Are you saving up for a dream vacation and

To help you pick your next card, we’ve chosen one card from each of the three big rewards programs—Chase Ultimate Rewards, Citi ThankYou Rewards and American Express Membership Rewards. These cards all offer the biggest sign-up bonuses in their programs, guaranteeing that they’ll get you award tickets fast.

These programs also give you flexibility in choosing how you want to redeem your points since you can transfer them to a variety of frequent flyer programs. With the options available to you, you’ll be sure to get the most value for your points.

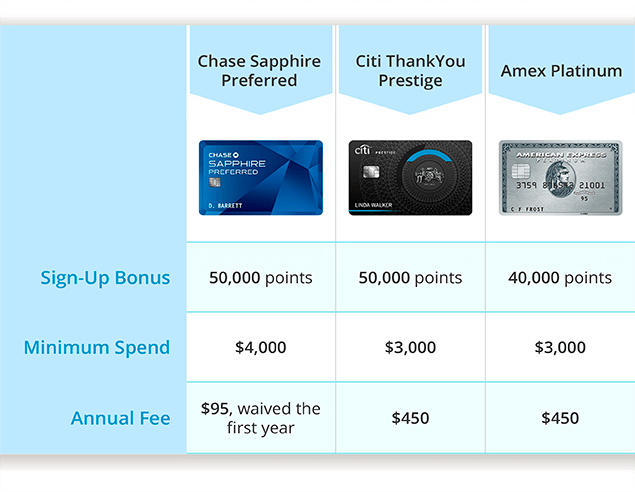

The Cards With the Big Sign-Up Bonuses

At 50,000 points the Chase Sapphire Preferred card has the biggest bonus, but the Amex Platinum card and Citi ThankYou Prestige are worthy runners-up at 40,000 points each. You’ll have to spend $4,000 in the first three months to get Sapphire’s bonus, and $3,000 for ThankYou Prestige and the Platinum card. That works out to $1,333 and $1,000 a month,

respectively.

Of the three cards, Sapphire is the only one that isn’t a premium card with a premium annual fee. For me, that makes it the go-to choice of the group. It costs only $95 a year, and the first year is waived. The other cards come with a hefty $450 fee, which you’ll be on the hook for the moment you get the card.

With the Sapphire Preferred card, you’ll get access to the Chase Ultimate Rewards program. This program allows you to transfer your points to six airline partners or to purchase travel directly through the Ultimate Rewards online travel center.

Ultimate Rewards has the fewest airline transfer partners of all the major credit card rewards programs, but Chase chose their partners wisely. Those airlines include at least one member of each of the three major airline alliances—Star, oneworld and SkyTeam—as well as a major U.S. carrier, United, and the largest low-cost airline in the world, Southwest.

The Chase Sapphire card also has a solid earning scheme. You’ll get double points at restaurants and for all travel purchases. That includes everything from airfare, rental cars and hotels to everyday expenses like gas, taxis, trains and subway fares.

The Premium Rewards Cards

If you can justify the $450 annual fee, you should consider either the Citi ThankYou Prestige or American Express Platinum card. At 50,000 and 40,000 points, respectively, both have the largest sign-up bonuses offered in their programs, plus they come with some excellent benefits.

| Benefits | Earning Potential | |

|---|---|---|

| ThankYou Prestige | Admirals Club and Priority Pass lounge access; Global Entry fee credit; $250 airline fee credit; Free fifth consecutive night at any hotel; 60% bonus on American flights and 33% on other airlines when booked through ThankYou | 3x on airfare and hotels; 2x dining out and entertainment; 1x all other purchases |

| Amex Platinum | Centurion and Priority Pass lounge access; Global Entry/TSA PreCheck fee credit; $200 airline fee credit; Gold status with Hilton and SPG; $75 credit for two-night stays booked through the Hotel Collection; Free Boingo Wi-Fi | 1x for everything |

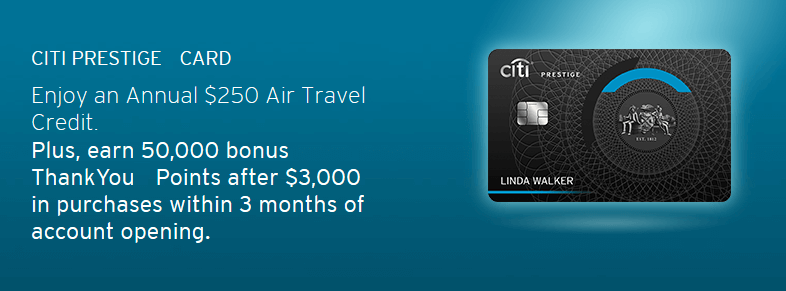

The ThankYou Prestige card gives you access to Admirals Club and Priority Pass lounges, reimburses you for Global Entry and has an annual $250 airline fee credit to cover baggage, change fees and more. It also gives you triple points for air travel and hotels, and double points for dining out and entertainment.

