Not only is the Discover it card great for earning cash back, but it’s also an excellent tool for paying down existing debt due to its 18-month balance transfer offer. With this special financing, you’ll get 0% APR for a year and a half. Plus, you’ll earn cashback rewards on every purchase you make.

The icing on the cake is that this card is absolutely free. You’ll never have to pay an annual fee. Let’s take a closer look at what this card has to offer.

Discover’s 0% APR Balance Transfer Offer

This is the Discover it card’s best perk. If you have outstanding debt on another credit card that’s charging high interest, you can save a lot of cash by transferring that balance to a Discover card.

Not only will you save hundreds of dollars in interest, but every dime you put into card payments will pay down your balance. You won’t be wasting money on interest, but instead you’ll be paying off your principal.

Four Things You Need to Do Before Applying for the Card and Transferring Your Balance

Below are the four key steps to take in order to be approved and to eliminate your debt. We’ll cover each in more detail in the following sections.

- Know your credit score: Make sure your credit score is above 670 before applying.

- Keep your debt down: If you carry too much debt, your credit score will take a hit and it’ll be less likely that you’ll be approved for a card. Try to keep your credit utilization below 35 percent.

- Watch out for balance transfer fees: Every balance transfer will incur a fee. Be ready for that amount to be added to your debt.

- Make a payment plan: Figure out how much you have to pay every month in order to eliminate your debt before end of the 18-month interest-free period is over. You don’t want to be hit by high interest rates.

If Your Credit Score is 670 or More This Card Can be Yours

Many applicants for the Discover it card with the 18-month balance transfer offer report that they were approved with good to excellent credit. That translates into a score of 670 or more.

Note that having that score does not guarantee approval, nor does a lesser score mean that you won’t get the card. Discover will consider your entire application before deciding.

If your credit score is not in the good-to-excellent range, then you should work on getting it up to that level before applying as a declined application will ding your credit score.

