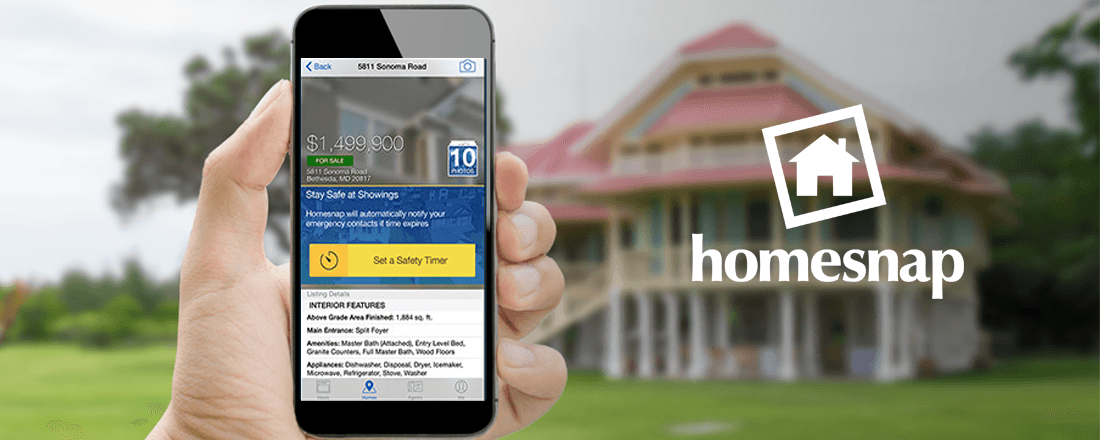

Finding your perfect home isn’t an easy task. It usually takes countless hours of research, time viewing homes, looking up listing agents, etc. Homesnap is an app that simplifies the process by providing accurate, real-time data on over 90 million homes in over 100 markets, representing about 750,000 agents nationwide.

How SAS Analytics Protect Your Finances

With the New Year, now is a great time for consumers and businesses to think about protecting their financial data. North Carolina-based SAS is one of the analytics companies that businesses turn to, to stay ahead of fraud and security threats. Banking Fraud Solutions Manager at SAS, Ian Holmes, spoke to RewardExpert about some of his company’s products that help keep banks, merchants and consumers safe.

4 New Year’s Resolutions for Personal Finances

It’s that time of year where everyone is talking about the goals they plan to set for the new year. There’s a lot of talk about getting to the gym more and eating less junk food

While all this is well and good there is a three-digit number that may be getting sadly ignored. Not your weight. Your credit score. While you are going to want to keep that number on the scale low you are going to want to get that credit score to gain as much as possible.

Make More Money and Find Alternative Investment Options with TWINO

If you’re looking to boost your financial returns and make more money, are interested in alternative investments and would like quick access to your newfound cash, consider peer-to-peer lending. One of the fastest growing companies in Europe’s peer-to-peer lending industry is Latvia-based TWINO.

How to Add a Credit Card to your iPhone Using iCloud and Apple Pay

It’s no secret that the invention of credit cards completely revolutionized the shopping experience. Now the payment experience is under a revolution of its own. Services such as Apple Pay allow shoppers to save their credit information on their iPhone and use it a payment method. You’ll find that with the availability of services such as Apple Pay and the iCloud keychain, the only thing anyone needs to shop is an iPhone.

Nearly Half of Small Business Owners Believe Tax Reform Will Benefit Their Business Finances

Republicans accomplished a feat this past week that had eluded them for more than three decades—a sweeping overhaul of the U.S. tax system. Passed through the Senate and House on party lines, and celebrated outside the White House by Republican legislators and the president, the bill is less popular with the American public. According to a recent CNN poll, only 33 percent favor the GOP’s proposed tax code.

On the other hand, an earlier survey by Paychex, a payroll and HR solutions company, found that tax reform has a more favorable rating among the small businesses it was intended to stimulate. RewardExpert spoke with Mike Trabold, Paychex’s Director of Compliance Risk, about the survey results.

Healthcare Bluebook Helps Consumers Save Money on Out-of-Pocket Medical Expenses

Healthcare in the U.S. is becoming increasingly expensive. According to the Centers for Medicare and Medicaid Services, healthcare spending grew nearly 6 percent in 2015, reaching $3.2 trillion or $9,990 per person. In the next year alone, health insurance premiums are increasing by 50 percent or more for many consumers. Deductibles and out-of-pocket annual maximums are also growing, leaving more patients footing the bill for the majority of their medical expenses in any given year.

This is How a Balance Transfer Card Can Help You Eliminate Your Credit Card Debt

If you’re in credit card debt, you are probably all too familiar with how interest works. Any time you leave a balance on a credit card, the credit card issuer charges interest. The interest rate on credit cards can be as high as 15%, so a credit card balance of $500 can easily turn into $1,000 or even higher over time. Before you know it, the debt balance is so high that achieving debt-free status can seem hopeless.

