Do you live paycheck to paycheck, counting the days between each infusion of cash so you can buy essentials and cover your bills—and rarely, if ever, having anything left over to stash away for a rainy day? If so, you’re far from alone. According to a survey of U.S. workers conducted last year, nearly 80 percent said they struggle to make ends meet. And that wasn’t just the low- and mid-income earners either. Nearly 10 percent of respondents making $100,000 or more a year said they usually or always live paycheck to paycheck.

Fortunately, Jon Schlossberg, founder and CEO of Even, an app that integrates with workers’ attendance, payroll and banking systems, has come up with a holistic approach to solving the paycheck to paycheck problem. He recently spoke with RewardExpert about the inspiration behind Even and how it works to address the issues at the core of this modern American challenge.

Combatting Money-Related Stress

Founded in 2014 and based in Oakland, California, with offices in Raleigh, North Carolina, and New York City, Even was inspired by Schlossberg’s research into today’s “important problems.”

“I have a background in psychology,” he explained, “and I started reading a bunch of journal articles and sort of stumbled on this research into behavioral psychology that shows that the amount of money you have actually affects the chemistry of your brain in very ironic ways, making it harder to lift yourself up and harder to save and make good decisions.”

Schlossberg likens the stress of money worries to the stress of being mugged at gunpoint—only for the nearly 80 percent of worker’s mentioned earlier, that stress is continual. “Imagine trying to make good financial decisions while you’re being mugged,” he exclaimed. “On a chemical level, that’s sort of like what’s going on for a lot of people.”

He and his team decided to tackle the problem head on. “Over the last four years, we’ve invested a lot into research and understanding the problems we’re trying to solve,” Schlossberg said. “We don’t have all the answers, but we’ve been experimenting and creating products to help people step by step.”

Products for Budgeting, Cashflow and Saving

Because the Even team has determined that there is no “silver bullet” approach to address the core financial issues many Americans are grappling with, they’ve created three products to help consumers budget, manage cashflow issues and save for the future.

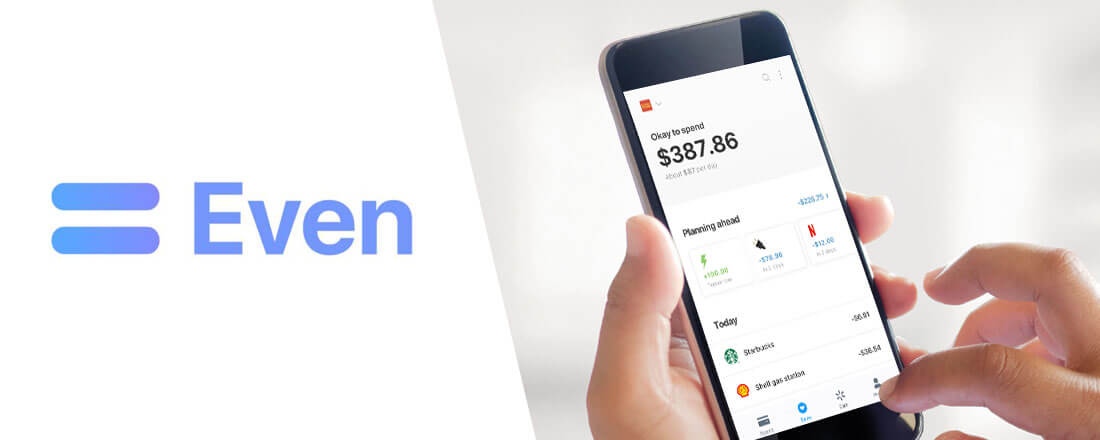

On the first front, “The technology we’ve been building takes a look at the transactions in your bank account and automatically figures out how much of your money you need to keep around for upcoming bills,” Schlossberg explained. “The average American living paycheck to paycheck checks his or her bank balance two times a day but that doesn’t always give the best information. Your bank balance doesn’t account for rent that is coming due or a utility bill that’s going to be higher because you’ve been running the AC. Even does that automatically and gives you what we call the ‘Okay to Spend’ balance instead.”

Second, “Even if you do all of that planning, there are still going to be unexpected things that happen in life and cause cashflow problems,” Schlossberg said. “Maybe your kid gets sick and you need to buy medicine, or you get a flat tire. You need to be able to solve the issue in a way that isn’t super expensive like a payday loan is, or an overdraft fee, or putting it on your credit card at 25 percent interest. Even allows you to get the money you’ve already earned that just hasn’t been paid out yet—without any fee or interest. We call this ‘Instapay.’”

Finally, Even helps consumers save. “You now have more money because you’re not wasting it on payday loans, overdraft fees and stuff like that,” Schlossberg continued. “We take this newfound money and help you save automatically as you earn for things like building an emergency fund or paying down your credit card debt a little bit faster. This really helps you make progress towards getting out of the paycheck to paycheck cycle.”

A Win-Win for Employers and Employees

How does Even accomplish all this? Schlossberg said it’s generally by partnering with employers to offer the app’s services as a benefit to their workers. Though the Even Basic app is available to anyone for $2.99 per month, it only includes the Okay to Spend feature. Even Plus is where the service really shines with the inclusion of Instapay and automated savings.

“With Even Plus, we sit at the intersection of your bank account and your payroll,” Schlossberg explained. “That really allows us to see the complete picture of your financial situation and provide the greatest benefit. If your employer does not currently partner with us, find a way to convince them to add the benefit.”

How can consumers do this? Schlossberg suggested directing them to the Even website, where they can easily review the benefits employers can expect when providing Even Plus for their workers.

“It’s honestly a win-win,” he added. “It significantly reduces stress for people who use the app. You see that repeated in the thousands of app store reviews that we have. But also, because of this reduction in stress, it makes people more productive at their job. We can actually see a clear ROI for the businesses that offer Even Plus in the form of happier people, reduced turnover and reduced absenteeism.”