Are you looking for a card that has great earning potential and lets you transfer your points to airline frequent flyer programs? In this post I’ll take a look at how many points various rewards cards give you for different types of purchases. It’s important to know what you’ll be able to earn with a card before you apply.

Of course that’s not the only thing you should consider before you get a card. You should think about what you want to do with your points, too. If you often fly on one carrier, you may want to consider getting a co-branded airline card instead. I covered the earning potential of those cards in this post.

Not all credit card rewards programs are the same, either. Some of them allow you to transfer points to various airline frequent flyer programs and other don’t. The later type of programs, like Capital One Venture and Barclaycard Arrival, work a lot like cash back cards. Basically, you purchase travel and then you can redeem points or miles toward statement credits to cover those costs.

Those are very flexible programs, allow you to purchase plane tickets from anyone and anytime, but they don’t give you the most

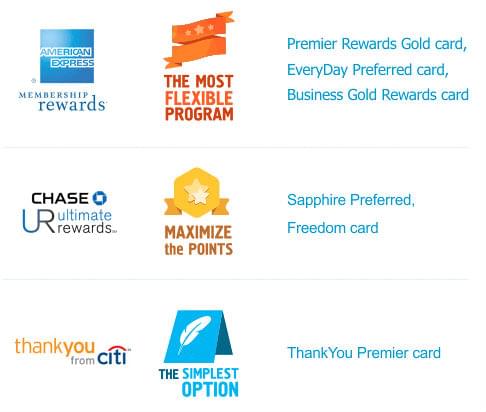

The three big programs that allow you to do that are American Express Membership Rewards, Chase Ultimate Rewards and Citi ThankYou Rewards. But those programs aren’t equal, either. Amex offers the most flexibility with 17 airline transfer partners, whereas Citi has 12 and Chase has six. Before choosing a card, you’ll want to consider which program will be best for getting you where you want to go.

Below is a roundup of the earning potential of the various cards in these rewards programs.

American Express Membership Rewards

In general, Amex has the least generous earning schemes, the smallest sign-up bonuses and the biggest annual fees of the three big rewards programs. What makes the Membership Rewards program so valuable, though, is that it also has the most airline transfer partners. It may be a bit harder to earn Membership Rewards points, but once you have them you have a lot more redemption options.

The three standout cards in the Amex lineup are the American Express Gold Card, the Amex EveryDay® Preferred Credit Card and the American Express Business Gold Card. All of them offer triple miles for certain purchases.

The American Express Gold Card may be the best earner of the bunch. You’ll get triple miles for airfare and double miles for dining out, gas and groceries. If you travel often, you probably spend a lot on airfare and at restaurants. Even if you don’t, the card is great because gas and groceries are things you are likely to buy frequently.

The Amex EveryDay® Preferred Credit Card is another excellent option. It has a smaller annual fee and it gives you triple miles for groceries and double miles for gas. If you rarely fly and spend a lot on food, this could be a better card for you.

If you’re a small business owner or an independent contractor, the American Express Business Gold Card card is another good card. It has a unique setup which allows you to choose one of five categories of purchases which will earn triple points. The remaining four categories earn double points. Those categories are airfare, advertising, gas, shipping and computer equipment. Getting triple points for gas is great, though the other categories may not be as useful if you don’t have a lot of qualifying business expenses.

| Sign-Up Bonus | Annual Fee | Bonus Earning Categories | |

|---|---|---|---|

| American Express Gold Card | 35,000 points | $250 Annual Fee | 3x airfare, 2x restaurants, gas and groceries |

| Amex EveryDay® Preferred Credit Card | 15,000 points | Annual Fee $95. | 3x groceries; 2x gas |

| American Express Business Gold Card | 500 points | $295 annual fee. | 3x airfare, advertising, gas, shipping or computer equipment; 2x on remaining 4 categories |

If you’re looking for a no-fee Amex card, the standard Amex EveryDay® Credit Card is a solid choice, offering double miles for groceries. The rest of the cards in the Amex lineup are disappointing earners. The standard Premier Rewards Gold card does offer double points for airfare and restaurants, but for a little more annually, the Amex EveryDay® Preferred Credit Card gives you more with triple points for airfare and double points for restaurants, as well as double for gas and groceries.

Neither the personal nor business versions of the American Express® Green Card and The Platinum Card® from American Express cards have any bonus categories. All purchases earn only one point per dollar.

Chase Ultimate Rewards

The Ultimate Rewards program has the fewest airline transfer partners, but it makes up for this in part by having an affordable and well-rounded lineup of cards with excellent earning potential. If you can, you may consider getting two or even three Ultimate Rewards cards because their bonus earning categories complement each other nicely.

If you get only one personal card, it has to be Chase Sapphire Preferred® Card. Without it, you can’t transfer points to airlines. More than that, though, you earn a solid double points on all travel, including gas, airfare, car rentals and hotels, as well as on dining out.

Once you have the Sapphire card, you can then transfer points earned with other Ultimate Rewards cards to frequent flyer programs. In which case, you should consider getting a Chase Freedom® too.

The standard Freedom card gives you a whopping five points per dollar spent on quarterly rotating categories, which may include restaurants, gas, hotels and specific retailers. Just be sure to use the Freedom card for purchases that fall into the bonus categories and the Sapphire card for everything else.

