Credit card debt can be a huge obstacle to your financial goals. Recent studies show that the average credit card debt is now over $15,000 per household. With the average American credit card debt rising beyond levels last seen leading up to the 2008 Great Recession, this could spell trouble for the economy and consumer finances. There is no single best way to pay off credit card debt – there are several to choose from. The path that you take is a personal choice, but the most important thing is that learn how to pay off credit card debt so you can become debt free.

This article will cover

- The best way to pay off credit card debt

- Mistakes you should avoid after paying off credit card debt

- At a glance: U.S. household debt trends

- Credit card debt by numbers and faces

- Next steps to pay off your credit card debt

The Best Way to Pay off Credit Card Debt

Getting out of debt with a credit card payoff plan takes a focused effort. Nobody miraculously gets out of debt, and its said that you have a greater chance of being hit by lightning than you do of winning the lottery.

So, it is time to get focused, develop a plan, and make those goals a reality.

1. Consolidate and Conquer your Credit Card Debt

The best way to quickly reduce the interest rate on your credit card debt to accelerate paying off the balance – Credit Card Debt Consolidation. You can combine the amounts you own on a bunch of accounts with high interest rates into one larger account with a lower interest rate.

You can do this with a credit card debt consolidation loan or with a

One word of caution: when you transfer a balance using one of these

However, if you get 18 months of zero percent interest and pay a fee of 3%, that’s the equivalent of paying 2% interest. Let’s do the math: 18 months is 1.5 years; 3% x 1.5 years = 2% effective interest rate.

In other words, don’t worry about the 3% fee to transfer your balance. Based on the math above, I’m pretty sure your current credit card interest rate is higher than 2%.

2. How to Pay off Credit Card Debt with a Strategy that Works for You

The most common debt payoff strategies are the Debt Snowball, Avalanche Method, and Blizzard. Each credit card payoff plan has their pros and cons, but they’re all successful in helping people pay off their debts. Pick the method that you think will work best for you. And, if you find yourself “falling off the wagon” and considering giving up, switch it up and try another method. You are not locked into one strategy!

The Debt Snowball Method

The Debt Snowball has been popularized by personal finance gurus like Dave Ramsey. You start by lining up all of your debts by the size of the debt balance. Make the minimum payments on all of your debts, then take everything else that you can afford and pay down the smallest balance debt first.

Once the smallest debt is paid off, “snowball” that payment onto the next smallest debt until it is paid off. Continue with this pattern until all debts are paid off. Behavioral Economists point out that the Debt Snowball is very effective because it provides several “wins” at the beginning of the process. The wins are the good feelings and noticeable progress associated with paying off a couple of small accounts quickly.

The Avalanche Method

The Avalanche Method takes a different approach. You also start out by lining up all of your debts, but this time you arrange them by order of interest rates. You would also make the make the minimum payment on all of the accounts, but the extra payment that you can afford would go towards the highest interest rate debt first. As that balance is paid off, move your payment to the next highest interest rate balance. Continue that pattern until all debts are paid off.

The “avalanche” name comes from starting with the highest interest rate debt, similar to the peak of a mountain. As you continue to pay off debts with high interest rates, more and more of your monthly payments will be going towards paying down the balance instead of interest. This avalanche of debt payoff reaches its maximum power as it begins to attack the lowest interest rate debts.

Detractors of the Avalanche Method will say that this method isn’t as effective as the Debt Snowball. The reason is that a person can be making payments on the high-interest rate debt for months without seeing much progress if that balance is also high. The concern is that people will give up because they cannot easily see the progress being made.

The Avalanche Method is mathematically correct, but it is hard to argue with the behavioral and psychological points of how important those small wins are at the beginning of a process. This is especially true when someone hasn’t been very good at paying off debts in the past.

The Blizzard Method

The Blizzard Method is a combination of the Debt Snowball and Avalanche Methods. With the Blizzard Method, you also line up all of your debts first by the size of their balance. You make all of the minimum payments required, then pay off the first one or two small balance accounts.

Once you have confidence in your ability to continue with your debt payoff efforts, you make a switch to the Avalanche Method. Now, instead of paying off the smaller accounts, you’ll focus your efforts on the highest interest rate balances first.

To me, this is the best way to pay off credit card debt. The Blizzard Method takes the best of both worlds. You achieve a couple of small wins with the Debt Snowball to give yourself the confidence that your efforts are making a difference, then you switch to the Avalanche Method to reduce the amount of interest that you are paying and accelerate the payoff of your debt.

