Although credit and debit cards look very similar, they are not. The most obvious difference between a credit and debit card is that a debit card draws from your available funds while a credit card offers a line of credit to be paid back later. However, this is not the only difference.

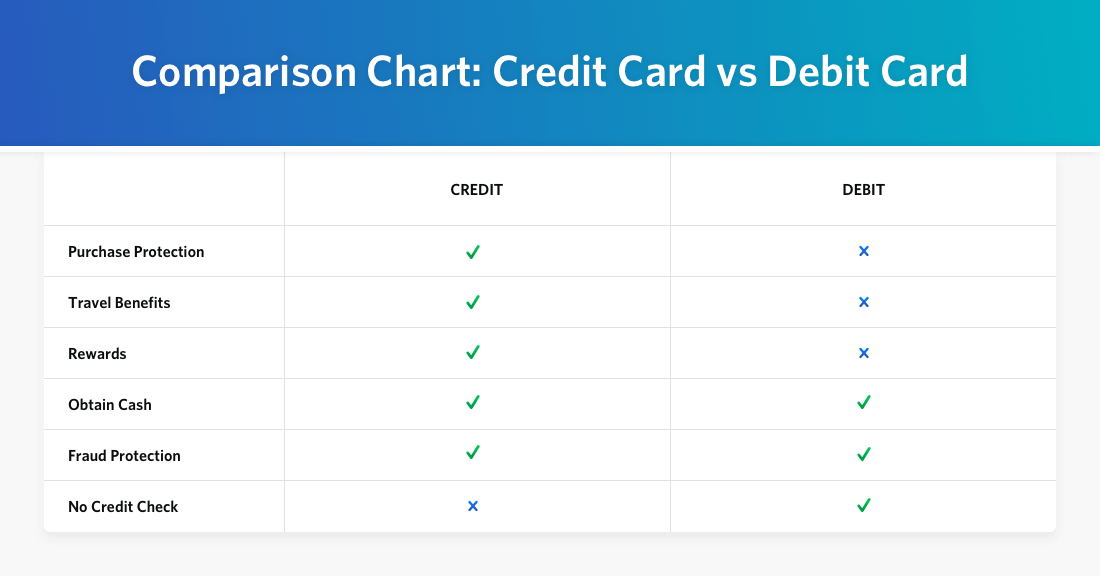

The benefits and rewards earning power credit cards come with make them better than debit cards when it comes to shopping, travel and everyday spending.

What is a debit card?

A debit card is attached to your checking account. It allows you to electronically withdraw or transfer funds. Debit cards will usually have a Visa or MasterCard payment processor logo which allows them to be accepted anywhere those cards are taken.

These cards can be used to make purchases online or at retailers, as well as allowing you to access cash at ATMs (automatic teller machines). When you use a debit card, the funds will be withdrawn directly from your checking account.

How is an ATM card different from a debit card?

The major difference between an ATM and a debit card is that a debit card has a Visa or MasterCard logo which allows it to be used at merchants as widely as credit cards.

Debit cards also allow you to withdraw money from an ATM. However, an ATM card only allows you to withdraw money from an ATM and cannot be used at merchants, retailers or online.

What is a credit card?

When you use a credit card you are borrowing that money from the bank that issued you the card. If you carry a balance, you will be charged interest.

Consumer credit cards give cardholders a chance to avoid interest with a 21-day grace period though. Therefore, if you pay your entire bill 21 days from the statement or billing date you will not be charged interest.

Is a debit card a credit card?

A debit card is not a credit card, although you may be asked regularly at retailers when you swipe or insert your bank card: “debit or credit?” The only difference is in how they process the payment and whether you sign or use your PIN to complete the transaction.

Although a debit card may have a Visa or MasterCard logo, it does not offer you a line of credit. A debit card withdraws directly from your checking account and does not offer financing options.

What is the best card to use debit or credit?

Sometimes it may be more beneficial to use a credit card instead of a debit card like when shopping for high-priced items and traveling.

When making an expensive purchase, some credit cards provide purchase protection and extended warranties that can afford you peace of mind and help protect your investments. If you are traveling, credit cards outshine debit cards when it comes to benefits. Not only can travel credit cards help you access perks and save on travel, but they may also provide things like trip cancellation insurance and lost luggage reimbursement.

Are credit cards more widely accepted at merchants than debit cards?

Debit cards are usually branded by Visa or MasterCard which are accepted anywhere you see the logo. So, both debit and credit cards are widely accepted by merchants worldwide.

Is a debit card safer to use than a credit card?

Although both debit and credit cards can have fraud protection, it may be a better option to use your credit card. If the balance on your debit card disappears and you haven’t used it, or some of the charges aren’t recognized, there may be fraud involved. While the dispute is ironed out some of your cash can be tied up and not available to you during the investigation.

Another reason a credit card may be safer to use is that federal law caps your personal liability for fraudulent charges at $50 on a credit card, but when it comes to a debit card you could be liable for $500 or more depending on how quickly you report it.

Is it easier to get a debit or credit card?

It is easier to get a debit card than a credit card because a debit card is available to anyone with a Social Security number regardless of their credit score.

Obtaining a debit card does not require a credit check. Banks are less concerned with your repayment history because they will not be loaning you any funds. They only allow you to spend the money you already have in your account.

Are credit cards better than debit cards for rewards and cashback?

When it comes to rewards, credit cards readily offer them in many forms, whereas finding them with a debit card is difficult.

You may remember a time not so long ago when many banks offered rewards with checking accounts. Those days are gone. However, rewards on credit cards are still plentiful and competitive. If you are in the market to earn rewards, credit cards are still offering tons of points, miles and cashback to sign up.

Credit cards have the best rewards

Credit cards also surpass debit cards when it comes to rewards. Credit card rewards are plentiful while the number of banks that offer rewards with debit cards are rare. If you handle your credit cards right, banks will not only lend you money but they will actually pay you for the privilege in points, miles or even cash.

Does a credit or debit card have less fees?

A credit card will not charge consumers a fee for purchases, and most debit cards do not either. These fees are the responsibility of the merchant.

Whether a debit or credit card charges less fees to a cardholder will mostly depend on how you use the card. There may be a monthly maintenance fee for your checking account, and there may be other fees such as an overdraft fee or a fee for withdrawing cash from an ATM or a bank that is not your own. These fees can usually easily be avoided and some banks will even waive the monthly maintenance charge if you maintain a certain balance.

It is also easy to avoid any fees when using your credit card as well. If you don’t pay an annual fee for your credit card and avoid interest by paying your balance in full, you can easily use a credit card for purchases without paying fees. However, prepaid debit cards are likely to charge fees.

Whether it is better to use a debit or credit card can depend on several factors including what you are using the card for. By far the most important consideration is how responsible you are when it comes to repayment.

The biggest advantages credit cards have over debit cards are the benefits and rewards you can earn with. However, these rewards can easily be negated by paying interest. So, carrying a balance on a credit card that does not have a 0% promotional interest rate is a losing game. If you plan to do that, a debit card may be the way to go.