The Chase Freedom Unlimited® card also makes a great second or third Ultimate Rewards card. It’s unique among the three big rewards programs because it gives you 1.5 points for every purchase. With this card you won’t have to worry about rotating bonus categories. Use it for any purchases that don’t earn a bonus with your other cards.

If you qualify, you can also pick up the excellent Ink Plus® Business Credit Card. You get an impressive five points per dollar spent on landlines, cell phones, internet and cable. Those are all things most of us pay for regularly, making the card a valuable earner. You also get five points for office supplies and double points for gas and hotels. Ink Plus allows you to transfer points to airlines too, so it may be a better option than Sapphire, depending on your spending habits.

[table “139nbspresponsivecollapse” not found /]Overall, the Chase Sapphire Preferred® Card, Chase Freedom® and Ink Plus® Business Credit Card are a great combination of cards. If you have all three of them, you’ll be earning double or quintuple points for a lot of your purchases.

Citi ThankYou Rewards

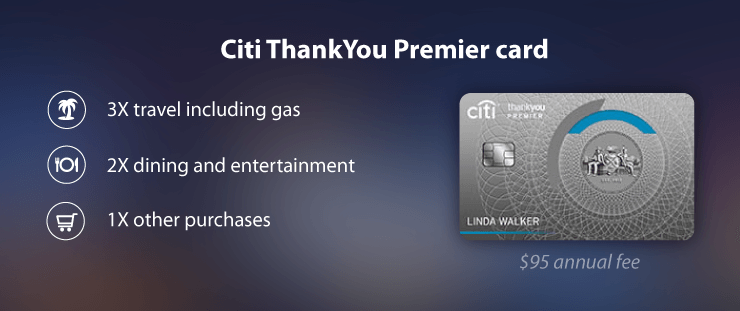

If Amex Membership Rewards is the most flexible program, and Chase Ultimate Rewards has the best earning potential, then the Citi ThankYou Rewards program does an admirable job of falling in the middle. It has twice as many airline transfer partners as Chase and more flexible earning categories than Amex.

Citi offers three personal cards and no business cards. That doesn’t matter, though, because you’ll only need one, the Citi Premier℠ Card. With Annual Fee $95, it’s Citi’s midrange offering. You’ll get three points per dollar spent on all travel, including airfare, car rentals and gas, as well as double points for dining out and entertainment.

| Sign-Up Bonus | Annual Fee | Bonus Earning Categories | |

|---|---|---|---|

| Citi Premier℠ Card | 60,000 | Annual Fee $95 | 3x travel; 2x restaurants and entertainment |

Citi’s other cards, the no-fee Citi ThankYou® Preferred Card and the expensive premium Citi Prestige® Card, have nothing more to offer in terms of earning. The Prestige card, in fact, is more limited because its triple earning category includes only airfare and hotels, instead of all travel purchases.

On the surface, the Citi ThankYou® Preferred Card seems like a solid option for a no-annual-fee card since it gives you double points for dining out and entertainment. The problem, though, is that you can’t transfer those points to airlines unless you have one of the other cards. And if you have one of those cards, you’re already earning those bonus points.

Other Travel Rewards Cards

There are several

The Barclaycard Arrival program has two cards. The first is Barclaycard Arrival™ World MasterCard® with No annual fee. The second is Barclaycard Arrival Plus® World Elite Mastercard® with $89(waived first year) The Arrival card has a solid earning scheme of double points for travel and dining purchases, but the Arrival Plus offers double points for all purchases.

The Capital One Venture Rewards program has two personal and two business cards. The no-fee Capital One® VentureOne® Rewards Credit Card and Capital One® Spark® Miles Select for Business offer 1.25 miles and 1.5 miles per dollar, respectively. That’s a solid offering, but it’s probably worth the extra $59 a year to get either the Venture Rewards or Capital One® Spark® Miles for Business since they both offer double points for all purchases.

What Card Should You Get?

The answer to that question depends partly on your personal spending habits and what you want to use your points for. Obviously you should get a card that’s part of a program that will get you to your destination for minimal cost. You also want a card that earns the most points for the types of purchases you make.

To start with, I’d skip the programs that don’t allow you transfer points to airlines. You can get better redemption rates for award flights by transferring your points to frequent flyer programs.

American Express is great if you want the most flexible program. The American Express Gold Card, with its triple points for airfare and double points for eating out, gas and groceries, is a good choice. The Amex EveryDay® Preferred Credit Card card offers triple points for groceries, which may make it a better choice, depending on your spending habits. The third contender is the American Express Business Gold Card, which allows you some flexibility in choosing your bonus categories. Although it is not a

If I wanted to maximize the points I earned through spending, I’d probably go with Chase Ultimate Rewards. The cards in Chase’s lineup have complimentary bonus earning categories, allowing you to earn points fast.

The Chase Sapphire® Card, with its double points for travel and dining out, is a solid earner that gives you full access to the Ultimate Rewards program (without it, you can’t transfer points to airlines). The Chase Freedom®, with its rotating quintuple earning category, is an awesome supplement to that card. And the Ink Plus® Business Credit Card gives you quintuple points for several recurring bills, such as phones and internet. If you’re up for the challenge of managing two or three cards, this is a great program.

The Citi ThankYou program is the simplest option. It offers a good compromise between flexibility and earning potential. You’ll only need one card, Citi Premier℠ Card, and it offers triple points for all travel expenses, including gas, as well as double points for dining out and entertainment. It also has twice as many transfer partners as Ultimate Rewards.