Until recently, earning Turkish Airlines Miles & Smiles hasn’t been easy for anyone living in the United States. The only ways to do so has been to credit Star Alliance flights to your Turkish Airlines Smiles & Miles account or through Marriott Hotel + Air packages. Now we have another way.

Top 9 Reasons Why I Love the Premium Citi Prestige Card

The Citi Prestige credit card is one of my top cards. In fact, I always use it for booking flights, but it is also great for a few other reasons! Here’s why I love the Citi Prestige.

Guide to the Citi Prestige’s 4th Night Free Benefit

One of the greatest –if not the greatest –credit card benefits is the 4th Night Free perk exclusively with the Citi Prestige® Card. Today we’ll do a deep dive into what it is and how to use it.

Citi Prestige 75k Offer and Membership Rewards 40% Transfer Bonus to Avios

Citi recently implemented a massive wave of changes to its flagship Prestige card. Most of these were announced last year year but did not become effective until this week. Just ahead of the July 23rd implementation, Citi announced some meager positive changes to put a positive spin on things. While most of these recent developments are barely worth mentioning, there is one legitimate bit of good news: the sign-up bonus on the Citi Prestige card has gone up to 75k points.

Changes to Citi Prestige and FlexPerks Cards

In June 2016, Citi announced a massive list of downgrades to the Citi Prestige® Card that really eviscerated this card’s value proposition. However, existing cardholders were given over a year of lead time to absorb the changes and cancel their cards if they felt the remaining benefits no longer justified the $450 annual fee.

How to Downgrade Premium Credit Cards: Prestige, Reserve, Platinum

Premium credit cards can be a great value, but they also carry a hefty annual fee. You can enjoy free airport lounges, travel credits, insurance, and other perks and privileges, but at some point, you might decide you

How the Annual Travel Credit on Premium Credit Cards Can Pay Off

You might be taken aback by the $450-$550 price tag on a premium credit card, but you need to weigh the benefits to see if the fee is worth it. One of the biggest payoffs beyond the sign-up bonus the first year is the annual travel credit one gets with a premium card. When you put that together with lounge access and the other benefits these cards offer you might find the card not only pays for itself but gives you extra funds for travel.

Comparing Premium Travel Rewards Cards

Competition in the

Speed Through Airport Security with Clear

If you’re looking to breeze through airport security, then you may want to consider signing up for Clear.

Similar to Global Entry, in the sense that you’ll be able to verify your identity at a kiosk and avoid waiting in line to have your ID checked by the TSA, this program is expanding to several new airports nationwide. Clear allows members to leave their ID at home as your identity is used by verifying either a fingerprint or iris scan.

These Credit Cards Offer Special Savings on Your Next Hotel Stay

RewardExpert is dedicated to helping you earn free travel with airline miles and points, which can be earned more easily using certain credit cards. But did you know that these same cards sometimes provide special discounts and promotions when you book a hotel?

Premium Credit Card Comparison: Chase Sapphire Reserve vs. Citi Prestige vs. Amex Platinum

Now that Chase has entered the premium segment of the credit card market with its new Sapphire Reserve card, it’s time for a comparison of the premium offerings from the three primary travel rewards credit card issuers, Chase, Citi and Amex. We rank each of these cards in a variety of categories and come up with a winner.

The Best Credit Cards to Get to Europe With Miles

Are you planning a trip to Europe? Do you want to save some money and fly there for nearly free? The quickest way to do that is to

Should I Pay for a High Annual Fee Card: Amex Platinum vs. Citi Prestige

There are so many

FF News: Bye Citi Prestige Lounges, Hello PreCheck and AA Changes

Admirals Club access for Citi Prestige

If you hold the Citi Prestige card, you’re about to lose an important benefit. Starting July 23, 2017, American Airlines Admirals Club access will no longer be a feature of the card. Of course, there is still Priority Pass membership as a benefit, which provides access to hundreds of lounges, but there are not as many in the U.S. For the $450 annual fee, this is a big loss for domestic travelers that fly American frequently.

How to Choose a Credit Card With No Foreign Transaction Fee

If you often travel abroad, or if you’re planning a big trip to a foreign country, you’ll need a

Guide to Getting and Using Citi ThankYou Points

In the world of

Best Credit Cards for Free Access to Airport Lounges

An airport lounge is a great environment to enjoy while you’re waiting for your boarding announcement. At the very least, you get a comfortable and quiet seating area with free coffee, soft drinks, snacks and WiFi. Some lounges also have showers and quiet areas. High-end lounges can be quite luxurious and offer striking design, gourmet food, top-shelf alcohol and even day beds that can be a rather attractive feature for a weary traveler during a long transit.

Which Premium Citi Card Is Right for You: Prestige vs AAdvantage Executive World Elite?

Citi offers two premium travel cards, the Prestige and the Citi® / AAdvantage® Executive World Elite Mastercard®. If you travel often and are considering a high-end rewards card, they’re both great options.

