APR you’ll pay early on and over time.

What Is a Balance Transfer Fee?

You know that adage: Nothing in life is free? Well, for the privilege of giving your business to some particular credit card company, that company is going to charge you a fee – a balance transfer fee.

This fee represents some percentage of the overall amount of money you’re transferring to the new credit card.

Typically, that fee runs between 3% and 5% of the amount you’re transferring.

So, for instance, if you want to transfer $12,000 from a high-interest-rate card to a card with a lower rate, or a card with a 0% introductory APR. You will pay between $360 and $600 for that service.

Some bloggers I’ve read will tell you this is a bad move because you’re simply increasing your debt. Well, yes, technically you are increasing your debt. But that misses the point entirely.

So what if you initially have to pay $360 to transfer your balance? If your new interest rate is substantially less, you will recoup the fee, plus much more, within a few months. Then, every reduced interest payment thereafter is money in your pocket, rather than the banker’s pocket.

It’s the same reason homeowners refinance a mortgage, despite the fees they initially pay as part of the mortgage process.

In short, it’s not the initial outlay that matters – it’s the savings accumulated over time.

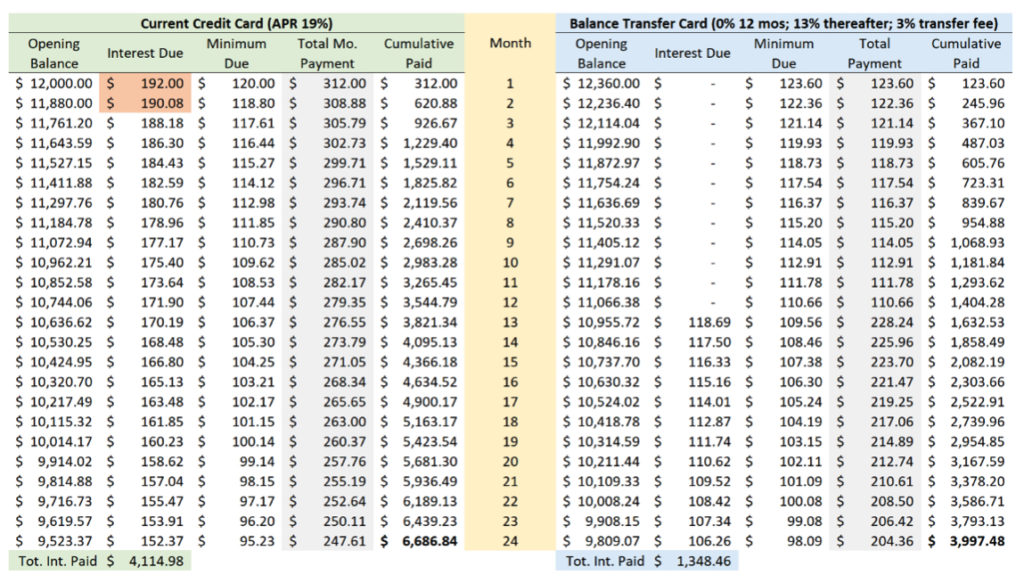

Consider this chart comparing a consumer’s current, $12,000 credit-card balance vs what it would be by switching.

The minimum payment due is set at 1% of the opening balance, which, in turn, is the sum that reduces the opening balance in each following month

Currently, this consumer is paying 19.2% interest. With her new balance-transfer card, she’ll pay a balance transfer APR 0% for 12 months, then 13% afterward… but she must pay a 3% balance transfer fee, or $360, which is why the opening balance for the Balance Transfer Card is $12,360.

A few things to notice here.

- First, the two orange boxes. They total to more than $382. So, our consumer has already saved more than the cost of her 3% balance transfer fee. Every reduced interest payment going forward is now money in her pocket.

- Second, look at the bottom – Total Interest Paid. Paying the balance transfer fee means our consumer has saved more than $2,766 in interest payments (the difference between those two numbers). Every day of the week I’d be happy to trade $360 for $2,766 in savings that end up directly in my pocket.