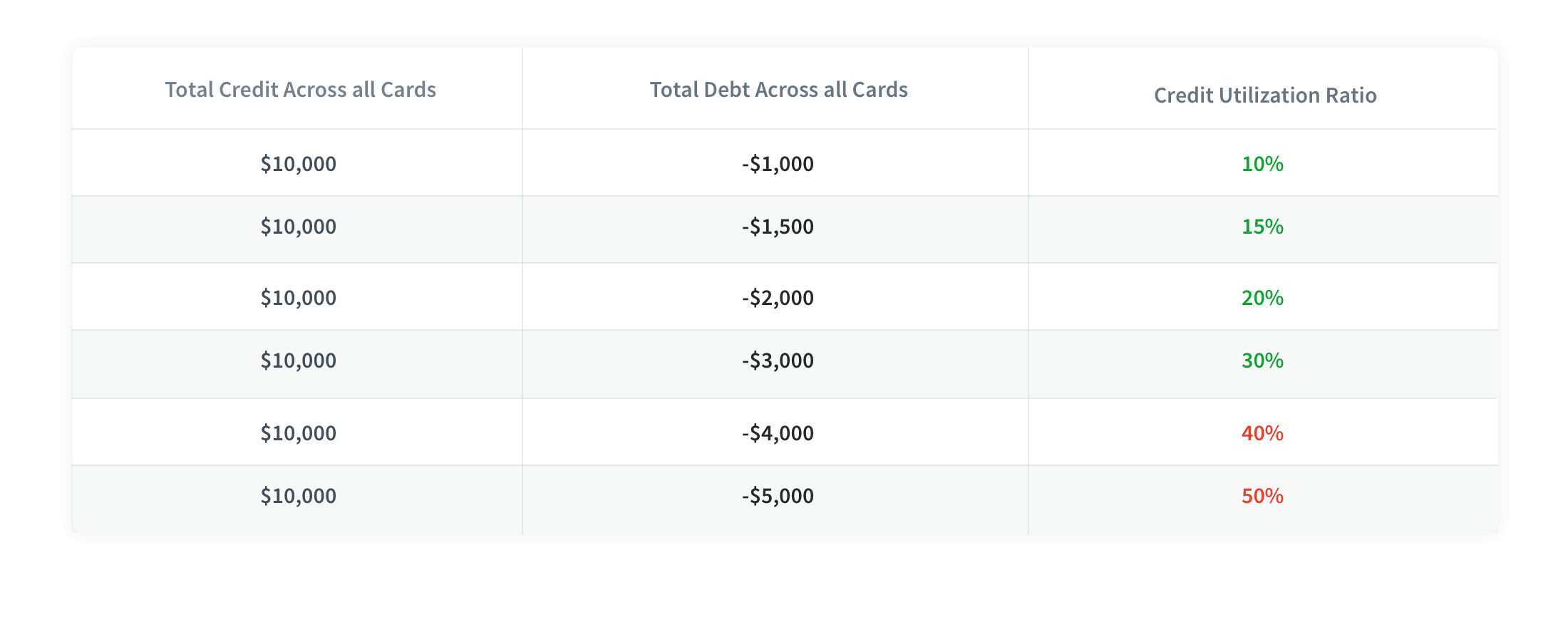

Keep Your Credit Utilization Ratio Below 35 Percent

Part of your credit score is determined by how much of your total credit has been used. Ideally, you want to keep your total debt below 35 percent of your credit. That includes all of your credit cards.

To calculate your credit utilization, just add together your outstanding balances and divide that by the sum of each card’s limit. For example, if you have $5,000 in debt across three cards and each card has a limit of $3,000, then your credit utilization would be about 56 percent ($5,000/$9,000).

That’s not great. Credit card companies will see you as a much greater risk compared to someone with a ratio of less than 35 percent. So get that debt down or your credit score will continue to take a hit.

Beware of Balance Transfer Fees

It’s important to know that balance transfers are not free. You’ll be charged 3 percent of the total balance you move to your Discover account.

That may sound like a major drawback, but just about every card adds fees for transfers. Discover isn’t charging any more than anyone else. More than that, you’re likely to save hundreds of dollars over the course of 18 months, even with the fee.

For example, it’ll cost you $150 to transfer a balance of $5,000 to your Discover account. However, if you’re paying 11.99 percent interest on the balance, which is a relatively low rate for a credit card, you’re getting hit with nearly $600 in interest charges.

That’s $450 in savings just for transferring that debt to your new Discover it card. And you won’t have to pay a dime in interest or fees for an entire year and a half.

Prepare a Payment Plan and Stick to It

You’ll get 18 months of 0% APR from the date of your first transfer. After this promotional period is over, you’ll be hit with an APR of 11.99 to 23.99 percent, based on your creditworthiness.

In other words, you’ll want to pay off your balance before the promotional financing expires or you’ll be hit with some hefty interest. The best way to do this is to come up with a payment plan that brings your balance down to zero.

For example, if you transfer a balance of $5,000 to the Discover it card, you’ll have to pay off a total of $5,150, which includes the 3 percent transfer fee, within 18 months. That works out to a $286.11 payment every month. Make sure you pay at least that amount and cover any additional charges you’ve put on the card and you’ll be all set.

If you can’t pay it off in time, consider getting another card that offers interest-free financing. There are several out there, though many don’t give you as much time as the Discover it card with the 18-month balance transfer offer.

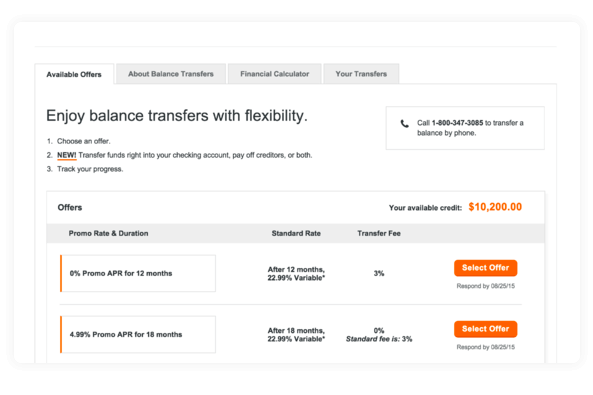

How to Make a Balance Transfer

Completing a balance transfer with Discover is quick and easy. It’ll only take a few minutes by phone or online. You’ll need two things:

- The account number of the credit card you’ll be transferring from

- The amount of the balance

With that info, you can call the number on the back of your Discover card. The phone representative will take care of the rest.

