Most international travelers know to beware of currency-exchange booths around the world because the fees are often exorbitant and the currency rates are not generally favorable. But now, you need to learn to beware of ATMs and credit-card machines as well.

If you don’t understand how these work when you use your bank ATM or debit card, or your credit card, you will be ripping yourself off.

Blame is on something known as “dynamic currency conversion.”

What Is Dynamic Currency Conversion?

DCC, as it’s called, is a process that allows merchants, a merchant’s bank, or an ATM operator to offer their own currency-exchange rate when you buy something overseas with your credit card, or when you hit the ATM for local cash.

It seems innocuous. And many consumers don’t really pay attention to what’s going on. But the reality is that the currency-exchange rate you are offered can be 12% to 18% higher, meaning you’re losing out on a potentially large handful of money when you spend overseas or withdraw money.

And the thing is … it’s all legal.

But if you understand what’s going on, and if you know what you’re doing, you can avoid this legal rip-off.

What Should I Be Aware Of When Making Purchase Abroad?

There are two situations in which you really need to pay attention to what’s going on, and the questions you are being asked by either a foreign ATM screen or by the little handheld, credit-card readers you’re presented with when making a purchase overseas on your credit card.

In both situations, you will be given an option to choose how you the transaction handled. That means you must read what’s being asked, and you must know what choice to make.

So, let’s start with a foreign ATM….

What Is The Foreign ATM Rip-Off?

Depending on what ATM you’re using in which country, you could face two potential rip-off situations.

Rip-off #1: In many countries, ATMs are programmed to react differently when it’s reading a foreign ATM card rather than a local one.

When you insert, say, an ATM card from a U.S. bank, the machine initially offers withdrawal amounts that are insanely large. For instance, where I live in Prague, I’ve had machines offer withdrawal amounts of between10,000 and 20,000 Czech crowns. To put that into perspective that’s the equivalent of $435 and $870 at the moment.

Think about that: How many times have you gone to your ATM at home and had the lowest withdrawal amount pop up north of $400? Never, is my bet.

The reason this ATM wants you to take out so much money is because of currency exchange, and ultimately dynamic currency exchange, which gets us to…

Rip-off #2: The more dollars you withdraw, the more dollars the ATM’s owner gets to convert, which means the more profit it earns from the exchange.

There are two currency-exchange rates to keep in mind:

- The official interbank rate that banks use when moving currencies between themselves;

- And the dynamic currency exchange rate, which can be pretty much anything a merchant or a bank sets privately