Alliant Credit Union: The Online Credit Union that Cares About Members’ Finances

Have you ever had to pay a fee to get your own money from an ATM? If so, you’re not alone. Nor are you in the minority if your bank has ever socked you with an unexpected overdraft fee. In fact, according to CNNMoney, in 2016, America’s three biggest banks alone raked in more than $6.4 billion dollars in these fees from their customers. Despite public outcry, there’s little anyone can do about it, either—except take their business to a more caring financial institution like Alliant Credit Union.

Medisafe Helps You Avoid Costly Healthcare Expenses

According to the Centers for Disease Control and Prevention (CDC), 82 percent of American adults take at least one medication and 29 percent take five or more. However, only 50 percent correctly follow their medication schedule, and 700,000 suffer an emergency due to medication mismanagement each year.

Why Money Orders Bought With Credit Cards Are Littered With Fees

Credit cards can be used for cash just like an ATM. This isn’t what credit cards are traditionally used for though. They allow consumers to buy now and pay later, so many people use them as a line of credit. You can spend as much as you would like on the card, staying within the card’s credit limit, and then must pay back the entire balance in full by a due date established by the credit card company. If you pay anything less than the full balance, interest charges will start to accrue.

Fashion and Finance: Make Money and Save Money With the Buffalo Exchange

With the holidays around the corner, it’s a great time to give. While we’re all looking to save money, wouldn’t it be great to know that you can clean out your closet, make some money and restock it at the same time? That great deal is possible thanks to a company called Buffalo Exchange.

For more than 40 years, Buffalo Exchange has been providing quality clothing and helping people feel good about selling their old clothes and getting new ones. The company has 49 stores in 20 locations. RewardExpert spoke with Marketing Director, Stephanie Lew, about why it makes sense to save money, help the environment and get a new wardrobe at Buffalo Exchange. Lew said, “We give customers the chance to find current, like-new items for a fraction of the price.”

This Is Why You Shouldn’t Withdraw Cash From Your Credit Card

Credit cards should not be viewed as a way to access cold hard cash like an ATM. The goal of a credit card is as follows: a bank issues you a line of credit (also known as the card’s credit limit) and you are allowed to use the card to finance various expenditures up to the credit limit. You must pay back all of your expenditures in full on a due date set by the credit card issuer.

Funding Circle Offers Fast, Affordable Financing for Small Businesses

Many small business owners are accustomed to stressful financial challenges—whether they’re struggling to collect on unpaid invoices, scraping together the cash to repair equipment, or securing credit to fund their company’s expansion.

In fact, according to the Federal Reserve Bank’s Small Business Credit Survey, 61 percent of the small business respondents had faced financial challenges in the previous year, with accessing necessary credit (44 percent) and meeting operating expenses (36 percent) the most common.

Tips and Tricks on How to Travel Cheaper in 2018

If you want to hit the road in 2018 and make it your best travel year so far, we have some great suggestions for you. These are our favorite tips on how to maximize your credit card benefits and loyalty program perks while also earning and saving miles and points.

Safeguard Your Financial Investment with ValueInsured

It’s a seller’s market across much of the U.S. thanks to brisk growth in home prices and low for-sale inventory in many areas. While that’s great news for homeowners who want to enjoy the financial benefits of increasing equity—such as refinancing to lower mortgage payments or even take out cash—it’s bad news for buyers, many of whom are afraid to make the largest investment of their lives at what could be the apex of another real estate bubble.

This is What You Need to Do if Your Credit Card is Stolen

It’s a scary feeling when your credit card is stolen. Think about how much could go wrong. A thief now has the opportunity to charge whatever they want on your card and leave you responsible for footing the bill. It’s a thief’s dream, but a consumer’s worst nightmare.

As soon as you realize your credit card is missing, there are a few actions you should take immediately to limit your liability from any unauthorized purchases that may result from your card falling into the hands of the wrong person.

Healthy Paws Pet Insurance Helps Pet Lovers Reduce the Financial Cost of Care

Take a peek at the average U.S. household and you’re likely to find a beloved pet at its center. According to the most recent American Pet Products Association (APPA) National Pet Owners Survey, the nation was home to 84.6 million pet-owning families in 2016. Pet owners spent more than $66 billion dollars on their pets that year and the APPA forecasts they’ll spend even more ($69 billion to be exact) on furry family members by the end of 2017.

Maximize Every Dollar You Donate with Betterment Charitable Giving

‘Tis the season for charitable giving, and Americans are increasingly donating. According to the Giving USA Foundation, individuals, estates, foundations, and corporations across the nation contributed an estimated $390.05 billion to U.S. charities in 2016, an increase of 2.7 percent in current dollars from the prior year. Giving by individuals increased nearly 4 percent, accounting for much of the rise in total donations.

Top Tips When Applying for a New Credit Card

Applying for a credit card isn’t a difficult process. The major credit card issuers have online applications that can sometimes inform you within minutes if you’ve been approved for the card. But there are some factors to keep in mind when applying to ensure that your credit score doesn’t suffer unnecessarily.