One of the greatest –if not the greatest –credit card benefits is the 4th Night Free perk exclusively with the Citi Prestige® Card. Today we’ll do a deep dive into what it is and how to use it.

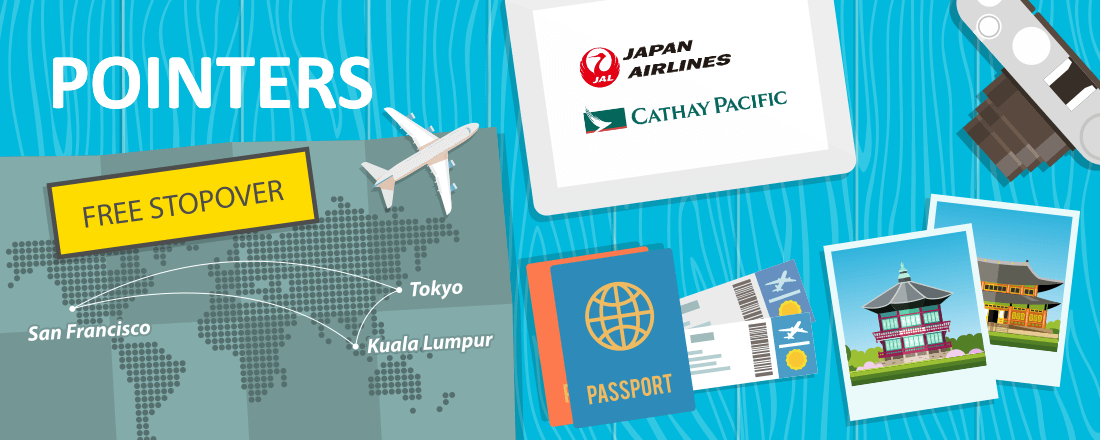

Use the Fifth Freedom Right to See More Places

World leaders tend to argue about everything, but they have worked out a lot of issues to make sure that most of our flights go smoothly. The International Civil Aviation Association (ICAO) recognizes five Freedoms of the Air that make modern commercial aviation possible. Since all countries are protective of their borders and revenues, international treaties had to be put in place to ensure that airlines can fly freely anywhere in the world

American Express Authorized User and Spending Bonuses

Lately American Express has been offering some great authorized user and spending bonuses for several of their cards. Many of these bonuses are targeted, but it might be worth calling American Express to see if you can get the promotion applied to your account. Below I will go into detail about the authorized user and

Hard-to-Reach Islands You Can Get to With United’s Excursionist Perk

If you’re looking to maximize your hard-earned airline miles by booking trips to multiple cities, or even countries, United MileagePlus is one of the best programs to do just that. The program allows for a longer stop in a city on the way to your destination, dubbed the Excursionist Perk, which lets passengers book a free one-way flight within a round-trip. Essentially, you can book three flights for the price of two if you do it correctly. A stop can be as short as 24 hours and as long as the calendar allows you to book.

Do You Need New Visas When You Get A New Passport?

Say you’re planning a trip to a country for which you have a valid visa, but then you realize something: by the time you depart, your passport will have expired, but your visa will not have. What can you do?

Mid-year Status Considerations for Airline Loyalty Programs

Now that the year is half over it’s a good time for savvy travelers to reflect on the awesome and free trips they’ve taken, on the miles they’ve flown, and on the status they’ve achieved or hope to.

How Long Can You Live on Hotel Card Sign-Up Bonuses

There are quite a few

Earn More Miles with the MileagePlus X App

United Airlines is one of the biggest airlines in the world, and therefore it’s no surprise that their loyalty program, MileagePlus, is also one of the most popular airline loyalty programs. It allows you to earn miles by flying on United Airlines flights, and redeeming those miles for free flights on United. But did you know that you can also earn United miles from your everyday shopping, through the MileagePlus X app?

Premium Credit Cards: Which Ones to Keep

In the last year several banks have come out with new premium cards, and there are more to come. With an onslaught of ultra-expensive credit cards tempting us with

Chase 5/24 Rule – Exceptions, Application Tips and More

Chase makes great credit cards. The Sapphire Reserve and Preferred top just about everyone’s

If you’re thinking about getting a Chase card, I’ve got you covered. Below is everything you need to know about the 5/24 rule. And if you’re looking for good alternatives to Chase cards, check out these suggestions.

What Is the Chase 5/24 Rule?

Simply put, Chase will not approve you for a card if you’ve opened five or more new card accounts across all banks in the last 24 months. They introduced this rule several years ago to prevent card churning.

In other words, they don’t want you to get a bunch of credit cards just for the welcome bonuses.

