Having all-in-one access to our different emails, messengers and calendars is central with a busy day-to-day schedule. Mailbird is an award-winning desktop email client for Windows which sleekly supports several accounts and identities, while integrating with productivity and communications apps, such as Slack, Dropbox, Google Drive and calendar, and more. Say goodbye to checking different inboxes one at a time with its seamless, simple and speedy design.

Mailbird Provides Organization for Email Productivity With Style

Thinking Capital: Flexible Financing for Canadian Small Businesses

Millions of small businesses call Canada home. In fact, according to the most recent data from Innovation, Science and Economic Development Canada (ISED), a department of the Canadian government formerly known as Industry Canada, nearly 98 percent of the country’s total employer businesses are classified as “small,” with fewer than 100 paid employees.

New Ink Business Unlimited Credit Card by Chase – 1.5% Cash Back on Everything

Much to the delight of frequent travelers, Chase keeps releasing Ultimate Rewards credit cards. And the bank has unveiled a new addition to the lineup of

Ellevate Network: Connecting Accomplished Women to Forge Global Diversity

The strong and tireless leadership of women is more vital than ever in today’s business world. Women have made countless entrepreneurial strides in the twenty-first century, but many obstacles remain. According to a PEW Research analysis, female headship roles only constitute a mere 10 percent of top executive positions at U.S. companies in 2016-17. Thankfully, Ellevate Network is an organization of qualified women diligently working on solutions to vanquish those unacceptable numbers, and propel more women to create, inspire and lead.

Policygenius Makes Getting Covered Easy

Searching for insurance can be a difficult task. There are so many types of insurance coverage, not to mention the long list of companies that offer different options. Which one is the right one for you? Then comes trying to understand all of the terminology used in the policies and quotes—are they even speaking English?

Why You Should Apply for a Discover Card Now

What could be better than a big sign-up bonus? How about an even bigger bonus? If you have ever considered getting a Discover credit card, there is no better time than now as Discover’s Cashback Match will double any rewards you earn in the first calendar year.

Friendship, Fashion and Finances – Ruby Ribbon Takes Shopping to a Whole New Level

Let’s face it. Being a woman is a tough job. From balancing work, finances, families and fashion, it’s hard to keep everything in check. But sometimes a little support and help can go a long way. Ruby Ribbon offers a variety of wire-free products that showcase style, elegance and comfort. RewardExpert spoke with CEO Anna Zornosa about what makes her company special and why more and more women are turning to Ruby Ribbon not just for the comfort of the products, but the comfort of having a side business to help manage their finances.

SwiftStack Helps Businesses Keep Their Data Managed Safely in Cloud Storage

The days of on-site data management are long gone, as businesses continue to grow and expand, along with their needs for data storage. Cloud storage has been the most used alternative, with a growing number of businesses turning to this method for their needs. But many businesses are reluctant to trust large, public cloud spaces. This opened the door for a new company to be born that had a better way for businesses to securely store their unstructured data using cloud storage in their own private environment.

JMango360 Puts Online Retailers Ahead By Building Stunning, Feature-Rich Mobile Apps

Mobile apps are hotter than ever for entrepreneurs in this day and age, and you don’t have to be a tech wizard to build your own stage for success. The revolution of m-commerce is now more accessible to anyone with the power of JMango360—an all-inclusive mobile app builder that allows one to easily and affordably develop their own webshop application. No longer do you need to be a coder or endure passé investment steps to throw your hat into the ring with the big-timers. These pioneers make the process snappy for an immaculate finished product.

