Who Is the BankAmericard Travel Rewards Card Good For?

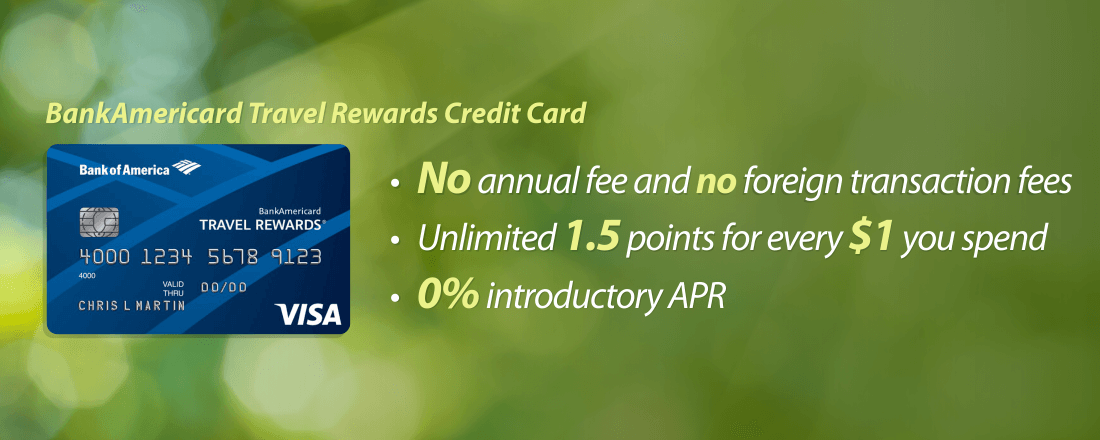

The BankAmericard Travel Rewards credit card is good for anyone who wants to earn statement credits toward travel purchases. This card has no transfer partners, but it does have a generous earning scheme, a decent sign-up bonus and no annual fee.

One of the best features of this card is its earning abilities. You’ll get bonus miles with every purchase, which is unusual among

Bank of America customers earn even more. Depending on your account balance, you can get between 10 and 75 percent bonus points on card purchases.

The card also comes with a solid sign-up bonus of 20,000 points. That’s worth $200 in travel purchases, which is basically free money since this is a no-fee card.

Bank of America offers a student version of this card: The BankAmericard Travel Rewards for Students card. It comes with the same earning scheme, sign-up bonus and other issuer benefits as the standard BoA Travel Rewards card, but is a basic Visa instead of a Visa Signature. That means you won’t get some perks offered directly from

Since the BankAmericard for students is designed for those without a long credit history, it’s the perfect card to get if you’re still in school and looking for a way to start building your credit.

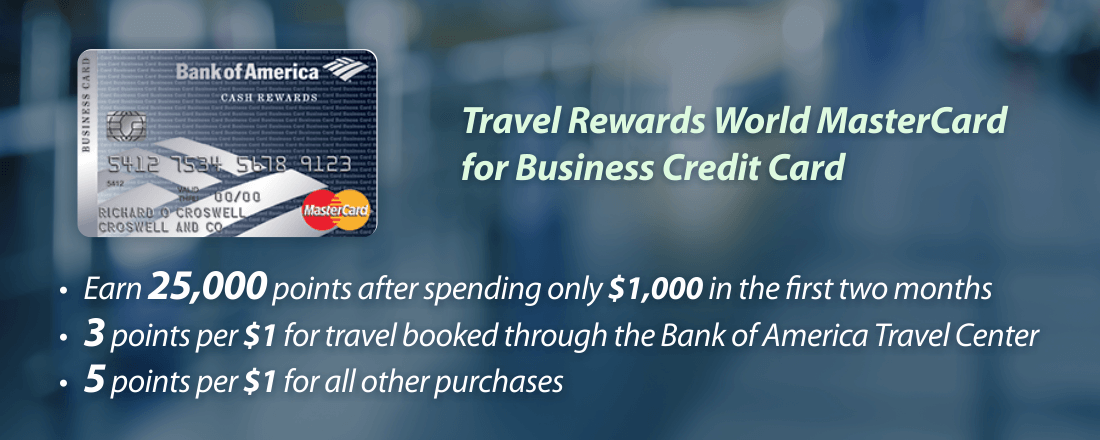

Sign-Up Bonus:

The BofA Travel Rewards card comes with a 20,000-point sign-up bonus. You must make $1,000 in purchases within the first three months to receive the bonus.

Points Earned:

- 1.5 points per dollar spent on all purchases

What Do Your Points Get You?

The Travel Rewards card works like a cashback card. You’ll earn points for every purchase you make, and those points can be redeemed for credit toward travel purchases. The simplicity and ease of use of this type of reward program is hard to beat, making it a good option for beginners to the points and miles game.

Simply buy the travel you want and redeem points toward those purchases. You don’t have to worry about award seat availability, blackout dates or anything else. With this card you always know what your points are worth and you’ll never be stuck with a poor redemption rate.

If you’d prefer a more traditional cash back card, consider a BankAmericard MasterCard. There are several cards in Bank of America’s lineup that offer general BankAmericard Rewards.

Usage Perks:

- No annual fee

- No foreign transaction fees

- Points don’t expire

0% introductory APR - Bank of America customers receive 10% to 75% bonus points on purchases

Usage Quirks:

- No transfer partners

- 3% balance transfer fee

- Fixed redemption rate

- No reward sweet spots or bargains

How Far Do Your Points Go?

The redemption rate of BankAmericard rewards points is fixed at one cent each. That’s not fantastic, but because you earn 1.5 points per dollar, you’re essentially getting a value of 1.5 cents per point. That’s not bad.

It gets even better if you’re already a Bank of America customer. Standard account holders get an extra 10 percent points for all purchases. Preferred Rewards clients get between a 25 and 75 percent bonus, depending on status.

Here’s how it breaks down. Standard cardholders get 150 points for every $100 spent. Bank of America account holders, though, get 165 points for the same $100 spend. Gold Preferred Rewards status holders earn 187 points, Platinum status gets 225 and Platinum Honors gets 262.

That means that top status holders get 2.62 cents back for every dollar they spend. That’s a really good return that even experienced travel hackers would be happy to get.

The customer bonus can add up quickly. For example, an average spend of just $2,000 a month would earn a standard cardholder statement credits worth $360 for the year. Platinum Honors clients would get $630 worth of credits for spending the same amount.

Status with Bank of America is determined by the total balance you’re carrying with the bank, including Merrill Edge and Merrill Lynch investment accounts. In addition to point bonuses, status holders also get a variety of other perks, including waived ATM fees, free trades, priority service, better interest rates on loans and more.

The catch is the amount of the balance you have to keep in order to earn status. Gold status requires an average balance of $20,000 to $50,000 for three months; Platinum requires $50,000 to $100,000; and Platinum Honors requires over $100,000. Remember, though, that all Bank of America account holders get a 10 percent bonus, no matter what their balance is.

Additional Cardholder Benefits

- Zero Liability Guarantee

- ShopSafe online shopping security

- Free monthly FICO scores

- Travel accident insurance

- Lost luggage reimbursement

- Trip cancellation coverage

- Trip delay reimbursement