Pottery Barn brings an interesting twist to the loyalty credit card: cash back or, if your purchase is big enough, special financing.

But as interesting as it is, this card is still a hard pass unless you’re such a Pottery Barn fan that you’re decking out your whole house in the retailer’s goods. There are much

I mean, really: Why would you pay special financing when you can pay no financing with something like the Capital One Quicksilver Cash Rewards card? But we will come back to that in a moment.

The Pottery Barn Credit Card: Do You Want to Decorate Your Wallet With This Piece of Plastic?

Bealls Credit Card – Everything You Need to Know Before Apply

With an effective cash-back rate of 10%, the Bealls credit card (and the Bealls Florida credit card) seems like a winner. But before you click “apply,” there are some caveats you need to understand about a Bealls credit card.

In short: If you’re looking for an all-purpose, all-around credit card to collect cash back, then steer clear of a Bealls credit card and, instead, look for a more

The Forever 21 Visa Credit Card: A Ho-Hum Credit Card Bested by Far-Better Competitors.

Given the quantity these days of

Total Rewards Visa Credit Card: Is it Worth the Gamble?

Sometimes, credit-card signup bonuses and benefits are

Ulta Credit Cards – The Ugly Side of Beauty.

I am not a consumer of cosmetics. As such, maybe everything I say about the Ulta Ultamate Rewards Mastercard is wrong. Nevertheless, after reviewing what the Ulta Mastercard offers, I will say this is a card that is largely useless unless you are totally into Ulta as your go-to-shop for cosmetics and other beauty-related purchases.

Claim Your $125 From Equifax Before it’s Too Late

Credit-reporting agency Equifax has been ordered to pay consumers hundreds of millions of dollars as part of a settlement for a 2017 data breach. At minimum, impacted consumers are eligible for a $125 payment, and some can claim as much as $20,000.

Here’s all you need to know to determine if you’re eligible to claim a piece of that gargantuan pie.

BJ’s Perks Credit Cards – Why You Should Think Twice Before Click “Apply”

Let’s be blunt about this: the BJ’s Wholesale Club credit cards look like they’d be a pretty good option, particularly if you’re a regular shopper at one of the company’s warehouse stores.

But the reality is that BJ’s two credit cards aren’t really worth the application effort. So, right here we can answer the primary question: Is a BJ’s credit card good for me?

The short answer is no.

The longer answer is maybe, but leaning heavily towards no.

Here’s why…

How ANYONE can save at least $17,650 in three years: Things You Will Need to Dump Now (But You Can Keep your Starbucks Latté)

A news story recently made the rounds based on an annual Federal Reserve survey. Four in 10 Americans – 40% of us – would struggle to pay for an unexpected, $400 expense.

For some, that’s likely a truly legitimate fact precipitated by events beyond their control. For others, it’s all the choices they’ve made to this point, whether that’s an educational opportunity spurned, spending and savings decisions that undermine their financial strength, rash decisions tied to a job, a relationship, an investment, whatever.

Merrick Bank’s Preapproved Credit Cards – It’s Ok to Say “No”

Building credit anew or rebuilding credit after some sort of financial disaster can be a struggle. It’s often a chicken-and-an-egg situation in which you can’t get a good credit card because your credit is so bad – on non-existent – and you can’t build or rebuild your credit because you can’t get a good credit card.

Several credit-card providers have stepped into that void with cards that help you establish credit when you’ve never had it, or which will

The Best Luxury Credit Cards to Own – But Think Twice About Applying for Others

There was a time when the only truly exclusive credit card was the American Express Centurion card – known almost ominously as “the Black Card.” So exclusive was it that American Express never really commented on its actual existence.

The card was almost mythological and all that was generally known was that one needed to make a lot of money – and spend a lot of money of an Amex card – to even, maybe, be invited to apply.

Southwest Rapid Rewards Performance Business Credit Card – Should You Apply?

Southwest Airlines has unleashed a new business credit card on the world, and it’s a good one, particularly if you’re a regular flyer on Southwest.

The new card is the Southwest Rapid Rewards Performance Business Card, which offers an enhanced day-of-travel experience and opportunities for accelerated earning in key business spending categories.