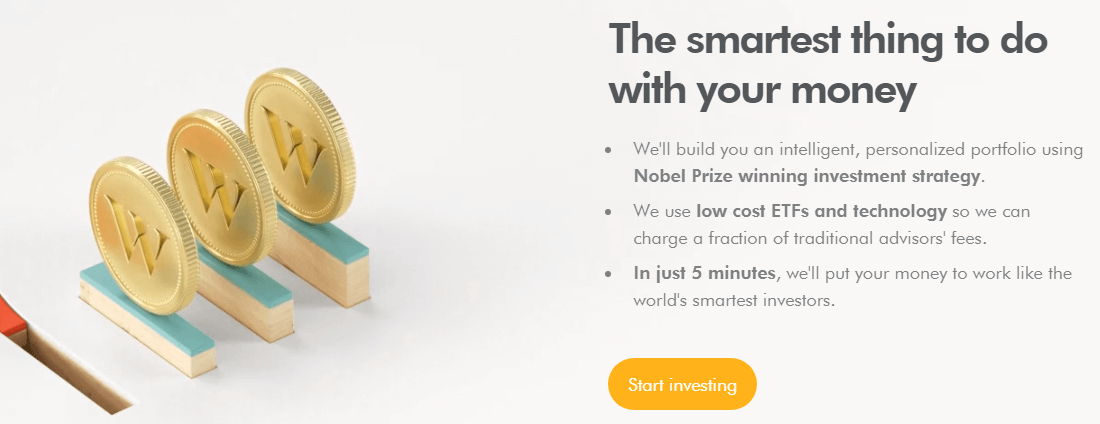

Wealthsimple: Making Smart Investing Simple and Affordable for All

Have you ever said to yourself, “I’m too young to worry about investing for retirement.” Or maybe it was, “I’m too old for investing to make any difference.” Perhaps you’ve even thought, “I don’t have enough extra cash to invest right now.”

Whatever excuse you’re using to avoid making a financial plan for the future, it’s time to cast it aside. You only need $1 (and a mere five minutes) to open an investment account at Wealthsimple, an online investment management company that was designed to make smart, automated investing available to everyone regardless of age, income or net worth.

Filling a Hole in the Investment Management Market

“Our CEO, Mike Katchen, and the other Wealthsimple co-founders, came into a little bit of money for the first time when they sold their previous Silicon Valley company,” Rachael Factor, Wealthsimple’s communications director, told RewardExpert about the organization’s beginnings. “Mike had been investing since he was a teenager, so the rest of the team turned to him for advice.”

“In the process, they all discovered that there wasn’t really a great way to invest in a smart, simple way,” Factor continued. “On the one hand, there was the DIY approach of purchasing individual funds through a brokerage and rebalancing them yourself. On the other, you could turn to full service advisors who were charging high fees. There wasn’t really anything for a regular person who wanted to invest.”

Katchen and his co-founders created Wealthsimple to fill this hole in the market with an online service that combines user-friendly digital tools with personal financial advice, low fees and no minimum account size.

Customized, Hands-Free Investing

Since its launch in September 2014, Wealthsimple has grown to manage over $1.5 billion for more than 75,000 clients in the U.S., U.K. and Canada. Factor noted that the service has been popular with investors of all ages.“Our oldest client is 102 and our youngest is 18,” she said. “But about 80 percent of our clients are 45 years old or younger.”

Getting started with Wealthsimple is exactly what the company’s name implies: simple. “You can sign up for an account on your computer or your smartphone,” Factor explained. “Answer a few questions about your goals, time horizon, investment experience and appetite for risk, and we’ll suggest a custom diversified portfolio. Then we do the rest for you with automatic rebalancing, dividend reinvesting and tax-loss harvesting.”

Wealthsimple Basic investors with less than $100,000 in their account will pay 0.5 percent in management fees. Once your account balance reaches $100,000, your management fees drop to 0.4 percent as you’re upgraded to Wealthsimple Black.

“Any client, no matter how much or how little they have invested with us, can access real advice from a licensed financial advisor at any time,” Factor added.

Short- and Medium-Term Savings Solutions

But Wealthsimple isn’t just for long-term investing. Earlier this year, the company launched the Wealthsimple Smart Savings account to help its clients save for short- and medium-term goals as well. As with the investment accounts, the new Wealthsimple Smart Savings account doesn’t have an account minimum or maximum. It offers a 1 percent interest rate and carries zero additional fees—you can even transfer and withdraw as often as you want for free.

“We have a really great solution to help people meet their long-term goals like retirement and such,” Factor said, “but investment isn’t appropriate for short-term goals—like that vacation you want to go on in six months—because markets can go down in the short term. Clients were asking us for a product that would help them with this type of savings as well. That was the impetus for us to create Wealthsimple Smart Savings.”

Factor said that Wealthsimple asks clients to name their savings accounts upon setup and has identified three general categories of short-term goals as a result. “One is emergency funds,” she explained. “Then there are savings accounts for major life expenses such as a down payment on a home or wedding fund. Finally, there are all the fun things. We have a client with a savings account for a kid’s surprise Christmas vacation in Florida. There’s another saving for a New Zealand trip and one for a Chanel double-flap.”

