The airlines are making a killing by charging us for checked bags. In 2017, airlines made over $4.5 billion from this additional source of revenue. Now, checking a bag is getting more expensive for travelers because United and JetBlue are increasing the first checked bag fees from $25 to $30. And the other airlines are sure to follow.

This article will cover

- Why Airlines Charge for Checked Bags

- How to Avoid Checked Bag Fees When You Fly

- Which Credit Cards Offer a Free Checked Bag Benefit?

- Which Credit Cards Offer Travel Credits?

- 9 Reasons Why You’ll Still Get Charged to Check a Bag

- How to Avoid Paying for Checked Bags

One of the ways that travelers avoid checked bag fees is by applying for the airline’s co-branded credit card for the free checked bag benefit. But did you know that you can still get charged for checking your bag, even if you are supposed to get it for free? Here’s why the free checked bag benefit doesn’t always mean “free.”

Why Airlines Charge for Checked Bags

For many years, airlines used to include many of today’s upcharges in the price of an airplane ticket. Over time, operating costs have risen as wages have increased and barrels of oil have gone up.

So, airlines started to break apart the price of airplane tickets in order to keep prices low for people who didn’t need all of the extras, then charge people who actually needed them.

From a pure economics standpoint, it makes sense. But, when you’re a traveler that has to pay extra, you certainly don’t like it.

How to Avoid Checked Bag Fees When You Fly

You can get a free checked bag when you fly in one of several ways. My favorite is to fly with someone like Southwest Airlines that doesn’t have checked bag fees. But, that’s not always an option.

Have Elite Status

Airlines reward travelers who fly with them on a frequent basis with elite status. One of the benefits of elite status is free checked bags. For example, Delta Airlines has four levels of elite status – Silver, Gold, Platinum, and Diamond. Each level of status offers free checked bags as a perk.

Fly Premium Class

When you buy a more expensive ticket, you can check bags for free. With Delta, you can get two free checked bags if you are flying First Class, Delta Premium Select, or Delta One. Additionally, the bag can weigh up to 70 pounds with these premium tickets.

Travel light

Plain and simple – don’t overpack. Even when you check a bag (whether you paid a fee or it was free), you’ll be charged extra if your bag weighs more than 50 pounds.

If you absolutely need to carry something heavy, bring it with you in your carry-on bag or personal item. There are no weight restrictions for bags that you bring onto the aircraft.

Combine Bags

Does everyone really need to have their own suitcase? If you can combine your clothes and other goodies into fewer bags, that will help avoid unnecessary bag fees. For example, when Anna and I travel together, we’ll just use one suitcase instead of two.

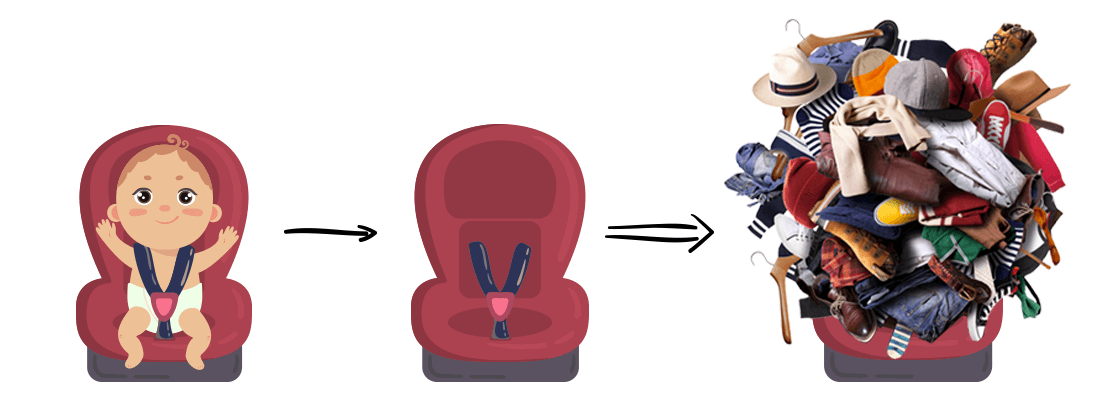

Use Car Seat Bags

When traveling with small children, you can check your stroller and car seat for free on most airlines. We purchased a car seat bag to protect the car seat from damage and dirt. As a side benefit, this forms a cocoon with a big empty space, where the child would normally be, that you can use to pack clothes, diapers, and other travel needs.

Bring Your Bag Onboard with You

I usually bring my suitcase onto the plane and put it in one of the overhead bins. However, with airlines charging checked bag fees, more people are doing the same to avoid the fees.

This is why priority boarding is more important than ever. The sooner you board, the higher your chances of finding room in the overhead bin.

If you’re one of the last people to board, most likely you’ll need to check your bag. Here’s a list of the

Get the Airline’s Co-branded Credit Card

I usually recommend people get the airline’s co-branded credit card to avoid checked bag fees.

As long as you pay for your ticket with the airline’s credit card, then you can check your bag for free. The benefit will also usually extend to other travelers who are on the same itinerary.

Use a Credit Card that Offers Travel Credits

Today, most travelers use many different airlines when they fly. For them, a credit card that offers travel credits that can be used to pay for checked bag fees can be a better way to go.