The Bad News: All personal credit cards from any bank count toward your total open accounts. You can’t get around the 5/24 rule just by getting non-Chase cards.

The Good News: Some credit cards don’t count toward the 5/24 rule. There are exceptions! Don’t worry, I’ll cover those later.

It’s worth pointing out that you can still

What’s the Big Deal About This Rule?

The list of Chase cards you can’t get if you’ve opened five accounts in the last two years is long. If these cards are out of your reach, you’re missing out. That’s why it’s important to understand the 5/24 rule.

These cards are subjected to the 5/24 rule:

- Ultimate Rewards Credit Cards:

- Chase Sapphire Preferred® Credit Card

- Chase Sapphire Reserve® Credit Card

- Chase Freedom (expired offer)

- Chase Freedom Unlimited® Credit Card

- Chase Freedom Flex® Credit Card

- Chase Freedom Rise® Credit card

- Business Ultimate Rewards Cards:

- Ink Business Preferred® Credit Card

- Ink Business Unlimited® Credit Card

- Ink Business Cash® Credit Card

- Ink Business Premier® Credit Card

- Southwest Credit Cards:

- Southwest Rapid Rewards® Plus Credit Card

- Southwest Rapid Rewards® Priority Credit Card

- Southwest Rapid Rewards® Premier Credit Card

- Southwest® Rapid Rewards® Performance Business Credit Card

- Southwest Rapid Rewards® Premier Business Credit Card

- United Airlines Credit Cards:

- United℠ Explorer Card

- United Quest℠ Card

- United Gateway℠ Card

- United Club℠ Infinite Card

- United Club℠ Infinite Card (former United MileagePlus Club)

- United℠ Business Card

- United MileagePlus Explorer Business (expired offer)

- United Club℠ Business Card (ex United MileagePlus Club Business)

- Marriott Credit Card:

- Marriott Rewards Premier Plus (expired offer)

- Marriott Bonvoy Boundless® Credit Card

- Marriott Bonvoy Bountiful® Credit Card

- Marriott Bonvoy Bold® Credit Card

- IHG Credit Cards

- IHG One Rewards Premier Credit Card

- IHG One Rewards Traveler Credit Card

- IHG One Rewards Premier Business Credit Card

- Disney Credit Cards

- Disney® Premier Visa® Card

- Disney® Visa® Card

- World of Hyatt Credit Cards

- World of Hyatt Credit Card

- World of Hyatt Business Credit Card

- Other Airlines Credit Cards

- Aer Lingus Visa Signature® Credit Card

- British Airways Visa Signature® Credit Card

- Iberia Visa Signature® Credit Card

- Aeroplan® Card

- Other Co-Branded Credit Cards

- Prime Visa

- DoorDash Rewards Mastercard®

- Instacart Mastercard®

When you can’t get these cards because of the 5/24 rule, here are some excellent alternatives.

Why You Want These Cards

There are a lot of reasons to want these cards. To start with, the Ultimate Rewards program is great and the points are valuable. The Sapphire cards in particular offer big intro bonuses worth hundreds of dollars. I couldn’t do without my Reserve card with its top-of-line perks:

- Free lounge access for me and a guest

- 50% bonus when redeeming through the Ultimate Rewards portal

- $300 travel credit annually

- Much, much more

Southwest Companion Pass

The Southwest cards are a must-have for domestic travelers for one reason: the fantastic Southwest Companion Pass. If you get two of the Southwest cards at the right time, you can get the pass with just the welcome bonuses. That’s how I’ve done it.

With the pass, you can take a family or friend with you for free on any Southwest flight. The pass can be used unlimited times and is good for up to two years!

I’ve saved thousands on family vacations with the pass. It’s simply the best deal in

New Marriott Bonvoy Cards!

The Marriott Bonvoy credit cards are brand new. As part of the upgrade, Marriott Bonvoy program now offers great welcome bonuses and other travel perks. Marriott’s reward program often flies under the radar, but it’s Hotel + Air Package deals are pretty great.

Today you can transfer Marriott points to 39 airline transfer partners at 3-to-1 ratio with most programs. Plus, you will bet a 5,000 miles bonus for every 60,000 points you transfer to frequent flier miles. Thus, with the transfer bonus, if you transfer 60,000 Bonvoy miles, you’ll get 25,000 miles in the airline frequent flyer program of your choice!

Most Bonvoy cards also come with a free night award on every card anniversary. But if you want to maximize your free night awards, the Marriott Bonvoy Boundless® Credit Card should be on your wish list.

