When it comes to banking, most people are looking for a community bank where the customer comes first. But they’re also interested in one that has all the components of a great technology platform as well. With Radius Bank, you get the best of both worlds–the convenience of online banking with a sense of community all wrapped up into one.

RewardExpert spoke with EVP of Virtual Banking, Chris Tremont, and assistant VP of Marketing, Kathleen Barrett, about the perks of being a member of Radius, and how their virtual bank offers better products for customers than traditional banks.

Finances at Your Fingertips

Radius Bank was founded in 1987, and recently went through a major rebranding to become more reflective of the customer experience and digital technology. They only have one full-service branch, but Tremont said the experience for customers is unparalleled.

“For us, the way forward was not through building physical brick and mortar. It is through technology and the user experience. There’s a big population of people who want to bank virtually, so we’ve developed many personal financial management tools to make it easy for our customers to manage their finances wherever they may be.”

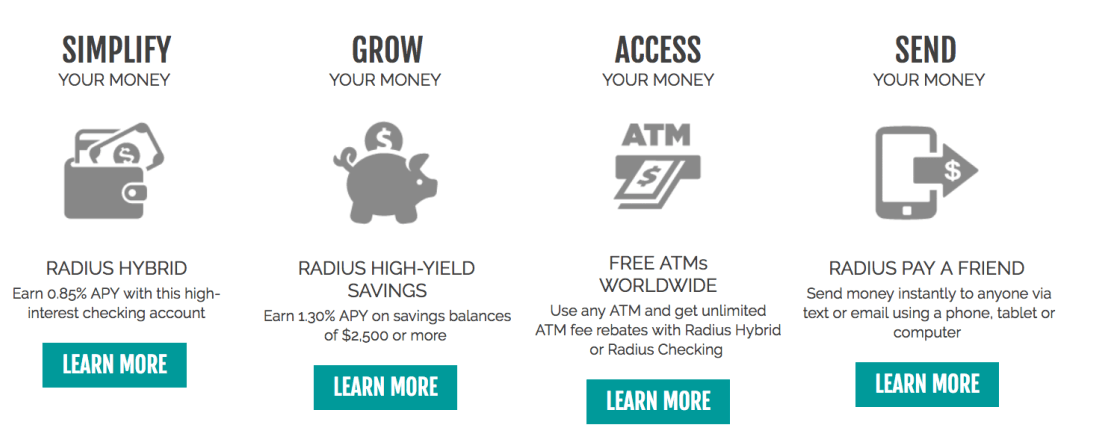

Some of the benefits of banking with Radius include:

- An online mobile banking dashboard–this gives the user a sense of where money assets are allocated to help with budgets and spending with financial goals in mind

- A variety of personal checking products, including the Radius Hybrid account, which is an industry-leading interest-bearing account

- High-yield savings product that offers a competitive interest rate

- Top-notch personal financial management tools that allow customers to get a holistic, 360-degree view of their finances, which gives users the ability to easily aggregate from other financial institutions

- No minimum balances required for checking accounts

- Free online and mobile banking, in addition to unlimited ATM rebates

Tremont said that Radius Bank users nationwide don’t need to feel limited by their debit cards. “You shouldn’t have to pay a fee to get access to your own money. We don’t charge, instead, we give people peace of mind.” Barrett added that the bank’s focus is more on helping their clients make money.

“We encourage people to set up automatic transfers into their savings, essentially hide money from yourself and put it in a separate account so you’re not spending as much.” She explained that the bank encourages clients each week to set money aside, specifically in the Hybrid checking account, so they can start to build interest and save for the future. “The Radius Hybrid combines the high-interest earning of savings with the flexibility of a checking account,” said Barrett.

Taking Technology to the Next Level

Radius’ proudest accomplishment in recent years is their user-friendly technology and mobile capabilities. “Through product development and our technology platform, we’re welcoming thousands of new checking and savings accounts every month. We went from a small bank a few years ago to one that’s moving at a fast clip. At the end of the day it’s all about the customer experience,” Barrett said.

As a full-service consumer bank, Radius operates nationwide and makes it simple for anyone to bank on the go. Tremont said that the digital bank fulfills the need of those customers who are looking for that Amazon-like experience of having the ability to easily navigate through your finances without cutting corners in terms of technology.

He also stated that it’s all about being one step ahead. “We tried to get ahead of the curve where we saw banking heading by seeing what consumers were looking for with their bank. We’ve built a fantastic product that makes lives and money management easier.”

Check out how you can unlock your own banking potential and see how Radius can help you take control of your finances in a quick, easy and technologically-friendly way. To sign up visit www.radiusbank.com.