When it comes to investing, many people incorrectly believe that you need to have a lot of time and a lot of money to be successful. In fact, you can get started on your road to financial freedom by investing whatever you have, thanks to companies like Acorns.

RewardExpert spoke with Manning Field, chief commercial officer of Acorns, which is a mobile investment platform that helps anyone and everyone invest their money. “We firmly believe that anyone can grow wealth,” according to Field.

Getting Started with Investing

You may think that you need thousands of dollars to get started. At Acorns, Field explains that all you need is a drive to succeed and few dollars in your pocket.

“There’s no easier way to start investing than there is at Acorns. We make it very easy and focus on getting started. You only need $5 to make the first step of becoming an investor possible.” He says that where other companies steer their energies toward people who have money, Acorns looks to help who they call the up-and-coming, those 182 million Americans who make under $100,000 per year.

“Our focus is on helping people who don’t necessarily have the means just yet, and empower them, creating ways in which they can save money and educate them and build confidence so that they can actually grow wealth,” he said. “This is the core of what Acorns does.”

So What is Acorns?

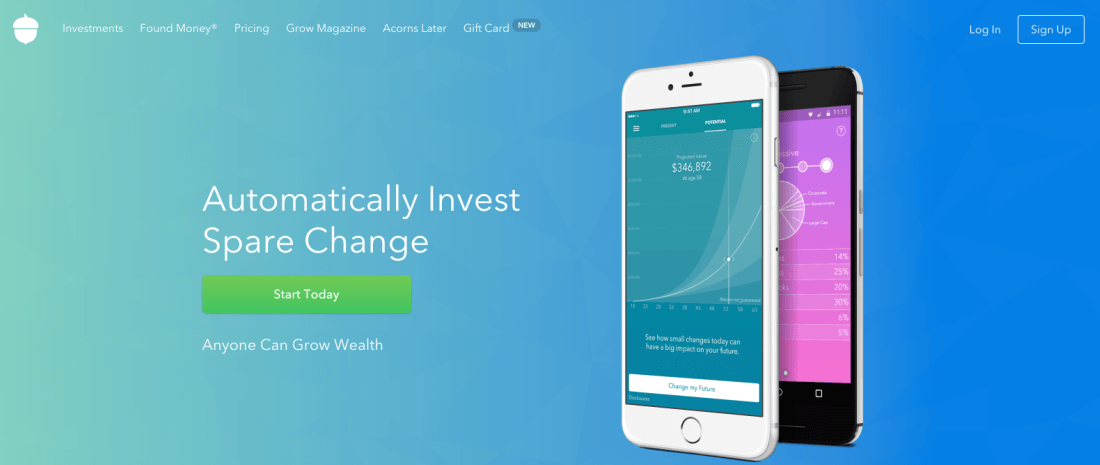

Acorns is the fastest-growing micro-investing app with over 2.4 million investment accounts worldwide. It’s a place where investing spare change can lead to a nice savings account down the road. When it coming to saving, Field believes anyone can do it even if you start at a small rate. “We think there’s an opportunity for everyone to put money away. We built our product to capitalize on that and make it as easy as possible for anyone to actually grow wealth.”

The company offers multiple ways to help anyone get started with their investing portfolios. For example, there is an entire page dedicated to Micro Investing, where each purchase helps to become an investment in your future. There are three steps:

- Connecting the cards and accounts you use to make purchases

- Making purchases (the company rounds up your purchases to the nearest dollar)

- Investing your change (Acorns will automatically invest your spare change)

Acorns also offers Found Money, which is another way the company helps to automatically invest funds in your account. Field says it’s a simple way to save. “We have a loyalty program as part of Acorns. We partner with over 150 brands as part of our relationship with customers. You make a purchase with one of these brands, and while you’re spending responsibly, it’s a way for our customers to put money away for their future.” When you shop with one of Acorns’ partner brands, they will automatically invest in your Acorns account.

The New Acorns Gift Card

As an additional way to give back (and receive for Acorns investors), the company recently launched its new Acorns gift card. People can essentially grow wealth together by investing in each other. Field stated that it’s just an extension of what the company already does. “We’re really focused on trying to get as many people started in investing as possible. We view the gift card as a great new channel in which to start to introduce the idea of investing and putting away for your future.”

Current Acorns customers can redeem their gift cards easily by automatically investing in their accounts, and gift card recipients who are new to Acorns can get a head start in opening a new account. “We believe the idea of gifting and getting people started persists throughout the year,” noted Field.

The company was founded by a father-son team, Walter and Jeff Cruttenden just a few years ago and is continuing to grow. Field said Jeff learned about investing at a young age from his father. “Then he went to college and realized all of his friends didn’t have the same backgrounds. So he wanted to help and make it as easy as possible to become an investor.” From there, Acorns was born with the philosophy of starting small, but accumulating wealth one acorn and one penny at a time.