For the best savings, make sure that you transfer as many of your high-interest credit card balances to

3. Prioritize Your Budget

When implementing your strategy of the best way to pay off credit card debt, you’ll want to look at what you are spending your money on. The easiest way to do this is to categorize your purchases into simple buckets, like:

- Food and

Groceries (groceries,dining out, fast food) Transportation (car payments, gas, insurance, repairs, tolls, train, bus) - Housing (mortgage, rent, home repairs, insurance, utilities)

Entertainment (movies, magazines, apps, Netflix, concerts, travel) - Debt Payments (student loans, personal loans, payday loans, credit card interest)

- Everything else (ATM withdrawals, donations, gifts)

When you break down your spending into these broad categories, you can start to see where big chunks of your hard-earned paycheck are going. If certain categories jump out at you, consider breaking them down further.

To get this information, review your credit card and bank statements. Some banks and credit card companies break down your spending for you so that it is easier to create this list.

My friend Paula has a saying, “you can afford anything, just not everything” which I completely agree with. It’s ok to spend money on things that are important to you, if you have the money.

What we want to cut down on is the unconscious spending on things that aren’t important to you so you can focus that money on paying down your credit card debt.

After you’ve figured out which categories you spend the most, find a credit card that offers cash back or rewards that matches your spending habits. For example, if dining and entertainment are big categories for you, consider the Capital One Savor credit card that offers 4% cash back on dining and entertainment. And credit cards like the Capital One Quicksilver are great for everyday use since you can earn 1.5% cash back on every purchase.

4. Automate Payments to Avoid Fees

The number one thing I do when I get a new credit card is set up an automatic payment of the minimum balance. This ensures that I’ll never get hit with a late payment fee. Many banks charge late payment fees of $39, so we definitely don’t want to waste money on fees like that can derail your credit card payoff plan. And, furthermore, we don’t want a late payment ruining our credit score for years to come!

These automatic payments take care of the minimum payment portion of the Debt Snowball Method, Avalanche Method, and the Blizzard Method, but you can’t stop there. Paying only the minimum could mean you are paying for today’s debts for the next 10 to 20 years.

5. How to Pay Off Credit Card Debt by Paying More than the Minimum

One of the key elements of these debt payoff strategies is the focused effort to pay more than the minimum amount due on your debts. The more that you can pay above the minimum amount due, the sooner that debt will be paid off and the less interest you will be charged.

If you’re not a fan of these debt payoff strategies, consider rounding up your debt payments to the next $100 increment. For example, a credit card with a $232 minimum payment due would be paid $300 to have an extra $68 go towards paying down the balance.

One of my favorite tricks to reduce the interest even more is to make payments multiple times per month. If you get paid weekly, instead of waiting until the due date to the pay the $300 we talked about above, make a payment to your credit card company of $75 every paycheck.

Because there are 52 weeks in a year instead of 48 weeks, paying weekly has the added bonus of being the equivalent of making an extra monthly payment every year!

6. Seek Professional Help

If you are overwhelmed with your debt and are unsure how to start, it may be time to get a professional involved. The average American credit card debt may be rising, but these trained experts are available to help you get control of your debt and put you on the right path.

Non-Profit Credit Counselors

Credit counselors from non-profit companies are experts in consumer finances. They offer a great way to develop a debt management plan. These credit counselors negotiate new terms with your credit card issuers and other creditors to consolidate your credit card debt and make the payments manageable. Instead of paying your credit card issuers and creditors individually, you’ll make one payment to the credit counseling agency.

A word of warning: this route may result in your credit card accounts being closed, and it may be several years before you can open up a new credit card.

Consider a Debt Settlement

Debt settlement is an debt relief option if you have access to a chunk of money. This strategy involves negotiating with your credit card issuers and creditors for a one-time payment of a portion of your debt to satisfy your obligation in full.

Creditors are resistant to provide a discount to the balance you owe unless they feel that you do not have the ability to make payments and will file bankruptcy. Hiring a debt settlement company can increase the chances that your offer will be accepted.

Take note that many companies will issue you a form 1099 for the amount of the discount. This means that you will have to pay taxes on this amount as if it were income. For many people, this means that you’ll be paying 20% to 25% of the amount forgiven in Federal and state taxes.

