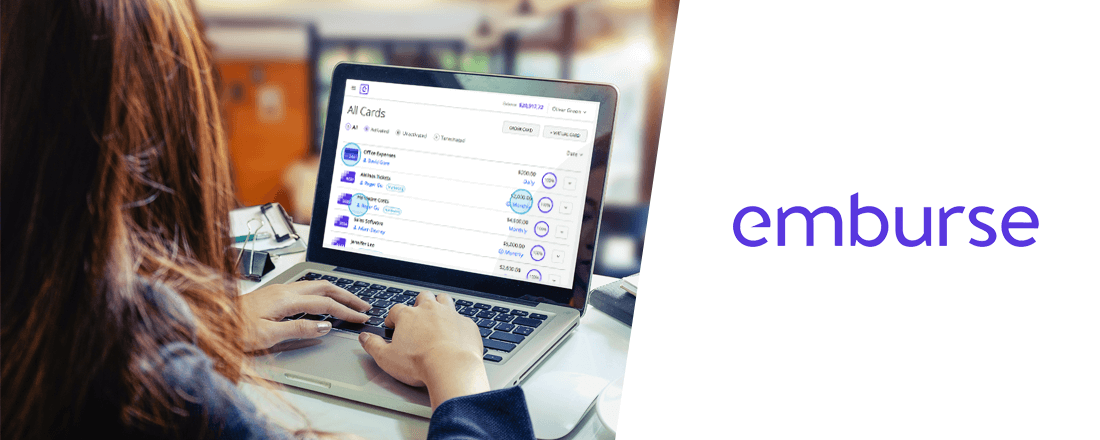

Most CFOs have run into this problem: they wait endlessly for employees to submit expense reports, and then they’re blindsided by charges that go beyond what the company has budgeted for. What’s the solution? Is it better to have employees use their personal credit cards for company expenses—even though management won’t know how much liability is outstanding until expense reports are submitted—or should employees be given corporate cards, providing real-time transparency around exactly how much is being spent, and where?

Earnin Makes Everyday Payday

Ever wish you could get paid for the time you have already worked and not have to wait for payday? Earnin is the company that is making that happen. Thousands of big name employers are signing on as well, including AT&T, Starbucks and WalMart. They find benefit in the fact that there’s no extra paperwork, no payroll modifications, no change in cash flow, and it’s free for the company. Employees simply enroll in the program and link their bank account.