If you’re a parent, you know that teaching your kids about finances isn’t always easy. You may give your children a weekly allowance or reward them for doing something great. But do you really know what they’re spending or think they truly understand the value of a dollar?

According to a recent study by the Organization for Economic Cooperation & Development (OECD), which runs the Program for International Student Assessment (PISA), 22 percent of 15-year-olds lack basic financial literacy.

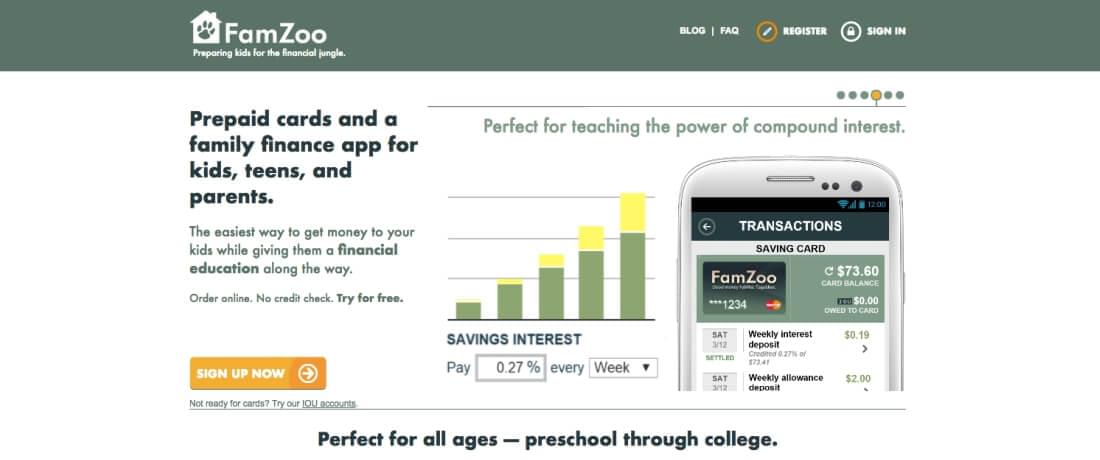

Father of five and CEO (or “Chief Dad”) of FamZoo, Bill Dwight, started his company to help parents monitor their child’s spending in a fun and simple way, while also teaching them how to manage money and be financially responsible. The PISA results show that many teenagers all around the world struggle to understand how even a simple budget works or know how to successfully use a prepaid debit card. Dwight says his company is “basically prepaid cards for kids and financial education all wrapped together in an app.”

My Family is a Zoo

Founder Bill Dwight said he came up with the name FamZoo because at one point or another anyone who has kids could feel like their family is a zoo. With everyone always on the go with different schedules, there isn’t a lot of time to dedicate to financial education lessons.

“When my two older kids got into middle school, my wife and I realized that no one is teaching them about personal finance,” said Dwight.

He said he looked around for products that were well-suited to kids, but found they were too much of a hassle and not really focused on the family.

“That’s when I originally started creating an online account in a spreadsheet. Then, over time, I thought it would be nice if the kids could sign into a website. So I built something for them to sign into a private family bank site where I realized they were learning some pretty good lessons, so I turned it into a business.”

Prepaid Cards and Notifications

FamZoo is a virtual family bank that teaches kids to earn, save, spend and give. The prepaid cards set aside real money where the parent is essentially the banker and the child is the customer. With prepaid card accounts, “you can only spend what’s loaded on the card,” stated Dwight.

“What we’re trying to do is create a controlled environment where kids can make those small, inexpensive mistakes with limited quantities on the cards – cards that can be locked immediately, cards that are monitored by their parents and cards where the parents are providing mentoring.”

The prepaid card with the optional notifications feature is a helpful way for parents to stay in contact with their children, wherever they may be.

Dwight noted, “My son, for example, spent a semester abroad in New Zealand while in college. He used his FamZoo card, and that was nice because we knew he was alive and well since we received our notifications.”

The notifications tell the parent where, when and how their child is spending the funds. It allows parents to see if their child is making any foolish decisions with their various transactions.“It’s a great way of feeling connected and spurring conversations about things that are financial-related,” stated Dwight.

Staying Connected to Spending Habits

By having everything tracked in one place, traveling parents can also feel plugged in to what’s going on with their children all the time. “We see this in a lot of different ways, whether it’s travel with one parent working, or military, or blended or divorced families,” said Dwight.

“Everyone can stay on the same page with tracking and notifications, which encourage a lot of transparency. I think if kids develop that transparency with their parents as kids, they will carry that transparency to their lives as spouses or partners of young adults. That’s been a very interesting and healthy side effect.”

The spending card also allows for parents to create their own interest rates for kids and introduce the concept of putting money into different buckets, with various purposes behind each one. “We have an ulterior motive to get kids hooked on philanthropic endeavors early on,” noted Dwight.

“When a kid sees or hears about a disaster somewhere, and they donate the balance of their giving card and complete the transaction, they really feel the ownership and connectedness to that, so we think that’s very powerful.”

Getting Your Own FamZoo Account

All a parent needs to do to get started is visit FamZoo.com and select Prepaid Card Accounts or IOU Accounts. An IOU account simply tracks money that a parent is holding for their kids. Instead of a prepaid card, the child deposits their money into the IOU account that the parent monitors. And when the child wants to use the funds, the parent deducts the amount. Only kids over the age of 13 can be official cardholders of the prepaid cards, so parents simply need to choose the best option for their family. Dwight understands that parents can be extremely busy and may not have a lot of time to dedicate to certain projects or lessons, so he designed his product with this in mind.

“We are expressly sensitive to the time constraints of parents, so I recommend beginning very simply and adding things over time – start with a spending card and set up alerts to get the text message to show your remaining balance. Turn on the notifications and the conversations will come to you,” stated Dwight. FamZoo accounts are also great to use on vacations as parents can help kids set aside travel budgets. “The real focus is helping parents teach their kids good money habits…anywhere.”