Consult with a Bankruptcy Attorney

Filing for bankruptcy is often the last resort when all other options haven’t worked out. Many attorneys will offer a free consultation to help you decide if bankruptcy will provide debt relief and solve your problems. If you are a good candidate for bankruptcy, the two most common forms of bankruptcy are Chapter 7 and Chapter 13.

My Dad was a bankruptcy attorney and it was good to see him help so many people get out from under the burden of so much debt. Many of his clients were good people that just had something bad happen to them – divorce, medical problems, or job loss. Others had a spending problem and needed to learn how to control those impulses so they can create a better financial future.

A Chapter 7 bankruptcy is also known as a fresh start because it wipes out all unsecured debt (except for student loans). Additionally, you can turn in cars, boats, and homes to eliminate those payments as well. Chapter 13 is a repayment plan where you repay your credit card issuers and other creditors over a 36 or 60 month period. The amount you pay the creditors back each month is based on the court’s determination of how much you can afford. Some people pay 100% of the balances owed, while others pay only a portion of the amounts owed.

Eliminating student loans in bankruptcy is very difficult and often unsuccessful. You and your attorney will need to argue that the student loans are an “undue hardship” to your finances.

7. Work with Your Creditors

The average US household income isn’t growing as fast as most would like it to. That means that more people are having problems paying all of their bills on time. If you are having trouble making your payments or need some extra time, be proactive and contact your creditors by phone or secure message via their website.

In my experience, most creditors can be reasonable if you communicate your problems with them. Unfortunately, many people take the exact opposite approach. When they encounter problems, they retreat and stop answering calls, replying to emails, or ignoring letters in the mail. As you can imagine, creditors get frustrated with the lack of communication.

There are many options available for debt relief when you are proactive this way. For example, the bank or lender can lower the interest rate or extend the terms of your loan to reduce your monthly payment amount. If you’ve been a long time customer and have always made on-time payments in the past, a creditor may be willing to work with you to keep your account current.

Sometimes all you need is a little breathing room to catch up on bills and get back on track to a brighter financial future.

Mistakes You Should Avoid after Paying Off Credit Card Debt

Now that we’ve figured out how to pay off credit card debt, you don’t want to repeat those mistakes. You need to take the right steps to ensure you don’t fall into the debt trap again.

Overspending on Your Credit Cards

The feeling of being debt free is amazing. And some people celebrate this goal by going shopping or going on a lavish vacation. While it is important to celebrate, you have to be careful to avoid going overboard.

Only make purchases on your credit card that you are sure that you can pay off in full when the statement arrives. If you cannot pay off the purchase, hold off on making that purchase until

Stop Living a Cash Lifestyle

One of the best ways to achieve freedom from debt is to pay for everything in cash. By paying for daily expenses in cash, you keep from adding to your debt balances and can focus on paying down your debts instead of adding to them.

Once the debts are paid off, some people stop living a cash lifestyle and revert to charging everything. That can get you in trouble if you don’t have the ability to stay within your budget. Even after paying off your debts, sometimes cash is still king.

Not Building an Emergency Fund

An emergency fund is crucial when it comes to handling emergencies that pop up. The common rule of thumb is to have three to six months of expenses saved in cash.

Ok, so having that much money isn’t going to happen overnight, but you need to save a little at a time until you reach your goal. Emergencies do happen, so be prepared for them with savings so that you don’t need to go into debt when the time comes.

Avoiding Using Credit

Some people are so harmed by the debt payoff experience that they give up debt forever. Although that may seem like a good idea, it can actually do more harm than good. You will have a better credit score if you use debt responsibly than if you have no debt at all. In fact, to achieve the perfect FICO credit score of 850, your credit utilization has to be within the 1% to 10% range. Not zero.

Closing your Credit Card Accounts

Once you’ve paid off a credit card, you may be tempted to close the account. Don’t do it! It can actually do more harm than good.

I made this mistake back in college when I paid a few credit cards. The customer service agent tried to talk me out of the decision, but I was determined. The joke was on me a month later when my credit score fell.

The reason why this is a mistake is that credit utilization (your balances vs. credit limits) makes up 30% of your credit score. When you close accounts with a zero balance, it will increase your overall credit utilization ratio, which causes your credit score go down.

At a glance: U.S. Household Debt Trends

As the economy has gained strength and jobs feel more secure, consumers have become more comfortable with debt. The average credit card debt has been rising for years as we have emerged from the Great Recession. A NerdWallet survey found that total credit card debt has increased more than 5% over the past year to an estimated $927 billion.

