Keeping a good credit score is important. A high credit score can do everything for you from being approved for a lower loan rate, earning a huge credit card bonus, lowering your insurance premiums, and getting hired for your dream job. One of the ways to keep your credit score high is to limit your inquiries. When you only apply for pre-qualified credit cards and pre-approved credit cards, you are protecting your good credit score by focusing on credit cards that you have the best chance of getting approved for.

How to Pre-Qualify for Best Credit Cards and Get Approved

How many credit cards should I have? Is there a perfect number?

The average consumer may have 3 credit cards, but if you’re really into travel rewards like I am, you may have applied for more than 3 credit cards just in the last 90 days. When people ask me “how many credit cards should I have,” I reply that it depends on your situation. Let’s look at the pros and cons of having multiple credit cards to help you determine the right number of credit cards for you.

How to Earn Over 20% Cash Back on Dining

Whether you are staying home or out traveling the world, one thing is constant. You will spend money eating out. Here’s an awesome way to earn more than 20% cash back when eating out.

See the World in Style with THIRDHOME

The most luxurious destinations and accommodations in the world can be yours for a fair price. And we’re not talking traditional hotels. A startup called THIRDHOME is shaking up the luxury travel industry with its business model. THIRDHOME is a luxury property and travel club offering home exchanges, rentals and even adventures. “Originally a luxury home exchange, it has evolved into the only travel brand that brings together a collective group of trusted homeowners, renters and adventurers who share a passion for discovery and demand an elevated experience,” said Senior Vice President of Operations at THIRDHOME, Sean Judge. He spoke to RewardExpert about the advantages of traveling the THIRDHOME way.

How To Pay Off Debt: Average US Credit Card Debt Reaches $15K!

Credit card debt can be a huge obstacle to your financial goals. Recent studies show that the average credit card debt is now over $15,000 per household. With the average American credit card debt rising beyond levels last seen leading up to the 2008 Great Recession, this could spell trouble for the economy and consumer finances. There is no single best way to pay off credit card debt – there are several to choose from. The path that you take is a personal choice, but the most important thing is that learn how to pay off credit card debt so you can become debt free.

Pay Yourself First with Helcim

Who doesn’t want to save money? When it comes to processing all those credit card payments, a startup called Helcim is helping merchants across Canada and the United States save big-time, allowing businesses to pass on lower prices to the consumer. Helcim Founder and CEO Nicolas Beique spoke to RewardExpert about the advantages of using his company, which now processes over $2.5 billion in payments each year. “We dedicated ourselves to providing affordable pricing and educating small business owners, so they could avoid the common pitfalls that were now obvious to us but may not be to a business owner,” he said.

Eagle’s Flight: Powering Employee Development

In an economy where the unemployment rate is holding steady at less than 4 percent and voluntary separations (or quits) are increasing, an appealing company culture is essential if your business wants to keep the employees you have as well as attract new job candidates. Leadership is a vital component of culture – both in its development and maintenance. If your organization has strong leaders, you’ll enjoy high productivity and low turnover. Poor leaders will yield the opposite.

Make Smarter Software and Service Purchasing Decisions with G2 Crowd

If you’ve ever purchased CRM, ERP, HR or other software for your business – or hired a branding agency, solution consultant or other business service provider – you know that researching your options is a time-consuming process. You also know that no matter how thorough you are in that review, your success is not guaranteed – especially when you’re forced to rely on biased information provided by the software developers or service providers themselves.

Stay Ahead of the Competition with NICE

With competition for the consumer fiercer than ever before, companies are constantly looking for an edge anywhere they can get it. NICE Systems believes its software offerings can give companies the advantage necessary to get ahead and stay there even in the most transformational of times. “NICE is all about empowering organizations to create exceptional customer experiences, using advanced omnichannel analytics, automation, artificial intelligence and cloud capabilities,” said Aviad Abiri, vice president of Portfolio Sales Enablement at NICE. Abiri spoke to RewardExpert about the advantages of becoming a NICE client.

The Fidelity Cares Teacher Financial Literacy Training Program

In a world where banking news is often grim – from Citigroup’s robo-signing settlement and Danske Bank’s money laundering inquiry to Wells Fargo’s latest scandal – positive efforts by financial institutions to benefit more than their shareholders are a welcome relief. One such program is Fidelity Investment’s Fidelity Cares Teacher Financial Literacy Training Program.

Improve Your Team’s Productivity with Free Software from Bitrix24

No matter what industry your business is in –from design and marketing to IT and travel– efficiency is essential to productivity. Bitrix24, a collaboration platform that provides a complete suite of free tools, was designed to increase business productivity through social collaboration, communication and management functions.

How to Get a Free FICO Credit Score from all 3 Credit Bureaus

Credit scores are a quick way for banks, insurance companies, and others to rank us based on our past behavior. Keeping track of your credit score is an important way to monitor your progress towards a better financial future. But how do you get a free FICO credit score? There are actually many ways how to check your credit score for free. Follow along, and I’ll show you how.

SafetyNet: Job Loss Insurance for Financial Peace of Mind

Even in a healthily growing economy –like the one we enjoy in the U.S. today– layoffs and business closures happen. In fact, in August 2018 alone, the information services sector lost 6,000 jobs, the retail industry lost 5,900, manufacturing lost 3,000, durable goods lost 4,000, and auto manufacturing lost 3,000. That’s more than just a list of numbers; it’s more than 20,000 Americans who found themselves unexpectedly out of work.