If you’d prefer to do it online, you’ll need to sign up for Discover’s online banking. Log in to your account, click on Credit Options and select See Offer from the dropdown menu. From there, you’ll need to select the appropriate offer, which is 0% for 18 Months, and input the requested information.

Note that it can take up to three weeks for Discover to make the payment to your other credit card. You’ll still be responsible for any payments that are due to your old card until Discover completes the transfer. It often takes less than three weeks, so check your card accounts if a due date is coming up soon.

What to Do After Your Balance is Transferred

The most important thing to do after you transfer your balance to the Discover it card is to pay off your debt before interest charges kick in.

Along those same lines, you should keep spending to a minimum. Using the card will only add to your debt and make it harder to pay off. Avoid putting big purchases or anything else you can do without until you’ve paid down your doubt.

Is Discover it a Good Cashback Card to Keep Once the Balance is Paid?

Yes, you can earn cash back for every purchase you make.

Not only will you be able to save money with Discover’s generous 0% APR offer for balance transfers and new purchases, but you’ll also be able to earn a lot of cash back after you pay off your balance. Every time you swipe your card, you’ll be putting cash back in your pocket.

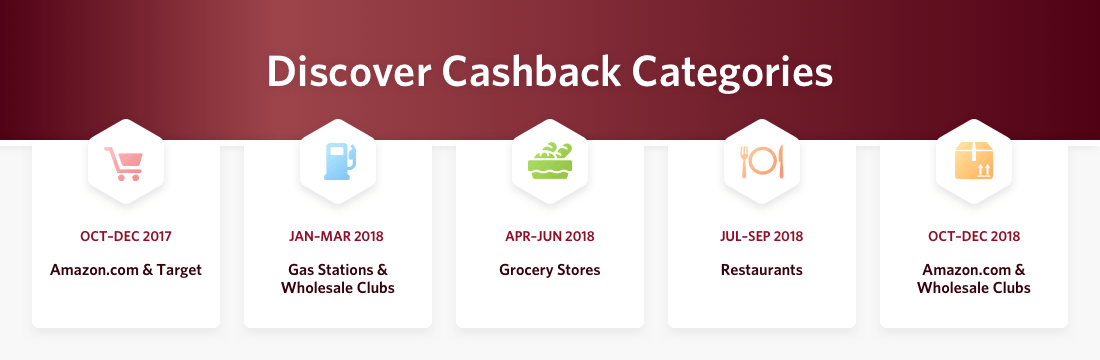

The Discover it card has a somewhat unique earning scheme. Most purchases earn 1 percent back, but certain categories earn an impressive 5 percent. The 5 percent category changes every quarter and typically includes gas stations, wholesale clubs, grocery stores, restaurants and Amazon.

You have to activate the bonus every quarter, so you’ll have to stay on top of the 5 percent categories to maximize your rewards. The bonus is also capped at $1,500 of spending per quarter. After you hit that limit, you’ll earn the base rate of 1 percent.

Still, you can earn a lot of cash back quickly with this lucrative earning program. If you max out your bonus spending every quarter of the year, you’ll get a whopping $300 back for just $6,000 of spending. That’s a fantastic return.

Get Even More With the Cashback Match

To sweeten the deal even more, Discover will match all of the cash back you earn during your first year as a cardholder so you’ll effectively earn 10 percent back in bonus categories and 2 percent back for all other purchases.

That means that the $300 you earned by maxing out the 5 percent bonus categories would actually net you $600 during the first year your account is open. That rate of return is unheard of in the world of cashback cards.

Final Thoughts

If you need to pay off some outstanding debt you should consider getting the Discover it card. Few cards offer 0% APR on balance transfer for as long as 18 months.

After you pay off your balance, this card’s earning potential will help you rake in some extra cash. You can get 5 percent back in quarterly rotating categories of purchases, plus Discover will match all of the cash back you earn in your first year. This combination of rewards and promotional financing is hard to find.