This means that the average American credit card debt has now reached over $15,000 per U.S. household that carries credit card debt.

This much is clear, the average American credit card debt is continuing to rise. The average household debt rose for the 12th consecutive quarter in 2017 and total household debt has now exceeded $13 billion. Our collective debt today is more than it was just before the beginning of the Great Recession.

As of the 2nd quarter of 2018, the Federal Reserve Bank of New York’s Center for Microeconomic Data found that the combination of student loan, auto loan, and credit card debts were approximately $3.5 billion, an increase of $154 billion.

This 4.6% increase means that consumer debt is growing faster than the overall economy. In other words, our debt is growing faster than the average US household income. And, when you add in the rise in interest rates (7 rate increases for 1.75% in the last 2 years), the interest on consumer debt like credit cards is only getting more expensive!

| Category | Total as of Q2 2017 | Total as of Q2 2018 | Annual Change** |

|---|---|---|---|

| Mortgage Debt | $8.69 trillion | $9.00 trillion | (+) $308 billion |

| Home Equity Line of Credit | $452 billion | $432 billion | (-) $20 billion |

| Student Loan Debt | $1.34 trillion | $1.41 trillion | (+) $61 billion |

| Auto Loan Debt | $1.19 trillion | $1.24 trillion | (+) $48 billion |

| Credit Card Debt | $784 billion | $829 billion | (+) $45 billion |

| Total Debt | $12.84 trillion | $13.29 trillion | (+) $454 billion |

*Change from Q1 2018 to Q2 2018

**Change from Q12 2017 to Q2 2018

“Typical” Face of the American Consumer

The typical American consumer is full of debt. A recent Pew Charitable Trust survey found that 80% of U.S. consumers have some form of debt. Considering that homeownership rates hover in the 60% to 66% range, this isn’t a surprising statistic. The survey reported that 70% of respondents said that “debt was a necessity in their lives.”

This mentality is a little disturbing for those of us who are seeking financial independence from debt. Debt can be a necessary evil sometimes, but “necessary” too often means date nights, vacations, new cars, and everything but actual necessary things in life.

On the plus side, consumer credit scores have continued to rise. For the first time ever, the average credit score has reached 700. Some of that has to do with consumers paying their bills on time, but a big factor is also the greying of society. We have more senior citizens than ever and they aren’t at the mall charging a shopping spree to their favorite credit card. Because of their long credit histories and lack of borrowing, people over the age of 55 have average credit scores 50 points higher than the next age group.

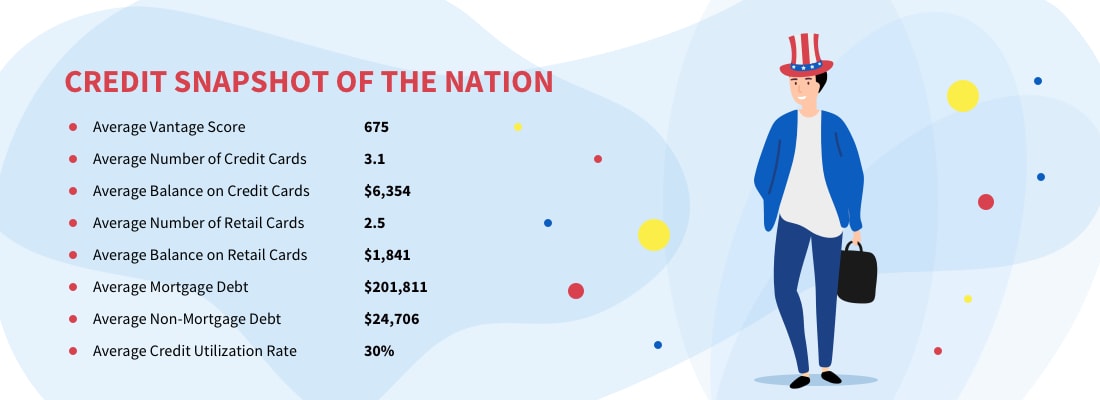

The average American has 3.1 credit cards with a balance of $6,354 and a utilization ratio of 30%. This translates into an average credit score of 675. With a focus on reducing that utilization ratio to 10%, you can easily get a credit score in the 700s.

Credit Card Debt by Numbers and Faces

Credit card debt means different things to different people. Whether you are a man or woman, young or old, or living in a “red state” or “blue state” the average credit card debt will vary. Here are some interesting statistics to put your personal situation in context with others that share some of the same characteristics as you.

