United Airlines has good domestic coverage, with several hubs in the middle of the U.S. for varied domestic and international routing options, and a very wide network of international air and hotel partners through Star Alliance and individual partnerships.

No matter where you fly to or whose planes you fly on, United won’t charge a fuel surcharge on the award, making it ideal for overseas trips. With some of the lowest mileage redemptions on long-haul flights to exotic locations in the South Pacific, and flexible routing and stopover rules, it’s a no-brainer for building dream trip itineraries.

Booking awards, even complex ones, on United is quite straightforward, as partner availability and booking is largely available online so focusing on United is great for people looking to get into the mileage game easily.

| PROGRAM | ALLIANCE | CURRENCY |

| MILEAGE PLUS | STAR ALLIANCE | MILES |

| POINTS TRANSFER PARTNERS |

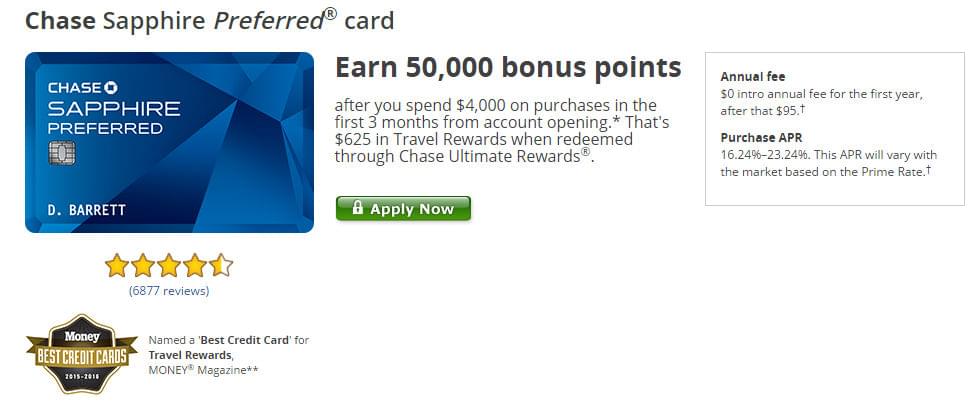

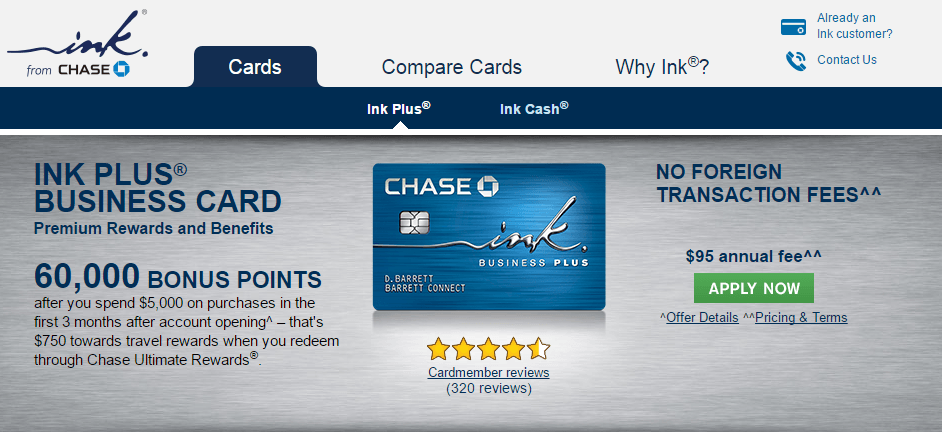

CHASE ULTIMATE REWARDS;

SPG STARWOOD PREFERRED |

AIRLINE PARTNERS

|

Aer Lingus

Germanwings

Great Lakes Airlines

Island Air

Jet Airways

Silver Airways

Adria Airways

Aegean Airlines

Air Canada

Air China

Air India

Air NewZealand

Avianca

| Copa Airlines

Croatia Airlines

Egyptair

Ethiopian Airlines

Eva Air

LOT

Lufthansa

Scandinavian Airlines

Shenzhen Airlines

ANA

Asiana Airlines

Austrian

Brussels Airlines | Singapore Airlines

South African Airways

Swiss

TAP Portugal

Thai Airways

Turkish Airlines

Aeromar

Air Dolomiti

Azul

Edelweiss

Eurowings

Cape Air

Hawaiian Airlines |

Hubs:

- Denver International Airport

- George Bush Intercontinental Airport, Houston

- Los Angeles International Airport

- Newark Liberty International Airport

- Chicago O’Hare International Airport

- Washington Dulles International Airport

- San Francisco International Airport

- Guam A.B. Won Pat International Airport

- Tokyo Narita International Airport

How Can You Use United MileagePlus?

Frequent flyers love United because it has some of the most flexible awards out there, which can easily be molded into free one-ways, European city tours or round-the-world adventures. Sweetening the deal is a huge partner network that always books in the lowest award category.

