The average consumer may have 3 credit cards, but if you’re really into travel rewards like I am, you may have applied for more than 3 credit cards just in the last 90 days. When people ask me “how many credit cards should I have,” I reply that it depends on your situation. Let’s look at the pros and cons of having multiple credit cards to help you determine the right number of credit cards for you.

This article will cover

- How Many Credit Cards Does the Average American Have?

- Which Credit Card Should You Get First?

- Which Credit Card is Right for Your Situation?

- The Perfect Credit Cards for Every Age Group

- Don’t Overlook Business Credit Cards

- Effects of Opening and Closing Credit Cards

- Benefits and Concerns of Having a Lot of Credit Cards

- How do Multiple Cards Affect my Credit Score?

- Bank Restrictions Limit the Number of Cards You May Have

- How Many Credit Cards Should I Have?

How Many Credit Cards Does the Average American Have?

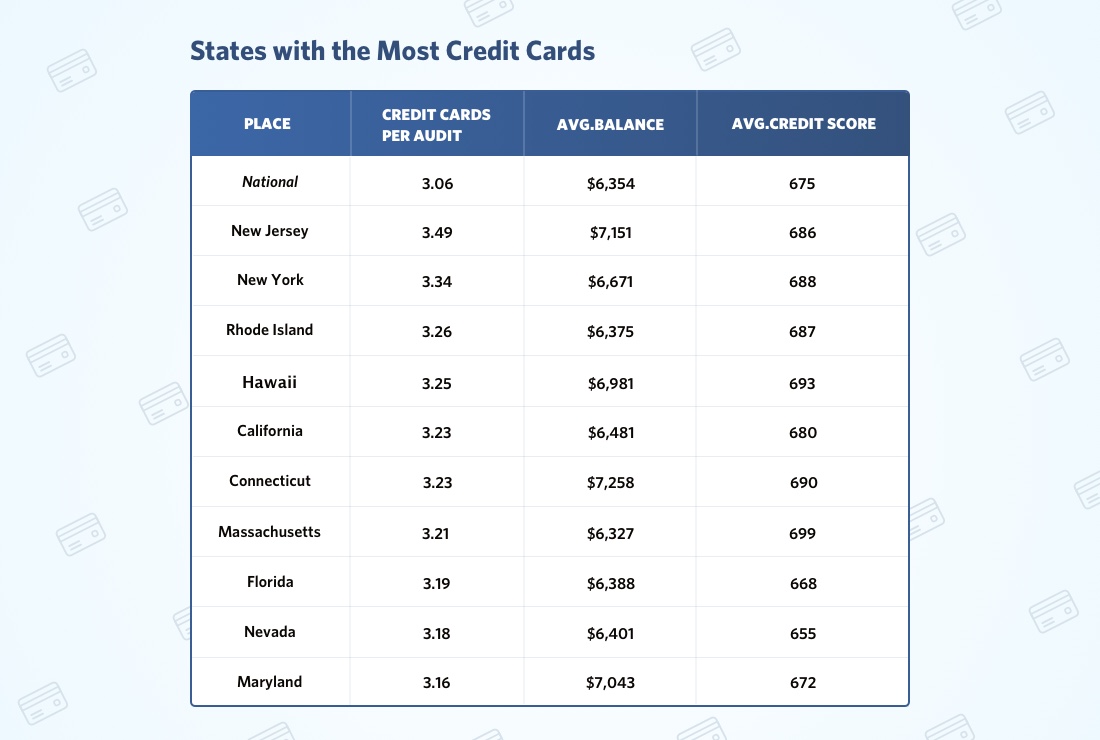

According to studies from the credit reporting agencies, the average American has about 3 credit cards that can be used anywhere (like Visa, Mastercard, American Express, and Discover). Additionally, the average consumer has 2 1/2 retail credit cards that can only be used at a specific store.

How many credit cards should I have? How many credit cards is too many? If the average American has between 5 and 6 credit cards, then most people can afford to add a couple of credit cards to really boost their benefits. I have significantly more credit cards than 6 and it hasn’t stopped me from keeping a high credit score or getting approved for the best mortgage rates.

Credit card usage is gaining acceptance among both consumers and retailers. As you go about your day, you’ll notice that fewer people are making a purchase with cash or a check. The potential for rewards is great, but make sure that you can pay off the balance in full each month. If you have some debt, here’s a great article that will show you how to pay off debt.

Which Credit Card Should You Get First?