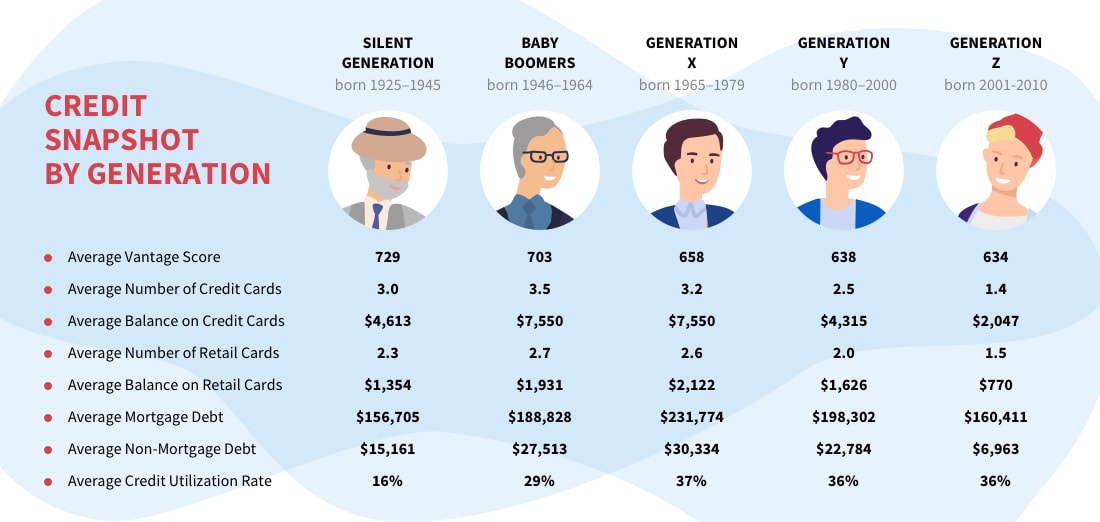

Average American Credit Card Debt by Generation

As you reach retirement age, credit card debt can be a scary thing because you know that you’ll be giving up a steady stream of income in a few years. For people just starting out in life, adding a little bit to the average credit card debt means being able to afford a little bit of fun when most of their paycheck is going towards a mortgage and childcare.

The chart below shows that both the youngest and oldest generations have the least amount of debt. Millennials are hesitant to get into debt because they saw what debt did to their parents during the Great Recession. Even though the overall debt level may be low for Millennials, their utilization is high since they do not have high credit limits established.

Whereas retirees are more conservative with their spending patterns. Their utilization is also low because of a lifetime of building up their credit history. Families in the 35 to 54 age range have the most debt because they are juggling saving for retirement, paying for college for their children, and making mortgage payments.

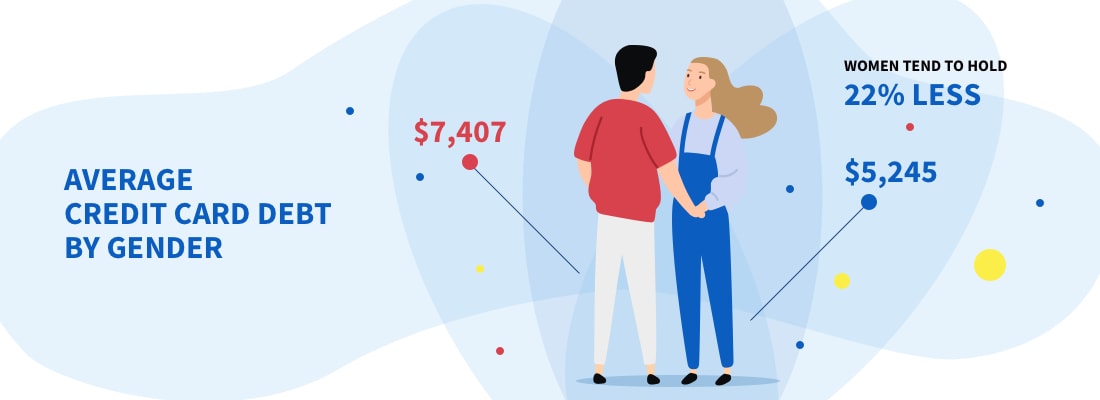

Average American Credit Card Debt by Gender

This chart shows that men carry more debt than women do. This may be due to traditional gender roles and that women are often the ones who stay home when children are young.

