If you’re tired of traditional lenders, the internet is chock full of options for any type of loan you can imagine. But whether you want to lower your student loan payments, buy a house or get a loan to fix up your home, how do you decide where to get the funds?

SoFi is one of the leaders in the online loan business, promising speed, transparency and a community-oriented approach designed to help customers get the very best bang for their buck. Rachel Reichblum, senior manager of product communications at SoFi, spoke to RewardExpert about the benefits of choosing to become a SoFi member. “We take a unique approach to lending, offering lower interest rates and big savings,” she said.

SoFi: A Finance Company That’s on Your Side

2019 Chase Freedom Calendar (Q4 Revealed to Earn 5% Cash Back)

The Chase Freedom credit card is one of my favorite ways to

The quarterly bonus categories are capped at $1,500 in spend each quarter. This means that you can earn up to 7,500 Ultimate Rewards points every three months when you max out the bonus opportunity.

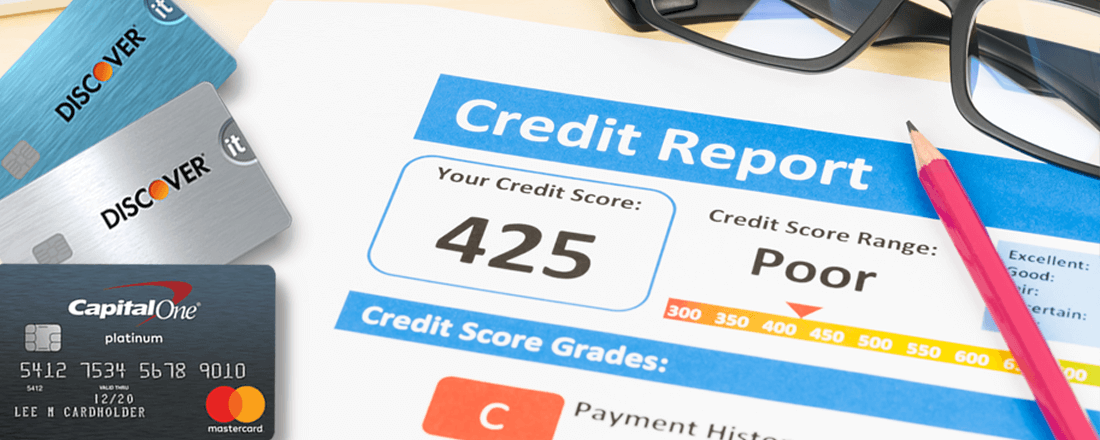

The Best First Credit Cards You Should Apply For

So you’ve decided to apply for your first credit card. But without a credit history, it can be hard to figure out which cards you can get. You won’t qualify for just any card, never mind figuring out the best card to fit your needs.

Save Money and Protect Your Business with Jumio

The internet is a minefield when it comes to security and identity verification. And with recent cybersecurity breaches, the stakes have never been higher. Making one false move can expose critical personal information and cost your company and your wallet a huge amount of money.

So here’s the key question: How do you verify a person’s identity when all you’re looking at is a computer screen? How can you make sure what you’re seeing in the digital world matches real life? That’s where identity screening companies like Jumio come in.

ETA: Where Technology and Payments Come Together

Many people go about their day without thinking about how technology has really evolved when it comes to payments. Gone are the days of putting items back on the shelf if you forget your wallet. All you need is your smartphone and an app to pay for your merchandise.

Best Credit Cards for Online Shopping in 2019

Every major retailer has an online store these days. That means consumers no longer have to leave their couch to buy clothes, books, groceries and more. But in a sea of credit cards, it can be hard to pick the best one for shopping online.

I’ll tell you how you can maximize your cash back while shopping online. I’ve included our roundup of the most rewarding credit cards. Plus, you’ll learn how to use shopping portals to earn 10 percent cash back or more. I managed to get 17 percent back for a recent purchase!

Say Goodbye to Your Tedious Expense Report and Hello to Expensify

Who enjoys filling out an expense report? They are time consuming and often messy. And let’s face it, it’s difficult keeping track of all those receipts. Like it or not, though, they are required by many employers.

Reducing Your Chance of an IRS Audit

Is the mere thought of Internal Revenue Service scrutiny enough to give you nightmares? For many Americans, it is. In a recent survey of more than 2,500 taxpayers, TaxAudit, the nation’s largest audit defense service, found that 47 percent feel anxious when they receive correspondence from the IRS. And while 65 percent are confident that their tax returns are error-free, 29 percent still worry the IRS will audit them.

Small Businesses Find Flexible Finance Options at OnDeck

Small businesses—defined as independent businesses with fewer than 500 employees—make up 99.7 percent of employer firms in the U.S. according to the Small Business Administration. The millions of new jobs they create each year are extremely important to our nation’s economy, yet traditional lending institutions often fail them when an unexpected opportunity knocks or cash is tight.

How to Pre-Qualify for Capital One Credit Cards

Most of us have gotten a letter from one credit card issuer or another telling us that we’ve been pre-approved for a card. But do you know what that really means? We’ll give you the lowdown on pre-approval and our tips and tricks for pre-qualifying for that Capital One card you really want.

Get Inspired by Living the Dream

Most people have probably thought about ditching their jobs and spending months traveling around the world. It’s also likely that the vast majority of these people don’t follow through with those plans. Instead, they put their dreams on hold to live a more conventional life, filled with offices, homes and bills. But if you are seeking a more adventurous lifestyle, do not despair.

There is a way you can hit the road, make money and live the dream, achieving a lifestyle that people will envy for decades to come. That’s what Jeremy Jones is doing. He and his wife Angie are the authors of the blog, Living the Dream.

