The ATM was a revolutionary concept in the 1980s. Customers could make deposits and withdraw cash 24 hours a day, even on the weekends. Mitek’s remote deposit capture service saves consumers and businesses both time and money. Instead of driving to the ATM and, potentially, waiting in line, check deposits can be made from the comforts of home or without stepping away from the office.

I had the pleasure of speaking with Michael Diamond, the SVP/GM of Payments for Mitek, to discuss the evolution of banking and what additional efficiencies are coming.

The History of Mitek

Although Mitek started in 1986, their current focus began with the advent of mobile banking and the evolution of banking laws. The Check 21 Act of 2003 enabled banks to transmit images between each other, rather than actual paper checks. Although adoption was slow in the banking world, the integration of cameras into phones sped up the process.

The Impact Of Mobile Check Deposits

The combination of a camera phone, a mobile banking app, and digital image technology has created a fast lane to mobile check deposits adoption. That being said, industry-wide statistics show that only 15.4% of consumer checks are deposited digitally.

The process is simple. A customer signs the back of the check as normal, then opens their bank’s mobile app. They click on make a deposit, take a picture of the front and back of the check, then enter how much the check is for. Once the customer clicks deposit, the money goes into their account just like they went to an ATM or bank branch.

With their technology, Mitek and its partner banks have processed over 2 billion checks for a total of $1.5 trillion in check volume. Although Mitek partners with over 6100 financial institutions and is used by more than 80 million consumers, an overwhelming majority of checks are still deposited at the branch or by ATM.

Follow this link to read Mitek’s latest mobile deposit benchmark report. Watch this webinar to gain a better understanding of the power of mobile deposit technology.

Does The Decline In Global Check Volumes Affect You?

The FDIC has released reports stating that check volumes have been declining an average of 6% a year. The most recent report indicated 4%. Although the decline may have slowed, the direction is clear. Within a couple of generations, consumers will not be issuing checks.

In the short term (if 50 years can be considered short), Mitek, its competitors, and their bank clients are instead focused on increasing mobile deposit adoption rates. Fewer paper deposits mean reduced bank expenses for branches, back office staff, and machines. Mobile check deposit is a win-win for everyone involved. Reduced expenses for the bank and money and time savings for bank customers.

As I mentioned above, only 15 out of 100 checks are being deposited digitally today. That means that 85 checks out of 100 are being deposited at the branch or via courier. Even as global check volumes decline slightly each year, there is a great opportunity to increase adoption for the foreseeable future.

Who Else Is Benefitting From This Service?

Americans are unique in their desire to contribute to charity. Whether it be to the ringing bells of the Salvation Army or the door-to-door charity workers canvassing our neighborhoods. Americans are givers.

The problem is that we can also be unorganized sometimes. Checks can get lost in the shuffle from one person to the next. Or they can take weeks or months to be deposited as the checks make their way to the right person.

Mitek is solving this problem by partnering with charities. They have embedded their mobile check scanning features into the charity’s apps so that charity volunteers and employees can deposit checks immediately. This a huge advantage for everyone involved.

The volunteers don’t have the fear of losing a check. The charity receives their money right away so they can proceed with their mission. And donors can be assured that donations were made in this tax year.

Alternative Uses: Account Opening Identification

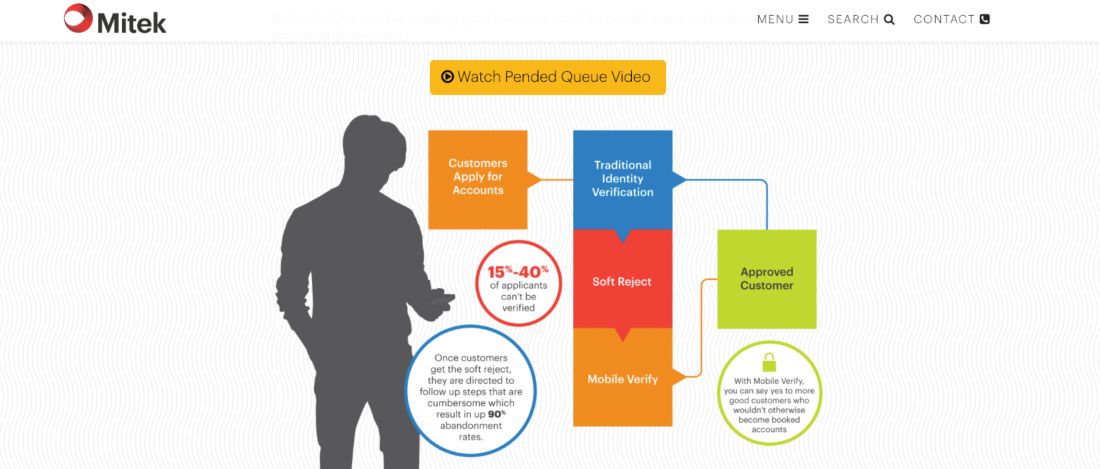

The technology that converts three three-dimensional check image into a digital check has alternative uses. Mitek has been test-piloting programs with partner banks and financial institutions to use the same technology to digitally identify account openings.

Identity theft and computer fraud are huge risks in today’s digital world. Mitek’s software digitally confirms that an identification hasn’t been tampered with and matches the photo with a selfie that the account holder takes. This process is integrated with the normal account opening process to reduce fraud and expedite the opening of accounts.

If you would like to learn more about mobile deposits or digital identity verification, please visit Mitek’s website for the latest news.