How does your state compare?

The average American debt and credit score varies based on the state. For example, Mississippi has the lowest average credit card debt of $6,217, while Alaska has the highest at $11,406.

Some of this variance by state in the table below is related to income and the ability to take on more debt. While other states are influenced by the high cost of living and the resulting debt from trying to make ends meet. Do any of these really stand out to you?

| State | Credit Card Debt Per Debtor | Credit Card Debt Per House |

|---|---|---|

| Alabama | $3,710.56 | $7,198.48 |

| Alaska | $5,879.85 | $11,406.91 |

| Arizona | $4,299.70 | $8,341.42 |

| Arkansas | $3,289.01 | $6,380.69 |

| California | $4,569.51 | $8,864.85 |

| Colorado | $4,898.56 | $9,503.20 |

| Connecticut | $5,171.89 | $10,033.47 |

| Delaware | $4,338.88 | $8,417.42 |

| Florida | $4,318.35 | $8,377.59 |

| Georgia | $4,727.46 | $9,171.27 |

| Hawaii | $5,330.46 | $10,341.09 |

| Idaho | $3,791.84 | $7,356.18 |

| Illinois | $4,412.71 | $8,560.65 |

| Indiana | $3,624.05 | $7,030.65 |

| Iowa | $3,169.16 | $6,148.17 |

| Kansas | $3,854.05 | $7,476.85 |

| Kentucky | $3,457.67 | $6,707.88 |

| Louisiana | $3,767.91 | $7,309.75 |

| Maine | $3,905.56 | $7,576.78 |

| Maryland | $5,287.61 | $10,257.96 |

| Massachusetts | $4,720.53 | $9,157.83 |

| Michigan | $3,458.51 | $6,709.51 |

| Minnesota | $4,257.26 | $8,259.08 |

| Mississippi | $3,204.95 | $6,217.60 |

| Missouri | $3,763.46 | $7,301.11 |

| Montana | $3,732.83 | $7,241.69 |

| Nebraska | $3,594.46 | $6,973.25 |

| Nevada | $4,263.19 | $8,270.59 |

| New Hampshire | $4,943.44 | $9,590.27 |

| New Jersey | $5,361.06 | $10,400.47 |

| New Mexico | $4,185.93 | $8,120.71 |

| New York | $4,969.84 | $9,641.50 |

| North Carolina | $4,124.04 | $8,000.63 |

| North Dakota | $3,756.19 | $7,287.00 |

| Ohio | $3,738.95 | $7,253.56 |

| Oklahoma | $4,038.90 | $7,835.47 |

| Oregon | $3,881.17 | $7,529.48 |

| Pennsylvania | $4,209.21 | $8,165.86 |

| Rhode Island | $4,376.34 | $8,490.10 |

| South Carolina | $4,187.65 | $8,124.04 |

| South Dakota | $3,608.28 | $7,000.07 |

| Tennessee | $3,903.24 | $7,572.28 |

| Texas | $4,937.00 | $9,577.78 |

| Utah | $3,775.21 | $7,323.92 |

| Vermont | $4,199.77 | $8,147.56 |

| Virginia | $5,404.32 | $10,484.38 |

| Washington | $4,568.09 | $8,862.09 |

| West Virginia | $3,381.36 | $6,559.84 |

| Wisconsin | $3,410.29 | $6,615.96 |

| Wyoming | $3,944.72 | $7,652.76 |

Average American Credit Card Debt by Income

When you compare debt to income, this is a much more realistic comparison than just looking at the overall average credit card debt statistics. If you owe $3,000 and make $15,000 a year that is a much worse scenario than being $11,000 in debt and having a salary of $260,000. This calculation is known as a debt-to-income ratio. The lower the ratio, the better off you are.

| Median Income | Income Percentile | Average Credit Credit Debt | Credit Card Debt: Income Ration |

|---|---|---|---|

| $15,100.00 | Less than 20 | $3,000.00 | 19.87% |

| $31,400.00 | 20-39.9 | $3,900.00 | 12.42% |

| $52,700.00 | 40-59.9 | $4,900.00 | 9.30% |

| $86,100.00 | 60-79.9 | $5,800.00 | 6.74% |

| $136,000.00 | 80-89.9 | $8,300.00 | 6.10% |

| $260,200.00 | 90-100 | $11,200.00 | 4.30% |

Who Pays ff their Credit Card Bills?