As Jones told RewardExpert, “Don’t keep thinking about it, commit to doing it!”

Transparency & Customer-First Approach Drives Sales

The launch of ecommerce has been a game-changer across the globe and is now something most people can’t live without. It has simplified lives and how we shop by saving us time and money.

For many years, ecommerce megastores dominated the online space, but the availability of ready-to-launch ecommerce platforms and services now make it possible for any company of any size to launch an ecommerce store.

PureFormulas.com (PF) is a health and supplements ecommerce store that officially launched in 2009. We spoke with Daniel Moure, CMO of PureFormulas, to learn more about how they got started and to understand their unique selling proposition.

A Credit Union Worth Banking With

In the digital age, online security is a fear for many consumers. Credit card information for millions of Americans is routinely hacked, wreaking havoc on those who thought they were secure. According to the Financial Conduct Authority, the retail banking sector suffered 17 different incidents in 2017 — the highest number of attacks experienced in the industry as a whole. That’s a jump of approximately 80 percent when compared to the previous year.

Cozi Makes Family Vacation Planning Easy

Spring break is here, which means families from all across the U.S. will be vacationing to warmer locations via car, plane or even train.

Planning a vacation or cross-country trip is no easy feat, especially when you’re organizing an itinerary for the entire family. The process can be tiresome and it can be hard to come to an agreement on what events everyone should participate in. To ease the burden, notably for parents, an app called Cozi helps families stay organized so everyone is on the same page before taking off for vacation.

Help Your Kids Become Financially Responsible with BusyKid

It can be tough for busy parents to stay on top of their finances and just as tough for them to find time to teach their kids about money. However, there is one Arizona-based company that is offering a way to do both. With BusyKid, chores, allowances and finances all come together into one easy solution.

The Power to Change the World

Imagine a world where one person or one organization could really make a difference. Imagine if their efforts to end poverty and war had a global impact. You don’t have to imagine that anymore. Meet the people at Abt Associates.

Abt Associates was founded by Clark C. Abt, a German immigrant who came to the U.S. at the age of eight. He earned a degree in aeronautics at the age of 22, which was soon followed by a masters in writing. After that, he completed a PhD in political science from MIT in 1965. He created Abt Associates the same year with one purpose: to create a world free of war and poverty.

The Credit Counselling Society: Helping Canadians Resolve Debts and Improve Finances

Are you having trouble making your monthly credit card payments? Do you—or a friend or loved one—dread answering the phone for fear of another collection call? If so, you’re not alone.

According to a survey conducted for the Global News last year, the average Canadian owes $8,539.50 in consumer non-mortgage debt. Even more troubling, 12 percent report consumer debt above $25,000, and 14 percent are carrying consumer debt between $10,000 and $24,999.

Fortunately, the Credit Counselling Society can help. The non-profit—with offices in Alberta, British Columbia, Manitoba, Ontario and Saskatchewan—has assisted more than 500,000 Canadians with solving their debt problems and improving their finances.

EverQuote Pairs Drivers with the Right Insurance

Have you ever tried shopping around to get the best quote on auto insurance? If so, you’ve probably spent hours online jumping from one carrier to the next, each promising to be the lowest price, and each failing to live up to your expectations.

EverQuote is dedicated to helping everyone find the right insurance. Their team of analysts, engineers and business development representatives are partnered with some of the best insurance providers to help consumers find the right fit for their needs.

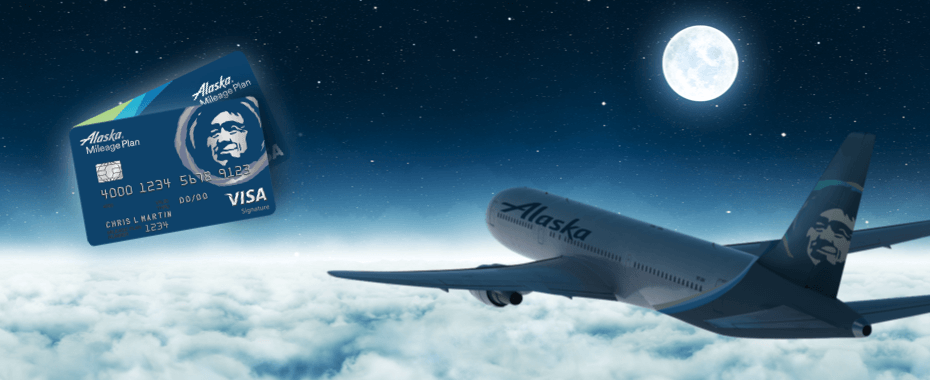

Alaska Airlines Credit Cards: Everything You Need to Know

Alaska Airlines credit cards are a solid option for anyone with good credit who lives in an area served by Alaska Air or one of its 17 airline partners. After you get the sign-up bonus, this card is best for earning Alaska Airlines rewards and supplementing your everyday cards that have more versatile points currencies.

This post is your go-to place for everything about Alaska Airlines credit cards and it’s Mileage Plan frequent flyer program. Alaska Airlines Mileage Plan is consistently ranked highly by customers and experts alike, offering exceptional redemption values to Hawaii and Asia. Between the low domestic and international premium redemption rates,

Kasisto Serves Up Financial Expertise with its KAI Platform

The next time you need to see how much you spent on coffee in the past month, or are wondering how much you have left in your bank account, all you have to do is ask. That’s because artificial intelligence is playing a bigger role in the financial services industry and is helping financial institutions and their customers spend less, save more and dramatically improve their financial lives.