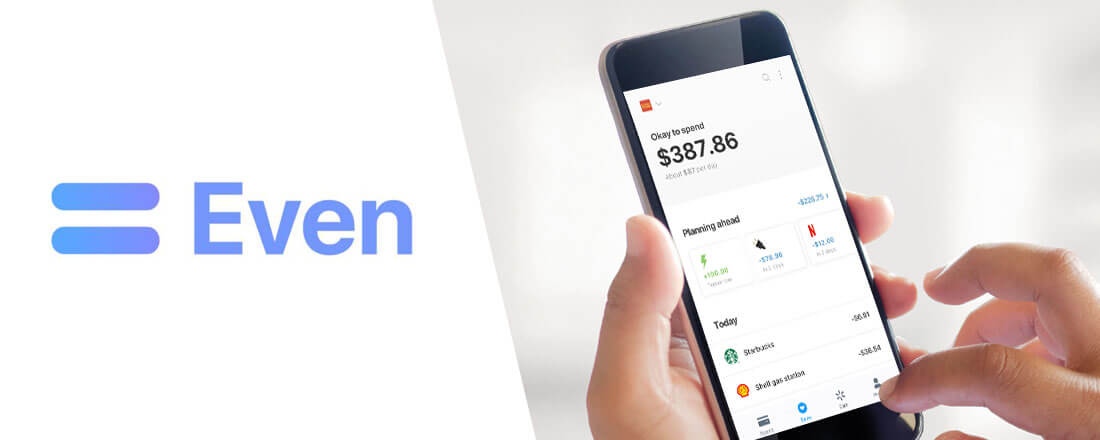

Even: Master Your Money for Better Financial Health

Do you live paycheck to paycheck, counting the days between each infusion of cash so you can buy essentials and cover your bills—and rarely, if ever, having anything left over to stash away for a rainy day? If so, you’re far from alone. According to a survey of U.S. workers conducted last year, nearly 80 percent said they struggle to make ends meet. And that wasn’t just the low- and mid-income earners either. Nearly 10 percent of respondents making $100,000 or more a year said they usually or always live paycheck to paycheck.

TrueConf: Video Conferencing Made Easy

If you’re looking for effective, interactive video communication, a company called TrueConf makes it simple to connect desktops, mobiles, phones, H.323/SIP endpoints and much more across your entire organization. RewardExpert had the opportunity to speak with TrueConf Chief Business Development Officer, Dmitry Odintsov, about what sets TrueConf apart from other businesses offering video conferencing and how it can help business owners save time and money.

Invest in the Next Big Thing with SyndicateRoom

The opportunity to be an early investor in the next Google or Facebook or Uber is something no investor would pass up. But getting access to red-hot startups in the early days has traditionally been restricted to institutions and venture capital firms. Now, a UK company called SyndicateRoom is opening up access to these companies, providing everyday investors with the opportunity to put their money into fast growing startups and become so-called tech investment “Dragons,” allowing them to invest alongside some of the biggest names in venture capital. “We’re an online investment platform offering investors access to highly-vetted startup investments,” said Marcin Zaba, SyndicateRoom’s head of marketing, who spoke to RewardExpert. “Investors can invest directly into individual companies or via our funds.”

$5 Dinners is Helping Families Spend Less on Groceries

According to the United States Department of Agriculture, the average monthly grocery expenditure for a moderate-cost meal plan for a family of four is about $966.50—or a little more than $11,500 a year. Erin Chase, founder of $5 Dinners, a website focused on budget-friendly family recipes, believes hard working Americans don’t need to spend nearly that much for healthy, nutritious meals. She cut her own food bill in half using a combination of strategic grocery shopping, meal planning and couponing, and now she’s helping others do the same.

SCOTTeVEST’s Patented Pockets Take the Hassle Out of Travel

Mobile phone, tablet, charger, sunglasses and reading glasses, keys, wallet, passport and more. When you’re on the go —whether just across town or to the other side of the globe— where do you stash all of these essentials? The answer is no longer limited to ‘my bag,’ ‘my briefcase’ or ‘my purse’ thanks to SCOTTeVEST’s innovative garments engineered for the everyday adventurer.

RewardExpert spoke with Scott Jordan, the company’s co-founder, to learn more about the inspiration behind his line of tech-enabled vests, jackets, hoodies and more as well as his plans for SCOTTeVEST’s future.

850 FICO: Do you really need the highest credit score?

While many people struggle to improve their credit scores, there are some super prime consumers who have earned a perfect credit score of 850. The higher your credit score, the better terms you’ll get on loans and perks on your credit cards. But do you really need the highest credit score possible to get the best loan interest rates and credit card benefits? And what steps can you take to improve your credit score?

Why the Free Checked Bag Benefit Doesn’t Always Mean “Free”

The airlines are making a killing by charging us for checked bags. In 2017, airlines made over $4.5 billion from this additional source of revenue. Now, checking a bag is getting more expensive for travelers because United and JetBlue are increasing the first checked bag fees from $25 to $30. And the other airlines are sure to follow.