All parents dream of being able to send their kids to college to earn a degree and get a good job. But today’s job market demands a higher level of education than ever before and college costs are rising at 8% per year! If you don’t start saving now, your children could be saddled with student loan debt for years after graduating.

I had the pleasure of speaking with Mark Kantrowitz, the Vice President of Research at SavingForCollege.com, to discuss the latest in college tuition trends and what options parents have to save for college.

What Was The Idea Behind Saving For College?

Joe Hurley is the founder of SavingForCollege.com and he literally wrote the book about the best strategies to save for college. Joe is a CPA and he recognized the power of tax-deferred and tax-free savings when they were first created.

The website was created in 1999 to educate the public about these wonderful opportunities to save for college and benefit from tax savings. Although 529 accounts are becoming more common, only a third of parents know about them and only 18% of children under the age of 18 have a 529 account.

Joe’s book, the SavingForCollege.com Complete Guide to 529 Plans is now in its 12th edition. Whether it is over the internet or through books, SavingForCollege.com’s mission is to educate consumers about the powerful advantages of 529 accounts.

What Is A 529 Account?

A 529 account is a specialized account dedicated to saving for college costs. Recent legislation has expanded the utility of 529s and the money can now be used for Kindergarten through 12th Grade education.

When money is deposited into a 529 account, the balance grows tax-free and withdrawals are also tax-free when used for qualified education expenses. Approximately 2/3rds of the states provide tax deductions against state income tax for contributions to 529 accounts.

How Much Can You Contribute To A 529 Plan?

Although the IRS doesn’t specify a limit for 529 plan contributions, you are limited by other tax rules. The annual gift tax exclusion allows someone to gift $15,000 in 2018 without needing to fill out additional tax forms or have it affect your lifetime gift exemption amounts.

The 5-year election allows you to gift five years’ worth of contributions into one year. This supersizes your 529 plan contribution from a maximum of $15,000 this year to $75,000. The total amount contributed over the five years is the same, but the accelerated contribution allows those funds to grow tax-free for an even longer period of time.

Federal law also limits the overall balance of 529 accounts. The law states that 529 plan balances cannot exceed the expected cost of the beneficiary’s qualified higher education expenses. The limits vary by state and range from $235,000 to $520,000. These totals are calculated to include estimates for tuition, textbooks, room, and board for undergraduate and graduate school.

How Is That Different Than An Education IRA?

There is another account designed specifically to fund a child’s education. This account is the Coverdale Education Savings Account and if often called an Education IRA.

The Education IRAs have more investment options to choose from, but the limitations often make a 529 plan a better option. Contributions are limited to $2,000 per year and can only be made until the child reaches age 18. And all money in Coverdale ESAs must be used by the time the beneficiary reaches age 30.

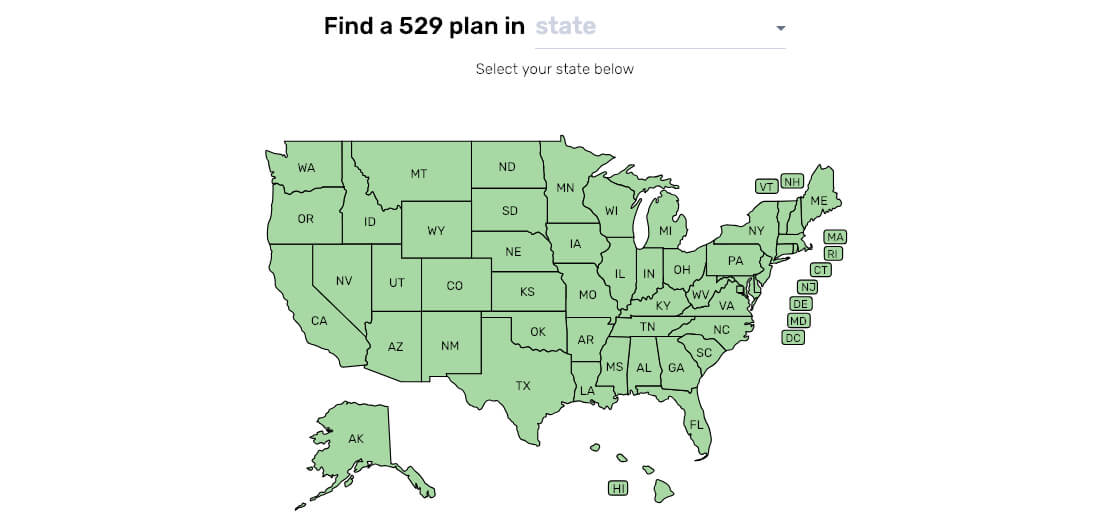

Do I Have To Use My State’s 529 Plan?