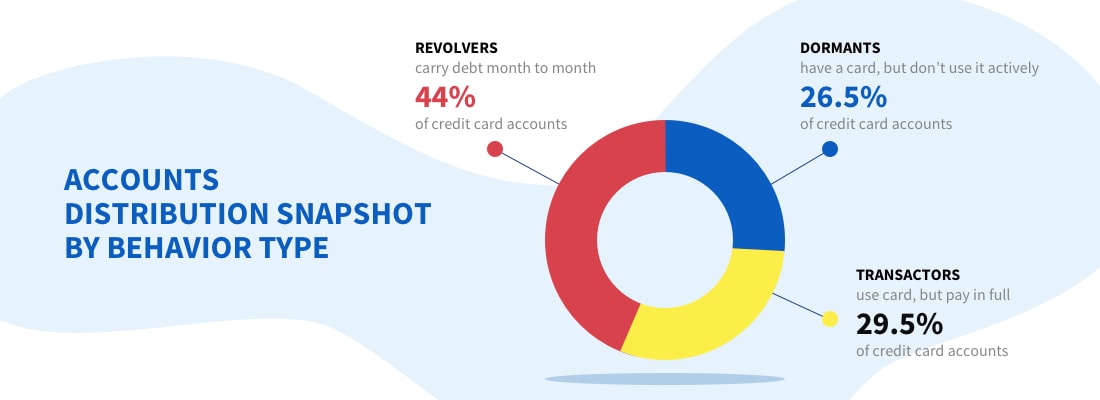

A recent study from the American Bankers Association found that 44% of people carry a balance on their credit cards each month. On a positive note, almost 30% of consumers use their cards and pay the balances in full each month. Imagine all of the credit card rewards they are earning! Here are the

More than 26% of people have credit cards open, but don’t use them. As we talked above, many of these dormant credit cards are owned by older consumers that don’t have as much need to use them.

Credit Card Delinquency Rates

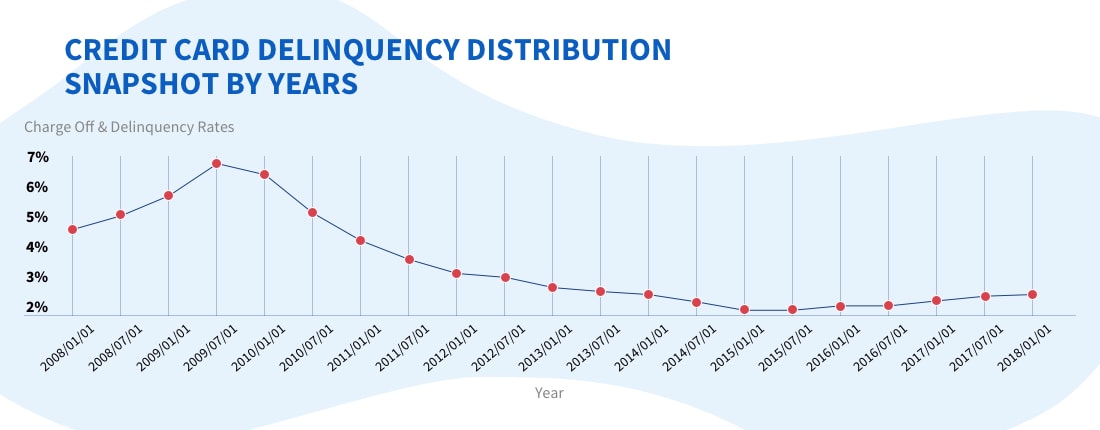

When consumers get into tough times and start missing payments is known as credit card delinquency. This means that they are more than 30 days late with their payments. Once they are 90 days late, this escalates to a serious delinquency.

Credit card delinquency rates peaked at almost 7% during the Great Recession, but have since bottomed out below 3%. As the economic expansion has continued, delinquency rates have started to rise again off of these historic lows.

Next Steps to Pay off Your Credit Card Debt

Credit card debt can be a serious obstacle in your path to financial success. With the average credit card debt for a household at $15,000, it is time to take action to eliminate those debts. We’ve shared some options for the best way to pay off credit card debt. Now it’s your turn to achieve this goal!

What is your favorite way how to pay off credit card debt? Have you tried the Debt Snowball, Avalanche, or Blizzard Methods before? Which one do you like best? Share your experience in the comments below so others can learn from you.