Program Perks:

- Most partner flights can be easily booked online

- Partner flights always fall into the lowest award category

- One-way awards

- Multi-city awards

- Two open jaws and one extended stopover on each round-trip ticket

- Unlimited less-than-24-hour stopovers

Booking Quirks:

- Itinerary holds aren’t free

- $100 fee for bookings less than 21 days before departure

- $75 for making a change 21 or more days prior to the date of travel (no change to origin/destination)

- $200 cancellation fee, lower for elite status holders

Best-Value Awards:

Redemption for North Asia, Japan and Oceania (one of the most expensive places in the world to fly to on a revenue ticket) start at 35,000 miles one way, just a bit more than a flight to Europe and less than the Middle East.

But while United is one of the best options for getting to Southeast Asia, it recently changed its routing rules making it more difficult to route creatively and visit Europe en route, slightly diminishing the value of these awards.

Worst-Value Awards:

Awards to Hawaii are quite overpriced in comparison to other airlines and the rest of the United award chart. You’ll pay significantly less miles from Seattle to Belize than from Seattle to Hawaii.

Standard awards are pricy on any airline, but disproportionately so on United. It’s common for standard awards to be twice the saver award redemption, but on United, they’re more than twice the saver fare across the board, so on United, it particularly pays to keep checking until you find a saver fare or be flexible in your dates.

The Good Stuff: Upgrades and Elite Status

Upgrades on United are complicated affairs, tied into the booking class on your ticket starting. This is the order of the upgrades: J, C, D, Z, P, Y, B, M, E, U, H, Q, W, S, T, K, L, G, or N.

If you purchased an expensive ticket the miles required to upgrade can be quite low and there’s no co-pay required. Cheaper tickets can require hefty co-pays of up to $600 along with 30,000 miles on long-haul flights.

Unless you’re flying domestically, the complex system and high co-pays make upgrading United flights with miles an inefficient use of miles.

Each level includes the perks of the previous category.

- Premier Silver: Complimentary economy plus upgrade at check-in; complimentary upgrades and companion upgrades; 25 percent bonus miles; Star Alliance silver status; priority boarding, check-in, security screening and baggage handling

- Premier Gold: Complimentary economy plus upgrade at booking; 50 percent bonus miles; international lounge access; no same-day change fees; three complimentary checked bags; Star Alliance Gold status

- Premier Platinum: 75 percent bonus miles; reimbursed Global Entry fee; no award ticket fees; no phone service fees

- Premier 1K© : 100 percent bonus miles; dedicated service line

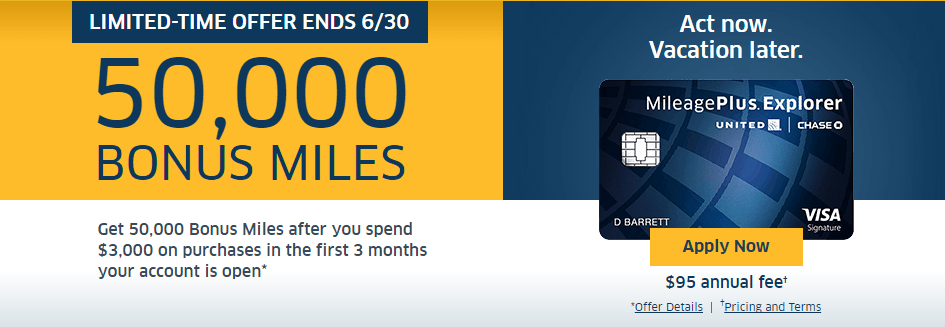

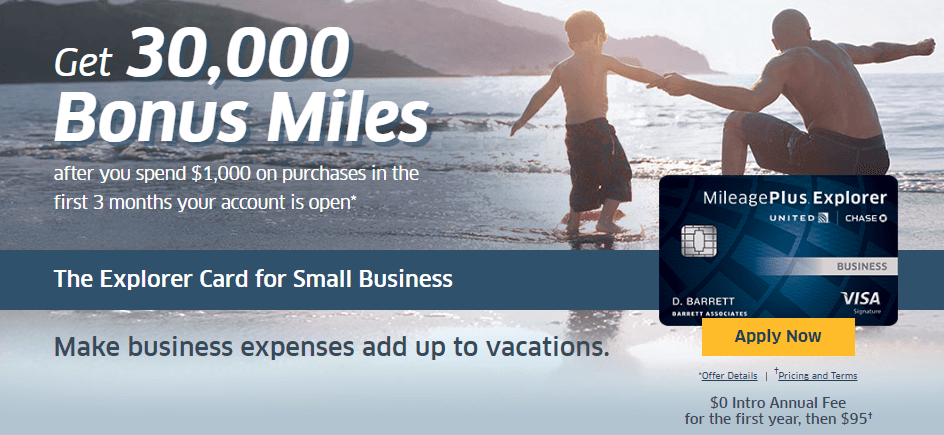

Associated Credit Cards

From Chase, two main cards offer perks on United: the United MileagePlus Club Visa and the United MileagePlus Explorer Visa, which are also both available in business versions.

- The United MileagePlus Club Card allows two free checked bags, and the United MileagePlus Explorer offers one free bag for you and one companion.

- Both offer early boarding, with the former in group two, after the upper classes and elites, and the latter in group one.

- The United MileagePlus Explorer Card comes with two one-time use lounge passes per year, but its sister card, the Chase MileagePlus United Club Visa, comes with unlimited club access (and a $450 fee). Cardholders have no blackout dates on award bookings.