Wealthsimple Smart Savings accounts integrate seamlessly with Wealthsimple Basic or Wealthsimple Black investment accounts. Deposits to the savings account count towards your total investments with the company as well, making it easier to earn Wealthsimple Black bonus benefits including VIP airline lounge access and dedicated financial planning.

To learn more about Wealthsimple and how its services can help you invest in your financial future, visit www.wealthsimple.com.

The Southwest Companion Pass: Unlimited Buy One, Get One Free

The Southwest Airlines Companion Pass is one of the best deals out there for domestic air travel. Once you earn the pass, you get to nominate a companion. Anytime you book a flight, that companion can fly with you for only the cost of taxes. That’s essentially a free ticket to anywhere in the U.S., and you can use the pass as many times as you want!

SnackNation: Bringing Healthy Brand Name Snacks to Your Office at a Bargain

How many times has a bag of Cheetos or a Snickers bar been your excuse for lunch? Well, SnackNation aims to change all manner of snacking in the workplace for the better. Vending machines begone, as their carefully curated shipments of goodies are delivered straight to your office door. Over and above that, they even donate meals to families in need for every package sent – helping to change the world one box at a time.

Devenir Helps HSA Customers Save for their Future

Health Savings Accounts or HSAs, are more than just useful for paying medical expenses. According to leading HSA provider, Devenir, “HSAs are one of the most tax advantaged accounts there is, and are often called a ‘triple-tax advantaged’ account.”

RewardExpert had the opportunity to speak with SVP of Research & Technology at Devenir, Jon Robb, who discussed how the company is committed to helping HSA consumers save for their future.

The Best Bitcoin Wallets for 2018

Does it seem like everyone you know is buying Bitcoin? Before you jump in the game and put a dollar/euro/yen into any cryptocurrency, it’s important to understand the risks.

Delta Credit Cards 2018 – Your Guide To the Top Benefits and Perks

While the Delta SkyMiles program isn’t what it once was, it still deserves a place in any frequent flyer’s life. Despite devaluations and the removal of published award charts, there are some bargains to be had. More than that, Delta’s elaborate network of routes and extensive list of airline partners makes it nearly unavoidable.

Gotham Is the Place to Help Sharpen Your Writing Skills

It’s often been said that “the pen is mightier than the sword.” But in the business world today common expressions have become emojis, words and phrases have their own abbreviations, and texting and informal emails dominate day-to-day communications. It can feel like good, old-fashioned writing has been forgotten and people no longer appreciate how powerful the written word can be. Gotham Writers is here to change that.

Protect Critical Infrastructure With Dragos

A cyber attack can be devastating, resulting in major losses to a company’s finances and reputation. But a cyber attack against critical infrastructure can also be deadly. Think about what could happen if hackers took control of a chemical plant, grabbed a hold of a nuclear power station, shut down the electrical grid or contaminated an area’s water supply. That’s where Maryland-based cybersecurity startup Dragos finds its niche.

Founded by former employees of the National Security Agency (NSA), Dragos focuses on protecting industrial control systems (ICS), which form the beating heart of infrastructure that millions of people depend on. Matt Cowell, director of product marketing at Dragos, spoke to RewardExpert about how the company can help keep businesses and the public safe.

Hotel Van Zandt Caters to Business Travelers

Kimpton Hotel Van Zandt opened its doors on November 16, 2015, as Kimpton’s first hotel in Austin, Texas, and as a product of Austin-based real estate developer JMI Realty. The hotel’s name is loosely drawn from its historic Texas muse, Isaac Van Zandt, the Republic of Texas Ambassador to the U.S., as well as his third great-grandson, and music legend, Townes Van Zandt.

HYLA Mobile Helps Consumers and the Environment

The Consumer Electronics Association (CEA) estimated that the value of consumer electronic sales in 2015 at over $220 billion. Some estimates predict that this industry will hit $1.5 trillion by 2024. Smartphones are a big part of this figure, with 1.46 billion devices shipped last year alone. But what happens to all of the old phones that these newer models are replacing?

XY Planning Network Benefits Underserved Gen X Market

For years it has been evident that if you want the help of a financial advisor, you need to have a lot of money for them to manage. Only the nation’s wealthiest individuals have been able to easily gain access to someone with industry know-how. In fact, only 5 to 7 percent of Americans can afford to pay the traditional Assets Under Management (AUM) fee.