If You’re Above 5/24

Keep in mind that those cards will count toward your 5/24 total. If you’re not worried about getting a Chase card (or already have the ones you want), then start applying for your next Amex, Citi, Capital One, Barclays or U.S. Bank card.

Otherwise, you might want to get a card that doesn’t count toward the total (more on this below).

Exceptions to the Chase 5/24 Rule

If you’re above 5/24 and you’re waiting it out to apply for a new Chase card, you can still earn intro bonuses. That’s because certain cards won’t show up on your credit report. They won’t count toward your total opened accounts, making them exceptions to the rule.

Which cards can you get? Just about any

That means you can get business cards from American Express, Bank of America, Citi and even Chase.

Yes, I said Chase. You will have to be below 5/24 to get a Chase business card, but it won’t contribute to your total number of new accounts for future applications.

With all those issuers, there are a lot of great options to tide you over until you can get another Chase card. Bank of America issues a great Alaska Airlines business card and, as I’m sure you know, American Express has a whole lineup of excellent business cards (including the Business Gold Rewards card and the Business Platinum card).

What About Barclays Business Cards?

There has been a lot of discussion about Barclays business cards. They issue business cards for JetBlue, Hawaiian Airlines and American Airlines, so it’s worth mentioning.

While most report that the cards don’t count, there are enough reports of them counting that I’d be wary of taking the chance unless I was okay with a hit to my 5/24 total. I personally haven’t applied for any of these cards for that very reason.

Almost Anyone Can Qualify for a Business Card

You might be thinking that you’d like to get one of those small business cards but you don’t run a business. You might be surprised at how easy it is to qualify for one of these cards.

If you’re like me, you probably sell some of your old stuff on eBay from time to time. If you do that a few times a year and make a few bucks, guess what? You’re a business owner. You can get a

There is several ways to qualify. Do you do a little freelancing on the side? That counts. What about a small crafts business? Or maybe a little neighborhood landscaping? It might be worth selling a few things on Etsy or Ebay just get access to these cards. Think about it.

Don’t Become an Authorized User

Becoming an authorized user on someone else’s card will look like an open account on your credit report. In other words, Chase will see it and might deny you when considering your application.

I’d avoid becoming an authorized user for this reason, but you can always call Chase and explain the situation. They may reconsider your application. I don’t think it’s worth the risk, though.

Avoid Store Cards, Too

Store cards that are part of major payment systems like

So skip that Gap card next time the sales clerk propositions you during check out.

Can I Upgrade My Card?

Upgrading or downgrading your card within the same lineup shouldn’t count as a new card account. For example, if you decide to upgrade from the Gold Delta SkyMiles card to the Platinum SkyMiles card, you should be okay.

Though unusual, some issuers will do a hard pull on your account for upgrades. If there’s a hard pull, it will appear on your credit report and Chase will likely consider it a new account. So ask the issuer if they plan to do a hard pull on your credit before you upgrade or downgrade your card.

What Counts

To sum up, these cards add to your 5/24 total:

- All personal credit and charge cards

- Business cards issued by Capital One or TD Bank

- All store credit cards

What Doesn’t Count

These actions won’t impact your chances of getting a Chase card:

- Getting a business card issued by Citi, American Express, Bank of America and Chase (Barclays business cards might count)

- Upgrading or downgrading your card (but consult the issuer to be sure)

Are There Ways to Get Around the 5/24 Rule?

Chase keeps tightening the rules. There used to be a few ways to get a Chase card even if you had opened five (or more) accounts in two years. The most popular of these methods was applying after getting a pre-qualified or other special offer directly from Chase. But that doesn’t work anymore.

In-Branch Offers

A few readers have reported in the past that they’ve been able to go directly into a Chase branch with one of these special offers and get approved. This won’t work now.

Asking to be pre-approved, even in a branch location, often results in the agent checking online, which will trigger the rule. They’ll know you’re over, and you won’t get a card.

If you take a chance and give this strategy a try, Chase might decide to close all of your accounts because you’ve ‘cheated’ the rules. Is it really worth it?

Targeted Offers

If you get a targeted offer online, in an email or via old-fashioned snail mail, you may still have a chance of getting a card even if you’re over the 5/24 limit. Of course, there’s no guarantee that this will work. Be sure to use your personalized invitation code, if you got one with the offer.

Call the Reconsideration Line

It’s possible that Chase made a mistake! If you’ve been denied but you don’t think you’re over the 5/24 limit, don’t be afraid to call the Chase reconsideration line.

Be sure to ask for the reasons that you’ve been denied. It’s possible that they included a card that you’re just an authorized user on by accident or have made some other error.

How to Track Your 5/24 Status

Whether you’re waiting for a card to drop off your report so you can get a new Chase card or your just not sure how many accounts you’ve opened in the last couple of years, there’s an easy way to check.

