In June 2016, Citi announced a massive list of downgrades to the Citi Prestige® Card that really eviscerated this card’s value proposition. However, existing cardholders were given over a year of lead time to absorb the changes and cancel their cards if they felt the remaining benefits no longer justified the $450 annual fee.

The changes officially go into effect on July 23, 2017, so now is an appropriate time to review what is changing and help cardholders decide if the card is worth keeping. Also, another round of changes is expected to be announced on July 17, though this time the changes will be positive but more minor.

What Benefits are Changing on July 23?

Here is a summary of what is changing on July 23:

- Elimination of Admirals Club access

- Decreased value for redeeming points with airlines, especially American

- Elimination of three free rounds of golf

- Change to calculation of the 4th night free hotel benefit

Elimination of Admirals Club Access

The current benefit allows complimentary access to Admirals Club lounges when flying on American. You can also bring in immediate family or up to two guests. After July 23, cardholders will still have access to Priority Pass lounges, the other lounge benefit offered by this card.

Decreased Point Values for Direct Airline Redemptions

Currently you can book flights through Citi’s travel portal and redeem your ThankYou points for 1.6 cents each if flying on American or 1.33 cents when flying on other airlines. This a really nice benefit for those that often fly on American because it puts a relatively high floor under the value of your points. It also provides more flexibility because you don’t have to find award space, you can just book paid flights and still get solid value for your points.

When the devaluation kicks in, points will only be worth 1.25 on all airlines. While this is still better than the 1 cent per point available for direct redemptions on many travel cards, it’s a rate that is fairly easy to beat.

Elimination of Three Free Rounds of Golf

This card currently offers three free rounds of golf per calendar year at over 2,000 courses around the globe. Eligible courses can be found on the Golf Switch website. This benefit can be worth hundreds of dollars as some of the courses offered are prestigious and expensive. This benefit will be going away completely, but reservations made before July 23 will be honored, so if you have any free rounds remaining, hurry up and reserve your tee time.

Changes to the 4th Night Free Hotel Benefit

The current benefit offers a statement benefit for the cost of the 4th night of a hotel reservation including taxes. When the changes go into effect, the new benefit will offer a credit for the average nightly rate, excluding taxes. Whether or not this is actually worse depends on the relative cost of the 4th night and the average nightly rate, but it definitely eliminates the ability to get outsized value by structuring your stay so that 4th night is relatively expensive.

Other Rumored Changes

Citi has been sending out promotional emails to customers with language “to celebrate the newly updated Citi Prestige Mastercard…” which indicates some positive changes are coming as well. While Citi has not confirmed the specifics, reporting on the topic indicates the following changes may also be on the way:

- Metal card

- Shoprunner membership

- ThankYou points will be able to be redeemed for one cent each for cash and gift cards

- ThankYou points can be used when making 4th night free bookings

None of these benefits are particularly exciting and many are available on other cards with lower annual fees. The only one that may be useful is being able to use points to book hotels in conjunction with the 4th night free benefit. This allows travelers to take advantage of the discount while also preventing a cash outlay. Overall, this card will be significantly less valuable going forward, and no longer a worthy competitor to other premium cards such as the Chase Sapphire Reserve or Amex Platinum cards.

Changes Comings to US Bank FlexPerks Program

US Bank has announced several changes to its FlexPerks program, both with regard to card benefits and the way that point redemptions as a whole will work in 2018. These changes are mostly negative, though the flexibility of the points will increase overall. The changes are all follows:

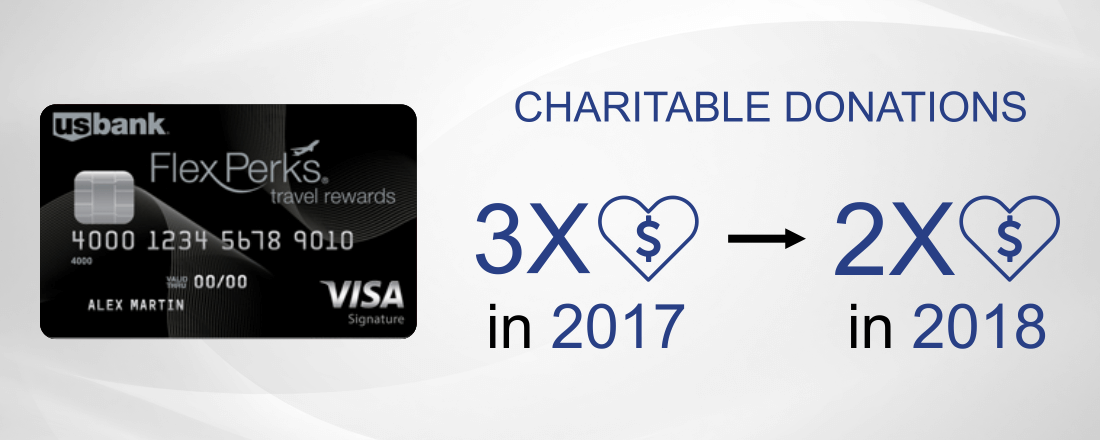

FlexPerks Visa Charitable Earning Bonus Category Earn Rate Reduced

Beginning in 2018 charitable donations will only earn 2x instead the of the 3x they earn now. Many people have been using Kiva loans to generate spend on the card while also loaning money to third world countries and earnings 3 points per dollar. These transactions will only earn 2x going forward.

Elimination of Reward Charts and Replacement with Flat 1.5 Cents Per Point Redemptions

The current FlexPerks reward scheme uses ranges for airfare redemptions where points can be worth anywhere from 1.33 to 2 cents. For example, 30K points can be redeemed for a ticket up to $600, 40K for a ticket up to $800 etc. FlexPerks are only worth one cent when redeemed for hotels. In 2018 the new scheme will eliminate the tiered chart for flight redemptions and simply make points worth a fixed 1.5 cents each. This change is a negative in general since even a redemption in the middle of an award tier is worth 1.67 cents per point. Travelers would be better off directing their spend to a ~2% fixed value card like Barclay Arrival Miles Plus or the Capital One Venture card. This change does raise the floor value of FlexPerks and also makes redeeming for hotels a more valuable proposition.

Elimination of the $120K per Year Points Earning Cutoff

We’ll finish off this post with a positive change. Currently if you spend more than $120K in a year on a FlexPerks card the unbonused earning rate drops from 1 point per dollar to 1 point per every 2 dollars. Effective January 1 2018, there will be no more cap that drops you into a lower earning tier.