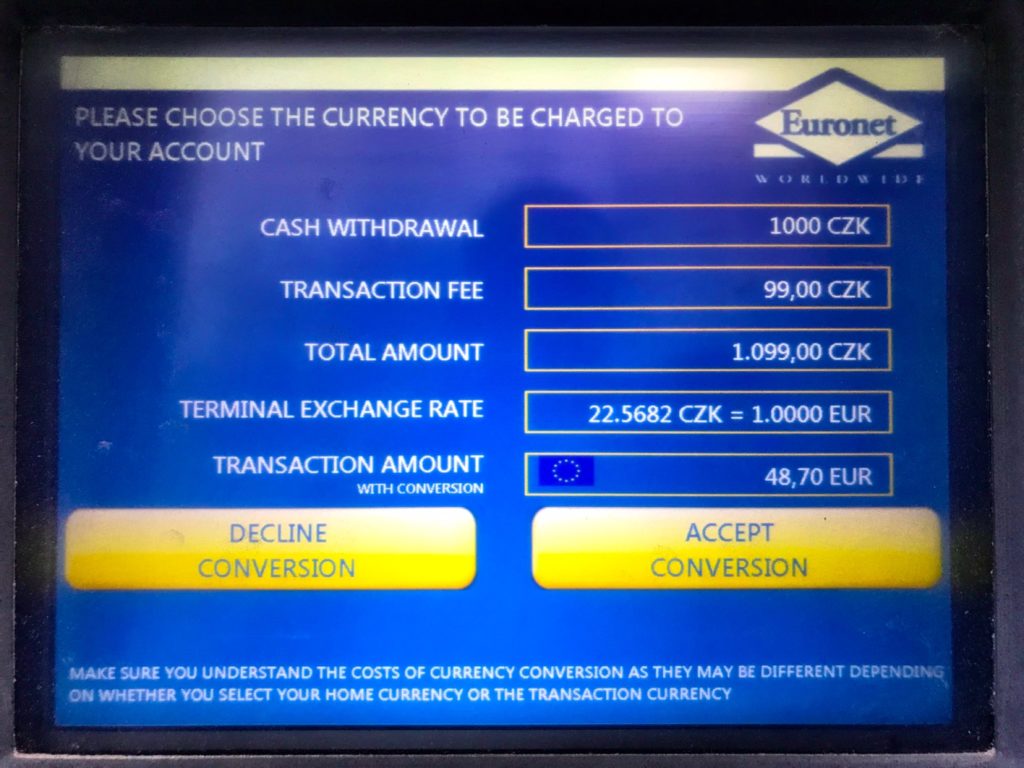

Recently, as part of a test, I stuck my U.S. bank card into the ATM of a notoriously bad European money-exchange firm called Euronext.

The ATM offered me an exchange of 20.22 Czech crowns per dollar converted. I then checked the XE.com app on my phone and saw the official interbank rate was 22.98 crowns per dollar at that moment.

If I’d been an average tourist not paying attention and I chose to withdraw those 10,000 or 20,000 crowns, I’d have paid roughly $55 to $110 more than I needed to. (And I would have ended up with way too many Czech crowns that I would have lost more money on converting back to dollars at some point).

What Foreign ATM Strategy Should I Use?

When traveling overseas, you should make it a habit to follow these two rules:

- Always find an ATM run by a local bank rather than one of the ubiquitous ATMs running by third-party operators such as Euronext. You will generally know you’re at a bank if you see the word “bancomat.” If you see “ATM” you’re probably at a third-party machine.

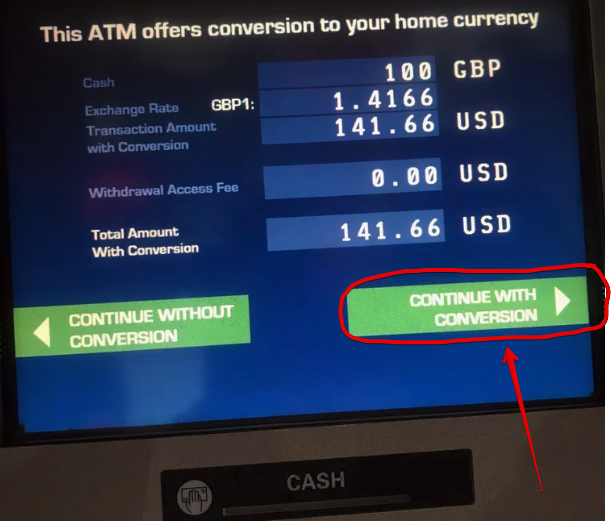

- When the machine shows you the transaction you’re about to engage in, it will often show you the exchange it’s using, and then it will give you a choice: “Continue Without Conversion” or “Continue With Conversion.” Always chose “Continue WITHOUT Conversion.” This goes for any ATM you use – bank or third-party.

In doing this, you’re telling the ATM’s operator that you will rely on your home bank to convert the currency. And your home bank will pack your transaction into all the other transactions in that currency and convert it at the lower interbank rate.

To give you an example of what that means, I recently stopped by a local bank in Prague to withdraw 1,000 crowns from my German bank account. On the ATM screen, Raiffeisen asked me to accept the transaction with an exchange rate of 23.44 crowns per euro, for a total withdrawal of €42.66 from my account.