The Top Premium Credit Cards For Getting Airport Lounge Access

There is nothing better than spending some time in a lounge when your traveling and between flights, whether you’re looking to relax, score some food, grab a shower or even book a massage.

Citi Prestige® Credit Card Review: No longer available but worth keeping

Who Is the Citi Prestige® Credit Card Good For?

Citi Prestige® Credit Card is an upscale premium travel reward card that is comparable to the American Express Platinum Card®. It has many similar travel benefits, and quite hefty $495 annual fee. The Citi card is no longer accepting new applications, but current cardholders still enjoy its outstanding perks, particularly those who travel a lot.

For starters, cardholders are reimbursed for Global Entry application fees. If you fly frequently, Global Entry will save you a lot of time in airport security lines. It guarantees you a coveted spot in a TSA Precheck line, and you will be able to skip immigration lines on your return home from international destinations.

Cardholders also receive a Priority Pass Select membership, which gives you free access to one of the best airport lounge programs available today. It’s good for you plus your family or two guests, and membership can be extended to authorized users for $50 each.

The Prestige card comes with some other great benefits, such as a $250 annual credit toward air travel and a free fourth hotel night. In addition to the airlines listed below, you can transfer points to your ALL – Accor Live Limitless, Choice Privileges®, Leaders Club, and Wyndham Rewards® account.

| AIRLINE TRANSFER PARTNERS | Aeromexico Avianca LifeMiles Air France KLM Cathay Pacific Etihad Guest EVA Air Emirates Skywards JetBlue TrueBlue Qantas Qatar Airways Singapore Airlines Thai Airways Turkish Airlines Virgin Atlantic |

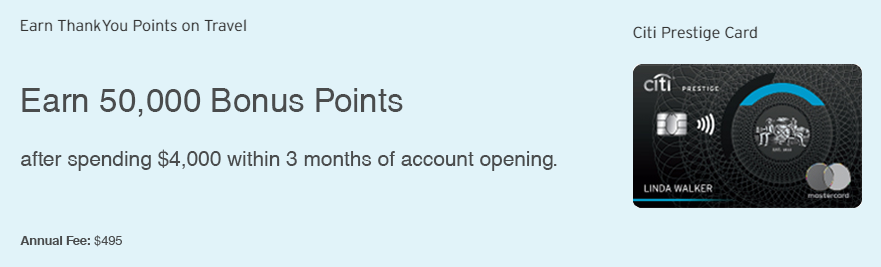

| ANNUAL FEE | $495 |

| Recommended Credit Score | 750+ |

| Type of Card | World Elite MasterCard |

| ISSUER | CitiBank |

Sign-Up Bonus:

Although the Citi Prestige isn’t currently available to new applicants, previously, the card’s sign-up bonus was 50,000 points after spending $4,000 in the first three months.

Miles Earned:

- 5 points per dollar on restaurants and air travel

- 3 points per dollar spent on hotels and cruise lines

- One point for everything else

What Do Your Points Get You?

Citi ThankYou is an incredibly flexible program. It’s the only major travel reward program that allows you to share points with other members.

This is a fantastic benefit, especially considering that other reward programs are adding more restrictions to prevent people from sharing points and miles. Shared points expire in 90 days, so don’t transfer unless you or your friends or family are ready to use them.

You can redeem your points for air travel online through the Citi ThankYou Travel Center at a value of 1.33 cents per point.

While none of the airline transfer partners are based in the U.S., each carrier is either a member of a major alliance or has powerful partners of its own. That means you’ll be able to redeem miles on dozens of airlines all over the world, including all of the major U.S. carriers.

Some of the airline partners are also the most desirable and luxurious carriers in the world, including Cathay Pacific, Singapore Airlines, Etihad and Qatar Airways. These are an excellent option if you want to fly in business or first class.

Usage Perks

- $250 annual credit for airline purchases

- Points can be transferred to anyone with a ThankYou account

- Free airport lounge access

- Points can be earned through banking

- Multiple airline transfer partners

- A 35 percent bonus when redeeming points for flights through the ThankYou Travel Center

- $100 credit toward Global Entry application fees

- Free fourth night at hotels booked through ThankYou.com

- Three free rounds of golf annually when booked through Citi’s golf portal

Usage Quirks

- High annual fee

- Shared ThankYou points expire in 90 days

- No major U.S. airline partners

- Most airline partners add fuel surcharges to award flights

How Far Do Your Points Go?

If you’re interested in premium class travel, one of the best ways to experience ultimate luxury is with Singapore Airlines’ First Suite. It’s best to transfer your ThankYou points to Singapore’s loyalty program, KrisFlyer, because it offers a 15 percent discount to members booking award flights online.With the discount, you can fly one way between New York and Frankfurt, or Houston and Moscow, in the carrier’s extravagant First Suite for 57,375 miles and $203 in taxes and fuel surcharges.

Additional Cardholder Benefits:

- Special bonuses for Citi banking

- 24/7 customer service

- Citi® Concierge

- Citi Entertainment®

- Zero liability

- No foreign transaction fees