All you need to do is to take a look at your credit report. There are a variety of places that allow you to do that for free, including Credit Karma and Experian.

Once you have access to your report, just look for accounts that have been opened in the last 24 months. They should be easy to find.

While you’re looking at your report, it’s always a good idea to check it over for any errors. Make sure all of the accounts (including mortgages and car loans) are yours, and that all of your payments are current.

If you find any errors (it happens more often than you think!) report it immediately to the credit bureau that issued the credit report.

There’s No Escape!

Chase’s 5/24 rule is here to stay. You can’t escape it. Chase has even tightened the rules over time.

So it’s important to know what does and doesn’t count before you apply for a new Chase card. Check your credit report and make sure Chase won’t turn you away. There’s nothing worse than a denied application and taking a hit to your credit score for no reason.

And if you are over five new accounts in the last two years, you might want to hold off on that new card. Unless, of course, you’ve been following along and know the exceptions to the 5/24 rule. I know I’m looking forward to the day I can apply for another Chase card or two. But if you’ve given up on getting more Chase cards in the near future, there are some

How to Travel to the Caribbean with Chase UR Points

Although it’s probably hot enough for polar bears to wear sunscreen this summer, it’s never too early to start thinking about your winter vacation in a tropical climate.

The Caribbean and its beautiful islands, sandy beaches and festive umbrella cocktails are often the go-to destination for those looking to escape the snowy winter. Unfortunately, high demand also means high prices. So how do you avoid the hefty price tag when it comes to traveling to the Caribbean? Having a healthy balance of Ultimate Rewards can help. Let’s take a look at the possible redemptions with Chase’s transfer partners.

The Alaska and Virgin America Merger Impact on Partner Airlines

The recent merger of Alaska and Virgin America has created America’s fifth largest airline. We know that Alaska is going to drop the Virgin America brand, but that was originally supposed to happen in 2019. It’s apparently been moved up. Virgin America’s Elevate program is now scheduled to end on January 1, 2018. Its airline partnerships will begin dissolving even earlier.

Saving Miles with Asiana Award Bookings

Asiana Airlines, a Korean carrier, is a diamond in the rough in the

Using Etihad Miles and Their Sweet Spots

Etihad Airways is a Abu-Dhabi-based airline that offers worldwide coverage, luxurious premium cabin seats, and a

How to Use Delta Upgrade Certificates

Delta upgrade certificates are one of the best benefits of elite status offered by any major US airline. There are two varieties – regional upgrade certificates (RUCs) and global upgrade certificates (GUCs). These instruments allow fliers to skip to the front of the pecking order for upgrades when booking paid flights.

For travelers seeking to fly in a premium cabin, upgrade certificates can save an

How the Annual Travel Credit on Premium Credit Cards Can Pay Off

You might be taken aback by the $450-$550 price tag on a premium credit card, but you need to weigh the benefits to see if the fee is worth it. One of the biggest payoffs beyond the sign-up bonus the first year is the annual travel credit one gets with a premium card. When you put that together with lounge access and the other benefits these cards offer you might find the card not only pays for itself but gives you extra funds for travel.

How Premium Credit Cards Can Help You Access Airport Lounges

Now that there are a number of new premium cards in the market it’s time to revisit the benefit of airport lounge access. It is one of the most popular ones for frequent travelers. The lounge is a sanctuary where you can unwind in a comfortable chair, work or play on your computer with free Wi-Fi, grab a complimentary latte or beer, watch some news and sometimes even take a shower.

Some lounges even provide more than basic comfort, with upscale décor, delicious light meals and inventive cocktails. You might even want to arrive at the airport early just to enjoy the lounge. There are a number of ways you can get access to this valuable perk including having a premium credit card. Let’s run through the options.

U.S. Bank Altitude Rewards and UBS Visa Infinite Cards Hit the Market

The premium travel credit card market has turned into a competitive battlefield where the largest banks are fighting for customers’ loyalty and attention. U.S. Bank and UBS are the two latest banks to offer new potentially lucrative cards to the market: the Altitude Reserve and Visa Infinite credit cards. Let’s take a closer look at them.

The Kings of Stopovers: Japan Airlines and Cathay Pacific Programs

Stopovers are an incredibly valuable tool that allows you to see more places for the same amount of

How to Fly in First: Upgrades and Credit Cards

It’s gotten harder for elites to get upgraded to first, and non-status fliers never had a chance. Don’t despair, though, you don’t have to pay hard-earned cash for the privilege of flying in style. There are still strategies to get up front, whether you rely on a free upgrade or