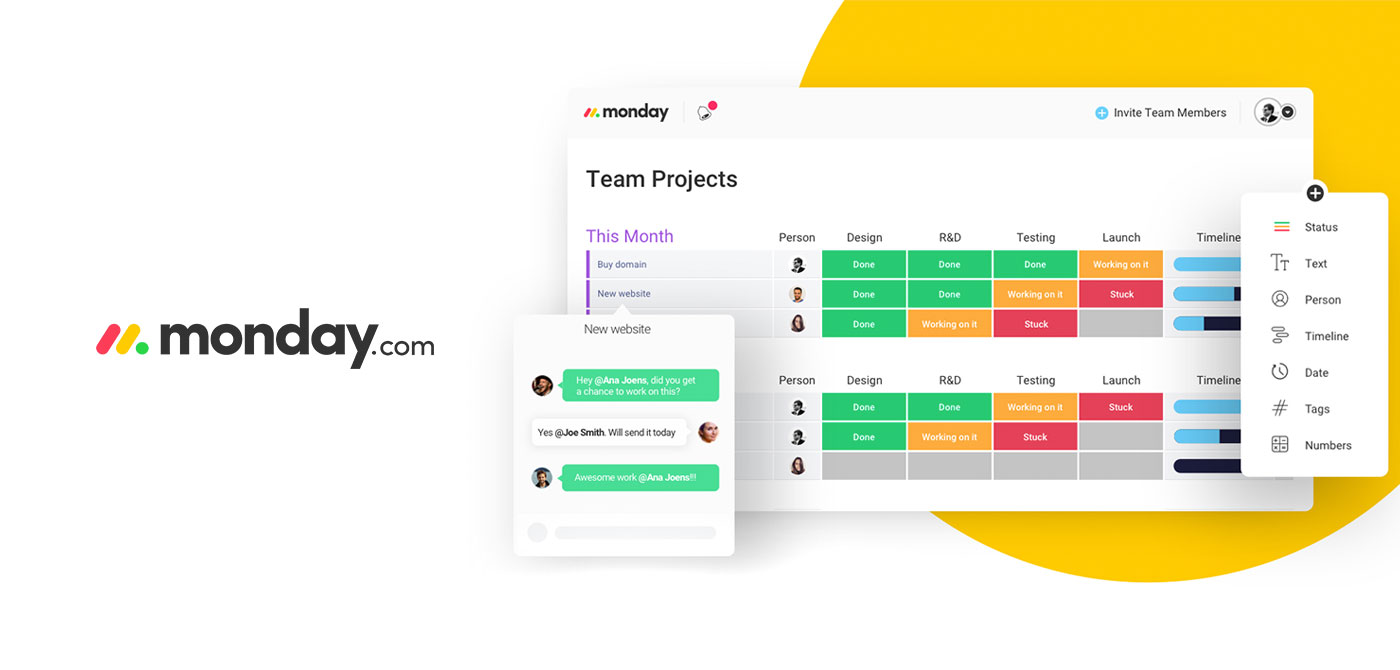

Save Your Business Time and Money with monday.com

It’s the most dreaded day of the week. Those Mondays where you have to kiss your fun-filled, relaxing weekends behind, get up early, dress for success and head back to work. So how do you beat a case of the Mondays and ensure you’re heading back to a fulfilling, enriching work environment where teams can collaborate quickly and effectively? Enter a company called monday.com. Matt Burns, head of customer success at monday.com, spoke to RewardExpert about the company’s products and mission. “monday.com is reframing the conversation around work and Mondays by promoting positive, productive work environments and atmospheres,” he said.

Tractor Supply Credit Card: Think Twice Before You Click “Apply”

Many large retailers have store branded credit cards. If you are a frequent shopper at Tractor Supply, a TSC credit card may help you save money in certain situations. But if you are looking for a credit card with a

Affirm Offers Consumers an Alternative to Traditional Credit Card Purchases

Are you tired of teaser offers that don’t last, sky-high rates and credit card balances that continue to grow thanks to compound interest? If so, it’s time to take a closer look at Affirm.

RewardExpert spoke with Elizabeth Dixon Allin, Vice President of Communications, about the inspiration behind the innovative micro-lender and how any consumer can take advantage of the company’s alternative to traditional credit card purchases.

Lincoln Financial Group Helps Your Employees Achieve Retirement Success

Do you offer retirement planning as part of your small business employee benefit package? If not, you may be in danger of losing good workers to your competitors who do. According to a survey by the Employee Benefit Research Institute, retirement savings plans were offered by 67 percent of employers in 2018. Within the companies offering this benefit, 79 percent of employees participated.

RewardExpert recently spoke with Joseph Mrozek, vice president and national sales manager for Lincoln Financial Group’s retirement plan services, about why a retirement savings plan is an important employee benefit and why employers should choose Lincoln Financial Group to provide it.

The Five Best Pubs in Prague for Real Czech Beer

Think of beer, think of Germany.

Think again.

Here in Prague, the Czechs put Germans to shame when it comes to knocking back brews. Czechs drink, on average, 143 liters of beer each year per person, far outpacing the nearest competitor – Namibia, at 108 liters.

Ann Taylor Credit Card: Only Useful For an Ann Taylor Fans

As with so many retailers, fashion retailer Ann Taylor has its own affinity credit card – the Ann Taylor Comenity Mastercard. If you’re an Ann Taylor fan, the card’s probably not a bad deal because of the exclusive benefit it offers.

But if for the typical credit-card customer, there are far

TD Cash Credit Card: There are Better Cash Back Credit Card Options

For consumers who frequently dine out or who are stay-at-home wannabe chefs, the TD Cash Credit Card seems like a worthy option, what with its 3% cash back feature on dining and 2% on grocery store purchases. And among cash back cards, those aren’t bad benefits. But … you can do better if you’re looking for a

How to Pay Less then 0.5% APR for a $15,000 Loan in 10 Years

Extinguishing credit card debt is one of the most grueling debt-management processes imaginable. The high rates of interest most credit cards charge can make the process seem never-ending. And it’s demoralizing to see so much of your monthly payment go toward interest and so little go toward paying down the balance.

4 Questions Answered to Help You Choose the Right Credit Card for You

Perhaps when you were young, people warned you about the dangers of a credit card. Whoever thought a small plastic card could lead to so much debt and potential financial prison?

Those warnings didn’t come without reason though, as just over 40% of families in the United States have some sort of credit card debt. Add that with $1200 of average annual interest and a credit card can look scary from the outside.