Who Is the Barclaycard Arrival Plus World Elite MasterCard Good For?

Though Barclays partners with quite a few

Barclays Arrival card works like the Capital One program. You accrue points that can be credited against purchases you’ve already made to effectively erase that expense before you pay your credit card.

If you find yourself hitting a wall trying to book travel with points and miles, or often traveling in ways you couldn’t or wouldn’t want to use points and miles for (e.g., cruises or flights cheaper than the value of the points you’d need to pay for them), Barclays Arrival is a great program to add to your travel booking arsenal.

| AIRLINE TRANSFER PARTNER | None |

|---|---|

| ANNUAL FEE | $89 (waived the first year) |

| APR | 16.24% – 20.24% |

| RECOMMENDED CREDIT SCORE | 700+ |

| TYPE OF CARD | MasterCard |

| ISSUER | Barclays |

Sign-Up Bonus:

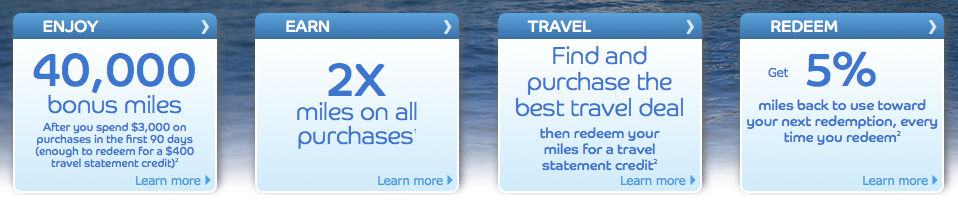

After spending $3,000 in the first 90 days after opening your account, you’ll receive 40,000 Arrival miles and have the annual fee waived for the first year.

As a newish card that has been very successful so far, the Barclaycard Arrival Plus World Elite MasterCard hasn’t changed its introductory offer, although it may if it runs into trouble attracting customers down the line.

Points Earned:

- 2 miles per dollar on all purchases

What Do Your Miles Get You?

Despite the fact that they don’t correspond in any way to airline miles, Barclays refers to the points earned in its program as miles.

Because Barclays Arrival does not have any specific partners, you can use your miles to erase any purchase, regardless of brand or mode of transportation. Barclays also claims no blackout dates because you don’t have to book a capacity-controlled award ticket. You can book any plane ticket and use your points.

You can actually buy any travel, and just credit your miles against the charge after you’d paid for the purchase with your Arrival Plus credit card. You can even partially erase a purchase if you don’t have enough miles to cover the whole thing.

Barclays Arrival takes a much wider view of what travel means than many credit cards, allowing you to use your miles toward Uber rides, ferries, meals and incidentals at hotels, rental cars and even buses.

When you credit your miles against a purchase, you’ll also get a 5 percent rebate on the miles used, which credits in a couple weeks.

Usage Perks:

- Points can be used for any type of travel, not just airlines and hotels, but also buses, taxis, vacation rentals and more

- Double miles on all purchases in all categories

- 120-day redemption period

- 5 percent rebate on all redeemed miles

- Chip and PIN technology

- Complimentary online FICO score

- No foreign transaction fees

Usage Quirks:

- No transfer partners

- Minimum redemption is 2,500 miles/$25

How Far Do Your Points Dollars Go?

Barclays Arrival only offers direct mile-to-purchase redemptions, unlike programs such as Starwood Preferred Guest or American Express Membership Rewards, which offer point-to-mile, point-to-hotel-point and point-to-purchase. So the value of your spend on the Barclaycard Arrival Plus World MasterCard is very clear and fixed, no matter what you use your points on.

For each dollar you spend on the Arrival Plus card, you earn two miles regardless of category. Then, when you redeem your miles you get a 5 percent rebate, giving you a 2.2 cent per dollar value on every purchase.

Additional Cardholder Benefits:

- Travel accident insurance

- Trip cancellation insurance

- Baggage delay insurance

- Auto rental collusion damage waiver

- Identity theft protection

- World Elite concierge travel services

- Special amenities at properties in the World Elite luxury hotels and resorts portfolio