Before you should be concerned with how many credit cards should I have, you need to get your first credit card. People who are young or are new to this country have a limited credit profile if they have one at all. As they seek to build their credit, it is important to pick a good card that they can use as the foundation to their credit report.

Do I need a credit card to build a good credit score? Absolutely. Your credit mix is an important factor in your credit score. Banks want to know that you can handle all types of credit – loans that you pay off over time and credit cards that you use on a regular basis.

Because average age is an important part of your credit score, start with a good no annual fee credit card and never close it. This mature account will boost your credit score as its length of credit history increases. If you must begin with a credit card that has a fee, consider downgrading it to a no-fee card when you can.

Some banks target limited credit consumers with credit cards that have high fees, high interest rates, and low credit limits. Stay away from these banks at all costs!

There are many quality banks that offer credit cards for people who are just starting their credit journey. Periodically, the banks you have credit cards with will perform soft inquiries on your credit to gauge your progress. If you continue doing the right behaviors, they may increase your credit score or provide

Before you proceed with a balance transfer, be aware that some of these offers have balance transfer fees. It can be ok to pay a fee, but make sure that your new interest rate plus balance transfer fees is lower than the interest rate you’re currently paying.

For example, if you have a credit card that has a high interest rate of 30%, it is ok to pay a 3% balance transfer fee to move your balance to a credit card with a 0% promotional offer. This way more of your money goes towards paying off the balance instead of paying interest to the bank.

Which Credit Card is Right for Your Situation?

The “right” credit card for you will depend on how much you spend each month and what categories you spend. There are literally hundreds of credit cards to choose from based on your personal situation.

I like to travel, so credit cards that

The Perfect Credit Cards for Every Age Group

No matter what phase in life you’re in, there are different types of credit cards targeted to your spending habits and the benefits that work best for you.

If your current bank doesn’t provide attractive credit options to fit your lifestyle, consider taking your business to a bank that does. It is perfectly normal to have credit cards from multiple banks. And it is ok to have credit cards from different networks – American Express, Discover,

In fact, I would suggest that you have credit cards from at least two different banks and from multiple networks. You don’t want to be left without a credit card if the bank decides to close your accounts. And each network has specific benefits that you may want to take advantage of.

If You’re Under 25 and Just Starting Out

Getting a credit card when you’re just starting out is more difficult than in previous generations. Federal law requires everyone under the age of 21 provide proof of income to qualify for a credit card. Otherwise, they’ll need an adult to co-sign for them.

As you enter the workforce and start earning income, one of the first things you should do is

You may have to begin with a secured credit card until you build up a credit history of on-time payments. Some starter credit cards will perform a soft credit inquiry and increase your credit line automatically after you’ve made several payments on time.

It is best to start out with two credit cards from different banks and across different networks. This will help you in case one gets lost or if a merchant doesn’t accept one of your credit cards.

If you have debt that you’re trying to pay off, consider the HSBC Gold Mastercard® credit card. It offers a 0% introductory rate for 18 months. Eliminating the interest will allow all of your money to go towards paying down the debt!

Starting Your Career and Family (Ages 25 to 35)

At this stage in life, you’ve started your career and are spending more money on dining, entertainment, and vacations. You want credit cards that reward you the most for eating out and going to movies & concerts, and traveling. Also be sure that the credit cards you use when traveling do not have foreign transaction fees. You don’t want to come home to this unpleasant 3% surprise.

Some of my favorites include the Capital One Savor (4% cash back on dining and entertainment) and Capital One Venture (2% on everything with no travel blackout dates). The cash back earned can either be used as a statement credit to offset your next bill or you can request a transfer to your bank account.

Raising a family and buying a home can be expensive. For large purchases, consider the Capital One Quicksilver® Card. Not only will you earn 1.5% on every purchase, they offer 0% interest on purchases and balance transfers within the first 15 months.

Established and Focused on Benefits (Ages 35 to 55)

As your career gets established, these are your peak earning years. What people tend to overlook is that you also spend a lot of money too! For example, when I lived in California, I was spending almost $3,000 per month just on daycare and private school for my kids. Good thing they accepted credit cards, which allowed me to rack up a ton of travel rewards.

When picking out credit cards for this stage of life, select cards that reward big spenders. Many hotel and

Make those trips to the grocery store and gas station more rewarding. The Blue Cash Preferred® Card from American Express gives 6% cash back on groceries and 3% cash back at the gas station and select department stores. Click here to learn more.