As part of the Citi ThankYou Rewards program, you can transfer your points to 12 frequent flyer programs, including airlines in all three of the major alliances. If you’d rather purchase flights through ThankYou’s online travel center, you’ll get a 60 percent bonus on American and a 33 percent bonus on all other carriers. That works out to 1.6 cents per point for American flights, making this card a good choice if you often fly on the carrier.

The Amex Platinum card comes with many similar benefits. You get access to the swanky Centurion lounges as well as Priority Pass lounges, plus reimbursement for either Global Entry or TSA PreCheck and a $200 credit to cover incidental airline fees. Amex piles on a few more perks too, such as gold status with Hilton and Starwood and a $75 credit for two-night stays booked through the Hotel Collection.

What the Platinum card doesn’t have, though, are the Prestige card’s excellent bonus earning categories. You’ll get just one point per dollar spent for everything.

The Platinum card is part of American Express Membership Rewards, which is the most flexible credit card rewards program. With 17 airline transfer partners, it has the most options when it comes to spending points. Partners include Delta, British Airways, ANA, Air France, KLM, JetBlue and Virgin America. And if you like to fly in style, you can also transfer to Emirates and Singapore Airlines.

What to Do With Your Points

There are a lot of ways to spend a 50,000-point sign-up bonus, particularly if you transfer your points to the right frequent flyer program. I’ve put together some ideas for using your points with the three big rewards programs.

Consider transfering your Chase Ultimate Rewards points to Virgin Atlantic for flights between the U.S. and the Europe. Round-trip economy seats start at only 35,000 miles. Or, transfer them to Korean Air and book a round-trip award flight to Hawaii. If you can find saver tickets, which can be tricky, you can get there for as little as 25,000 miles because the airline includes Hawaii in its North America zone.

And while British Airways charges a lot in fuel surcharges and fees for long-haul flights, its short-haul redemptions remain valuable. At only 4,500 Avios for short flights outside the U.S., you could buy 11 one-way tickets with Sapphire’s sign-up bonus.

Though it has 12 airline partners, you might have to look a little harder for the best redemption options with the Citi ThankYou Rewards program. If you transfer to Air France KLM Flying Blue, you can get to Hawaii from the U.S. for as little as 30,000 miles roundtrip. Flying Blue also offers round-trip flights to the Caribbean for 25,000 miles.

ThankYou isn’t a partner with any of the three major U.S. legacy carriers, but you can transfer points to Etihad and book domestic flights on American for the same price you’d get through the AAdvantage program.

If you’re dying to try one of the ultra-luxurious suites in the sky, save up a few extra ThankYou points and transfer them to Singapore Airlines. You can get a one-way ticket in a first class suite on some shorter flights for as little as 51,000 miles. Look for flights out of Singapore to other Asian destinations like Tokyo. For a few more miles, you might be able to grab a one-way between New York and Europe instead.

There are so many options with Amex Membership Rewards that it can be hard to figure out what to do with your points. To start with, you can take advantage of some of the redemptions noted above, like British Airways short-haul awards, Flying Blue to Hawaii or the Caribbean, transatlantic flights on Virgin Atlantic and Singapore Airlines first suites.

Membership Rewards is also a partner with ANA. You can get from North America to what the airline calls Asia Zone I, which includes China, Korea, Taiwan and more, for as little as 45,000 miles roundtrip during the low season. For 5,000 miles more, you can get to Asia Zone II, which includes India, Thailand and Singapore, among other countries.

If you transfer your Amex points to Alitalia, you can get great deals to South America. Flights from the U.S. to Northern South America cost only 35,000 miles roundtrip, and to Southern South America for 50,000 miles.

Wherever you want to go, it’s time to get a travel rewards card and start earning that big sign-up bonus. You’ll be flying before you know it.