- Third. Look at the gray column: Total Mo. Payment. They’re reduced – sharply during the first year of 0% interest, but starting in month 13, as well, because of the reduced interest rate she’s paying. Those savings can reduce monthly financial pressures, or she can use the savings to apply toward the outstanding balance and get out of credit card debt quicker.

- Finally, look at the two numbers in bold. Even though our consumer had to pay an initial $360, she’s paying substantially less overall, representing significant savings.

How Not to Pay Balance Transfer Fee.

More than 70% of credit cards offering a 0% balance transfer APR promotion charge a balance transfer fee. But that just means 30% don’t.

And that’s what would make our example even better: if our consumer didn’t have to pay a balance transfer fee. Then, every single payment starting with the first one she makes is money in her pocket.

Credit Cards with $0 Balance Transfer Fee

Well, there are credit cards that offer that.

Chase Slate and Amex EveryDay from American Express both currently offer credit cards with a $0 balance transfer fee and a 0% balance transfer APR for the first 15 months.

SunTrust Bank, meanwhile, offers the SunTrust Prime Rewards card with a flat 5.5% interest rate for 36 months, and no balance transfer fee. At first glance, including the SunTrust card in this analysis would seem pointless, given that it charges 5.5% interest.

But this is one of those trick questions: What’s better – 0% for 15 months or 5.5% for 36 months?

This is where savvy consumers use a little math to save money, while too many people around them just assume 0% is better and jump at that option.

The True Cost of a Balance Transfer

If you’re looking for a new credit card on which to transfer an existing balance, which card is best for you ultimately depends on how fast you plan to pay off your existing credit card balance.

Quick pay-off: A card such as Chase Slate or Amex EveryDay is best. You will have 15 months with no interest payments, which can represent large monthly savings, depending on the interest you’re paying now and the size of your existing balance. Plus, you will pay no balance transfer fees.

Average-term pay-off: Here I’m talking about using a card such as the Citi Simplicity card that currently offers 0% for 21 months, with a balance transfer fee of 5%, which can be hefty. And we’re going to compare it to a personal loan, which is the other option many consumers consider when they’re trying to pay off credit card debt.

We’ll use a personal loan rate of 9%, which is actually a bit low for the current market. But that only serves to make this a stronger comparison, since higher rates are worse for the consumer.

With a three-year personal loan at 9%, you will pay $381.60 a month. If you, instead, apply for a Citi Simplicity card, and then apply that same $381.60 as your monthly credit card payment, you will pay off the balance on your Citi card in just over 31 months … which means you’re saving more than 5 months of loan repayments, or just under $2,100.

Subtract the $600 balance transfer fee you will pay to Citi, and you’re still saving a meaningful $1,500. (And if the personal loan rate is higher, well then your savings are substantially larger)

The caveat here is vigilance! You must conscientiously apply to your monthly credit card payment the personal-loan amount you would have paid to the bank. Otherwise, the math won’t work out, and you will end up paying more to the credit card company, even though you have 21 months of 0% interest.

Long-term pay-off: If you know you will need 24 months or longer, then a card such as SunTrust Prime is your best option. By month 23, your eight months of interest payments with Chase will have surpassed all 23 previous months of interest payments with the SunTrust card. So, you will be saving money long term by paying a little bit of interest from the very beginning.

The Wrap Up

Transferring a balance from one credit card to another has almost become a sport in America, which is why so many credit-card companies have fashioned so many different credit cards specifically designed for a balance transfer.

For consumers, however, you can’t just jump at any balance-transfer card you find.

They’re all structured differently, which means not all of them will make sense for you in the long run.

Some have 0% for a short period of time with no balance transfer fees.

Some

As I said above, you can’t just assume one card is better than another based on a cursory glance of interest rates and balance transfer fees. You need to know how the numbers work out based on your specific situation.

But we want to know: What’s the worst balance-transfer story you have? Have you been shocked by an unexpectedly large interest-rate increase after the introductory, 0% period ended? Let us know in the comments below.