Ready to Retire and Enjoy Life (Ages 55 and Up)

As the saying goes, “70 is the new 40” because life doesn’t end when you retire.

When you retire (or get close to it), most people want to simplify their life so they can focus on what’s important to them… enjoying the “empty nest,” spoiling their grandchildren, and knocking items off their bucket list.

It is a good idea to select credit cards that don’t have complicated reward rules, such as Citi® Double Cash Card, Venture or VentureOne. Just use the card to pay for everyday expenses, then

Don’t Overlook Business Credit Cards

Business credit cards are an important tool in your credit card arsenal. They allow you to better track business expenses and offer an extra opportunity to earn valuable perks, rewards, and cash back.

If you have a business or are looking to start one, most accountants will tell you that you should keep your business expenses separate from your personal expenses. By applying for business credit cards and using them for all business expenses, you can easily track your business spending. Your CPA will love you for it.

It is easier to get a business credit card than you may think. You don’t need to be a multi-million dollar revenue company to get business credit cards. In fact, you can

Effects of Opening and Closing Credit Cards

Opening and closing credit cards can and will affect your credit score. Often, the expected result from either of these actions is quite the opposite of reality. Before you open or close a credit card account, pay close attention to these next two sections.

What Happens When you Open a Credit Card?

Does applying for a credit card hurt your credit? Yes and no. When you open a new credit card, several things happen.

First off, your credit score will initially drop due to the inquiry, but then should increase within a month or two when the new account starts reporting to the credit bureaus. For more details how a new credit card affects your credit score, see below.

If you applied for a credit card with a sign-up bonus, you’ll need to spend a certain amount within a specified timeframe to earn that bonus. The details will vary, but most credit cards give you 90 days to meet the minimum spend requirement.

Pay attention the perks that you receive with your new credit card. Some benefits are automatic, while others require a separate registration. For example, if your new credit card includes a Priority Pass airport lounge membership, you’ll need to call to activate that benefit.

I like to place a small sticker on the back on each credit card to remind myself of which categories I’ll earn bonus points. I also write the statement closing date on the back of the credit card so that I don’t make a big purchase right before the statement closes.

What Happens When you Close a Credit Card?

When people think about “how many credit cards should I have”, they often decide that they have too many. This leads them to consider closing one or more of their credit cards. Back in college, I closed a few credit cards thinking I was doing a good thing. Instead, my credit score went down!

There isn’t an exact answer to the question of how many credit cards is too many. However, the effects of closing a credit card will vary based on how old the credit card is and how much of a credit limit you have.

Consider keeping the credit card open if it has been in your wallet for years. Older accounts are valuable in keeping your average age higher. If the credit card has an annual fee, ask the bank to waive the fee for you or downgrade the card to one without an annual fee. For example, you can request to downgrade from the Capital One Savor (with a $95 annual fee) to the Capital One SavorOne (with no annual fee).

When the bank won’t allow you to downgrade the credit card, ask to move the credit limit to another credit card you have with that bank before you close it. This way your credit utilization ratio will not be affected when you close the credit card.

Benefits and Concerns of Having a Lot of Credit Cards

There are many pluses and minuses to having a lot of credit cards. Having many credit cards to choose from provides for greater flexibility and the opportunity to earn many benefits and rewards. The downside is that multiple credit cards means that there are many more ways to hurt your credit if something goes wrong.

The Benefits are Awesome!

I love having multiple credit cards because the benefits I earn are awesome. My family can travel the world for close to free thanks to all of the rewards and perks.

I have some credit cards that provide annual free nights at hotels, while others give us priority boarding and free checked bags when we fly. If you travel internationally, as I do,

Maximizing rewards is easier when you have multiple credit cards. For instance, I can earn 4% cash back when dining with the Capital One Savor, 3% on travel with the Chase Sapphire Reserve, and 3% (in the first year) on everything else with the Discover it Miles.

There are a lot of great credit cards available, but none of them is the best at everything. That’s why it pays to have a diversified wallet of credit cards.

The Risks Should not be Overlooked

Having a lot of credit cards is risky in the wrong hands. If you are prone to overspending, all that available credit could be too tempting to ignore.

And each credit card has its own due date for payment. Do not miss a payment! Not only will you pay a fee around $35, it can devastate your credit score for years. Keep reading to see how I avoid late fees and missed payments.

In today’s age of cyberhacking, the more credit cards that you have, the more opportunity there is for a hacker to steal your information without you noticing right away.

