Student loans are big business. According to the Federal Reserve Bank of New York, more than 44 million borrowers now carry more than $1.4 trillion in education loan debt with the average debt per student borrower at $27,857. These are numbers that will continue to grow as the cost of tuition rises along with interest rates on federal and private student loans. In July, the interest rates on new federal loans increased to 4.45 percent. The average variable rate on private student loans grew to 7.81 percent, while the average fixed rate stood at 9.66 percent.

CommonBond, a relatively new player in the student loan market, aims to relieve the burden of high student loan interest rates on U.S. borrowers as well as address other common failings within the education loan market. Phil DeGisi, the company’s chief marketing officer, recently spoke with RewardExpert about CommonBond’s mission, loan products, and unique position in the marketplace.

Transparent and Manageable Higher Education Finance

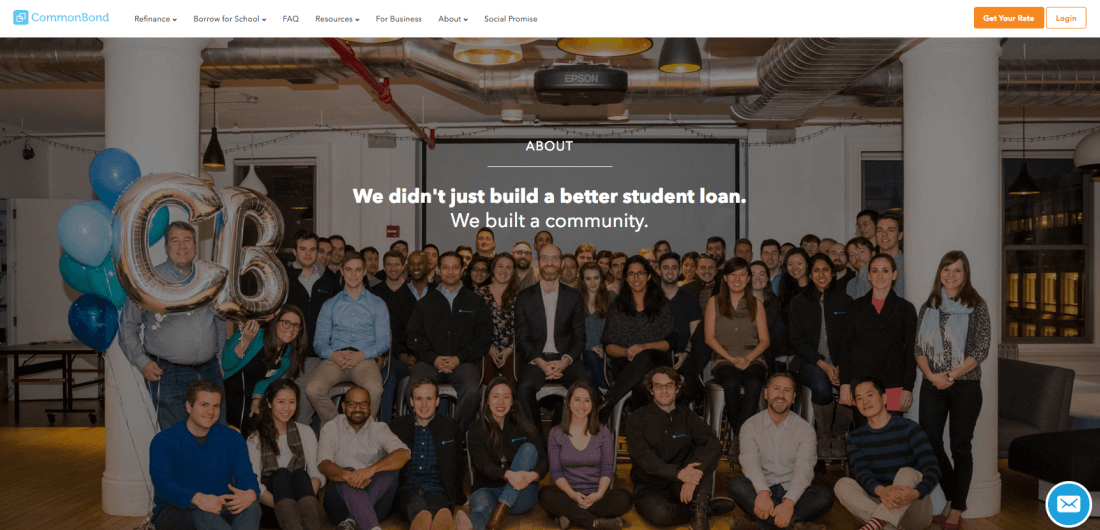

“CommonBond was born out of the personal experience of our co-founder and CEO, David Klein,” DeGisi explained. “When he went back to graduate school, he had to pay for the whole thing with student loans. As he went through that process, he realized that the rates were too high, the service was quite poor, and the process itself was really confusing.”

Fortunately, personal frustration led to the idea for CommonBond, which Klein founded in 2011 along with fellow Wharton MBA students Mike Taomina and Jessup Shean.

“We launched nationally in 2013 and have been growing ever since,” DeGisi added. “Our mission is to make higher education finance more affordable, more transparent, and easier to manage whether you’re a student, a graduate, or a family member of someone with student loans.”

To date, DeGisi said CommonBond’s customer base is in the tens of thousands. The company has funded over $1 billion in loans.

Offering Savings, Service, and Simplicity with a Side of Social Impact

“We help people pay for college with in-school student loans,” DeGisi said. “Those are our undergraduate and graduate student loans. We also refinance student loans to help people pay their student debt back faster.”

He noted that there are several reasons new borrowers and those seeking education loan refinances should check out CommonBond’s products.

“We have a U.S.-based customer service team of student loan experts,” he said. “They are empathetic and are here for our members and applicants to make the process as easy as possible. We also make it really easy to get a price quote on your student loans. You can do so in a matter of minutes.”

DeGisi encourages new borrowers to try out their Undergraduate Student Loan Calculator.

“You can enter information about where you are going to school, upload your Financial Aid Shopping Sheet, and we’ll take that information and give you back a plan,” he said. “This includes showing you the impact of different repayment strategies. Right now, the bulk of people still choose to fully defer their student loans while they are in school. But we want to help educate them that by paying $25 a month or even making interest-only payments during school, they can actually save a meaningful amount of money on interest.”

Visitors to CommonBond’s website will find a Refinance Student Loan Calculator as well.

“It basically requires only three numbers,” DeGisi continued. “You enter your current interest rate, loan balance, and the anticipated new rate from refinancing to see how much money you can save.”

DeGisi added that CommonBond’s average refinance customer saves more than $24,000 over the life of their education loans when they refinance at the company’s

While the savings can be substantial for both refinance customers and new borrowers—CommonBond never offers double-digit interest rates on in-school student loans—many customers choose them because of the company’s social promise.

“We believe that for profit businesses can and should have a social impact,” DeGisi said. “Our social promise is that for every loan we fund, we will also fund the education of a child in need. We’ve partnered with Pencils of Promise to deliver on that. It’s something we’re really proud of, and we like how it aligns with our mission. If we’re growing, the impact we have is growing as well.”

CommonBond for Business

CommonBond recently introduced an enterprise product for employers called CommonBond for Business. It was designed to enable employers to offer a variety of student loan benefits to their employees.

“We know a lot of employers are looking for ways to attract and retain top talent,” DeGisi explained. “One of the ways they can do that is through a variety of benefits. We offer a contribution product through CommonBond for Business that makes it possible for an employer to make a payment towards an employee’s student loan debt each month, almost like a 401k match. That’s something we’ve seen a lot of interest in from employers as they think about how to support the financial wellness of their employees.”