I chose the option to “Continue Without exchange.” I got my 1,000 crowns, but it only cost me €39.10—an exchange rate of 25.57 crowns per euro, very near the official exchange rate at that moment. Making that simple choice saved me from a 9% hidden cost.

What Is The Overseas Credit-Card Rip-Off?

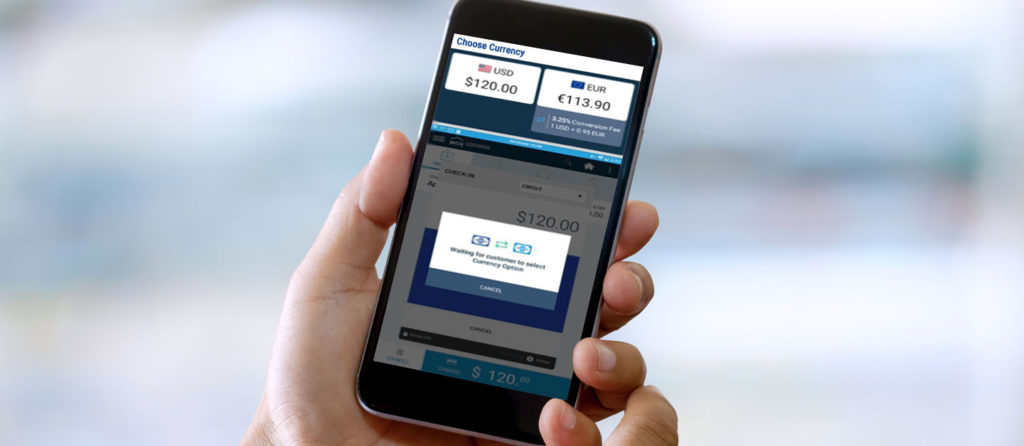

When you make a purchase overseas with your credit card, the card reader will very often ask you which currency you would like to use to complete your payment.

Travelers reflexively chose their home country. Ones I’ve talked to say they assume that by choosing, say, dollars instead of the local currency they won’t pay a currency exchange fee. Alas, this is 100% not true.

If you are shopping overseas, even with a credit card, you are paying in the local currency. Period.

But by giving you a choice, the merchant is hoping you will choose dollars over the local currency. In doing so, that gives the merchant the legal right to impose their own currency exchange rate … and that rate is never as good as the interbank rate. Indeed, in many cases it is egregiously higher, meaning the merchant is profiting from your lack of awareness.

What Credit Card Strategy Should I Use Overseas?

Simple: Any time a credit-card reader offers you a choice between paying in dollars or paying in the local currency, always choose the local currency.

In doing so, your U.S. credit-card company will handle the currency exchange and it will almost always be at, or very near, the official interbank exchange rate.

That will save you 10% or more, easily.

What Are the Best Credit Cards for Traveling Abroad?

These days, you have a

But there are more that are not good.

The best way to tell if a card is bad for overseas travel:

Check to see if it charges a foreign-transaction fee. If it does, do not use it overseas because you are immediately adding between 3% and 5% to ever single purchase you make. Over the course of a week or two overseas, that can add up to hundreds of wasted dollars.

Instead, find yourself a credit card

Two of my favorite card for international travel are Capital One Venture Rewards and Chase Sapphire Preferred.

You can use your Capital One miles to purchase airfare and hotel rooms, generally at the rate of one cent per mile. Plus Capital One has partnered with various airlines, allowing you to transfer miles to those frequent flyer programs, generally at a 1:1 ratio.

I’ve written in the past that Chase Sapphire Preferred is one of the best all-around travel credit cards, and that hasn’t changed. Along with using points to buy travel at a discount, Chase lets you transfer points to a variety of airline frequent flyer programs at a 1:1 ratio.

The Wrap Up

Traveling overseas is intoxicating. But it can also be more expensive than it needs to be, if you are not using your ATM and credit cards correctly.

Apply these rules I’ve laid out, and you can save hundreds of dollars on your trips … money to help you afford another trip later.