One of the best benefits of 529 plans is that you can use any state’s plan. Use resources like SavingForCollege.com to compare options and pick one that is best suited for your situation.

Keep in mind that about 2/3rds of the states offer tax incentives for residents that contribute to their home state’s 529 plan. You’ll have to do the math to figure out which is more important to you, the tax deduction or benefits of another state’s plan. These benefits might include better investment options, lower fees, or reduced fund expenses.

What Happens If My Child Doesn’t Go To College?

The benefit that I love the most about 529 plans is that unused money can be used by other relatives. If your child doesn’t go to college or receives a full-ride scholarship, the money isn’t lost.

You have the option of transferring the money to a sibling or a parent. In some cases, you may even decide to let the money continue to grow for your child’s future children. Or, the money can continue to grow in your child’s name so that they can go to school in the future.

As a last resort, you can withdraw funds from a 529 account and pay a penalty. Consult your tax advisor about how such a withdrawal would affect your taxes.

Can We Use 529 Plans For Trade Schools?

529 plans are designed for higher education, but that doesn’t mean that your child must go to a traditional college. Not everyone wants to go to college to become a teacher, an architect, lawyer, or any number of white-collar careers. Some students want to attend a trade school to become a mechanic, plumber, electrician, or another trade.

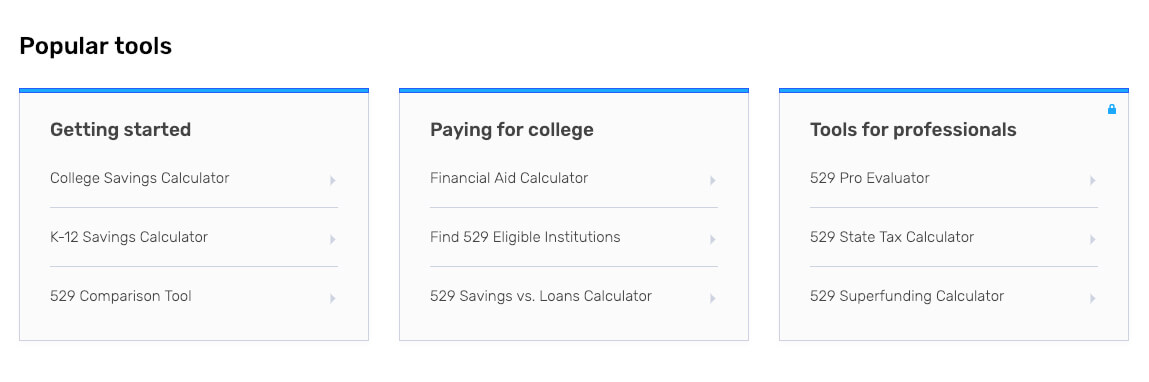

Not all trade schools are eligible for 529 plan distributions. If the trade school is accredited and eligible for Federal student aid, then these school expenses are eligible for tax-free withdrawals from a 529 account. SavingForCollege.com has tools that can help you determine if the trade school you are considering is eligible for tax-free withdrawals.

What If My Child Wants To Study Abroad?

An international education is a wonderful investment that can be incredibly valuable personally and in certain career fields. If your child is looking to study abroad for their entire education or as part of a study abroad year, it is possible that the 529 plan will cover qualified education expenses.

Just like a trade school, as long as the international education institution is accredited and eligible for Federal student aid, then those school expenses can be paid for with a 529 account. For a study abroad year as part of a domestic college education, as long as the domestic college is eligible, then the study abroad program is also eligible.

Keep in mind that travel expenses to these international schools are not covered through a 529 plan.

If you would like more information about the best way to save for college for your children, grandchildren, or relatives, please contact Mark at SavingForCollege.com. Many questions can be answered in the message boards, the numerous articles written, or via their user-friendly tools.