I’m still a fan of having multiple credit cards, but it is important to know the risks that you face before you apply.

How do Multiple Cards Affect my Credit Score?

Having multiple credit cards will generally improve your credit score. Here are the reasons why and what you can do to maximize these benefits to boost your credit score.

Each Inquiry Decreases Your Score

First off, when you apply for a credit card (whether you get approved or not), there is an inquiry which generally lowers your credit score 3 to 5 points. These credit inquiries will often appear on one or more of your credit reports. Credit inquiries generally affect your credit score for 6 to 12 months, then fall off your credit report after 2 years.

If you plan on applying for multiple credit cards, space out the credit inquiries and applications over time. When the credit inquiries are too close, banks will think that you are desperate for credit because you’re in financial trouble.

Keep Your Utilization Ratio Below 30%

Your credit utilization will go down with the new credit limit added to your overall total available credit. Credit utilization is the biggest driver of your credit score at 35% of the total calculation. You will increase your credit score when you add available credit by paying down your credit card balances, increasing your credit limits on existing cards, or getting approved for a new credit card.

You’ve probably heard the rule of thumb to keep balances below 30% of your credit limits. That is a good idea for most people. To get the best credit score, balances should be between 1% and 10%. You might think that 0% (or $0 balance) would be even better, but that’s not the case.

The Ideal Average Age of Account is 10 Years Old

The average age of your credit accounts will decrease when you open a new account. This happens whether it is a credit card, student loan, auto loan, personal loan, or mortgage. Because of this impact, it is wise to space out your new credit applications so allow your other accounts to age and increase the average age of your accounts.

For the best credit score, the ideal average age of account is 10 years or higher. Ten years can be a hard target to hit, so at least strive to maintain an average age of 5 years or more to get

Never Miss a Payment

Missing a payment is one of the worst things you can do to your credit score. We’re human and we all make mistakes.

To keep from missing a payment, set up automatic payment of the minimum due from your checking account. This will avoid late payment fees and protect your credit score.

Ideally, you will pay your credit cards off in full each month. Doing so avoids being charged interest rates that are normally between 15% and 30%.

Bank Restrictions Limit the Number of Cards You May Have

Banks have tightened their rules in the past few years to keep us from earning too many bonuses. Sign-up bonuses are a “loss leader” for banks and they want to ensure that we are customers beyond the first year so that we can become a profitable customer.

American Express

American Express has a “once per lifetime” rule that means you will only earn the bonus once on each credit card. If you close a credit card with American Express, you should be able to apply for the card again later, but you will not receive the bonus.

Bank of America

Bank of America has the “2/3/4” rule that allows you to open two new credit cards within 60 days. A 3rd credit card can be opened within 6 months. The 4th credit card can be opened within 2 years.

Chase

Chase has a few different rules. You can only receive one bonus per credit card every 2 years. The clock starts once the bonus is received, not when you apply for the credit card. For the Chase Sapphire Reserve and Chase Sapphire Preferred, the bonus period was recently extended to 4 years.

The “5/24” rule is very well known among the travel community. This rule prohibits you from opening a new credit card if you’ve opened more than 5 new credit cards within the last 2 years. The 5 new accounts includes accounts at other banks, being added as an authorized user, and lines of credit. If you can’t get Chase cards because of the 5/24 rule,

Citibank

Citibank’s rule is “one bonus per family” every 2 years. Even though Citibank offers multiple credit cards for many of their brands (such as American Airlines and ThankYou points), you can only receive the bonus once every 2 years. The clock resets if you close an account, so make sure that you apply for a new credit card before closing an old one.

How Many Credit Cards Should I Have?

As with everything in personal finance, the answer to “how many credit cards should I have” will vary from one person to the next. Following RewardExpert’s diversified wallet strategy, you should have at least 3 credit cards. An all-purpose travel card like the Capital One Venture or Discover it Miles that allows you to book travel without blackout dates. An airline or hotel card from your favorite to get extra perks and save money on fees. And a cashback card that focused on the categories you spend the most, like the Capital One Savor that gives 4% cash back on dining and entertainment.

Beyond these three credit cards, your ability to control your spending, space out your applications, and afford the annual fees will guide you in deciding how many credit cards you should have in your wallet. Keep in mind that you shouldn’t go wild with credit card applications. Receiving the best rate possible on your mortgage or getting approved for your next car loan is far more important than a couple of

Remember, slow and steady wins the race.

How many credit cards do you have? Is there a specific reason for each? Let us know in the comment section below.