One of my favorites is the Capital One Venture Card, which provides a $500 welcome bonus and an unlimited 2% back on every purchase. Best of all, these travel credits can be used on any airline and there are no blackout dates.

Which Credit Cards Offer a Free Checked Bag Benefit?

There are many credit cards that offer a free checked bag benefit. Here are some of my favorites:

American Airlines

Several American Airlines credit cards from Citibank offer a free checked bag benefit. The no annual fee Citi AAdvantage MileUp Card does not waive checked bag fees.

- Citi® / AAdvantage® Executive World Elite™ Mastercard® offers one free checked bag for you and up to 8 travel companions.

- CCiti® / AAdvantage® Platinum Select® World Elite™ Mastercard® waives the checked bag fee for you and up to 4 companions on your first bag.

- CitiBusiness® / AAdvantage® Platinum Select® Mastercard® provides one checked bag for free for you and up to 4 companions.

Delta Airlines

Each of these Delta Airlines co-branded credit cards listed below offers one complimentary checked bag for you and up to 8 companions traveling on the same itinerary. The American Express Delta Blue SkyMiles Card does not waive the checked bag fee at all.

- American Express Gold Delta SkyMiles Credit Card (click here for business version)

- American Express Platinum Delta SkyMiles Credit Card (click here for business version)

- Delta Reserve Credit Card from American Express (click here for business version)

JetBlue

Barclays offers two credit cards for JetBlue, but only one of them offers to waive checked bag fees for cardholders.

- The JetBlue Plus Card will waive the first checked bag fee for you and up to 3 companions.

Southwest Airlines

Southwest Airlines provides two checked bags for free with every ticket. However, if your bag weighs too much, you will be charged. The Chase Southwest Rapid Rewards Priority Card offers a $75 annual travel credit that can be used to pay for plane tickets or fees that you may be charged.

United Airlines

Chase offers the co-branded United Airlines credit cards. The free checked bag benefit varies based upon which credit card you have. However, the United free checked bag benefits is the least generous of all of the major airlines. Two of the United card options – the United TravelBank Card and the MileagePlus GO Visa Prepaid Card – do not waive checked bag fees at all.

- Chase United Explorer Card will waive the checked bag fees for the cardholder and one companion.

- The Chase United MileagePlus Club Card offers a free first AND second checked bag for the cardholder and companion.

For both of these credit cards, the business version matches the same free checked bag benefits of the personal card.

Which Credit Cards Offer Travel Credits?

Since I tend to fly whichever airline can get me there the cheapest and in the least amount of time, I need something that can be used to pay checked bag fees no matter which airline I’m flying. Here are some of my favorites.

Capital One Venture Card

Annual Fee: $0 intro for the first year, $95 after that

Capital One is becoming very popular with the flexibility of their Capital One Venture Card. Not only does it offer a solid $500 intro bonus, the travel credits earned from the unlimited 2% cash back can be used for any airline without blackout dates. Whether I’m paying for a plane ticket or a checked bag fee, this credit card has my back.

American Express Platinum Credit Card

Annual Fee: $550

The American Express Platinum Card offers $200 in annual travel credits that can be used to pay for fees, such as the checked bag fee. The limitation is that you have to pick one airline at the beginning of the year and the travel credit cannot be used for any other airline besides the one you picked. Amex is behind the times here considering how flexible their premium credit card competitors are with their benefits.

Chase Sapphire Reserve

Annual Fee: $450

The Chase Sapphire Reserve provides $300 in annual travel credits that can be used to purchase plane tickets, book hotel reservations, or pay for fees, such as the checked bag fee. The card does charge a $450 annual fee, so many cardholders just see the $300 as a rebate of what they’ve already paid to reduce the net cost of the credit card to $150.

Citi Prestige Credit Card

Annual Fee: $450

Unfortunately, the Citi Prestige credit card has been removed from the Citibank website. Rumors are that they are updating the benefits and will release the card again soon. For Citi Prestige cardholders like me, there is a $250 annual air travel credit that can be used to book flights and pay for airline fees, like checked bag fees. This credit also has an annual fee of $450, which is $200 after factoring in the air travel credits.

Discover it Miles Card

Annual Fee: $0

Discover it Miles is a

9 Reasons Why You’ll Still Get Charged to Check a Bag

Even when you think you’re following the rules, it is still possible to get charged a checked bag fee. And when you’re trying to stick to a travel budget, this extra fees can add up quickly and be extremely frustrating.

1. Your bag weighs too much

When you check a bag, the limit is usually 50 pounds. If you go over this limit, then you’ll be paying an over-the-limit checked bag fee, even if you have the airline’s co-branded credit card that provides a free checked bag.

2. You didn’t buy your ticket with the airline’s credit card

One of the restrictions of the free checked bag benefit is that you have to buy your airplane ticket with the co-branded credit card from the airline’s website. If you didn’t, then you are out of luck.

3. Your credit card hasn’t been open long enough

There’s always a loophole. For the Citi AAdvantage Platinum Select World Elite Mastercard, the fine print says that the “account must be open 7 days prior to air travel.”

4. You bought a Basic Economy ticket

Airlines are starting to reverse this rule, but when Basic Economy was first launched, you would get charged a checked bag fee even if you had the airline’s co-branded credit card that offered a free checked bag.

5. You’re traveling with too many people

The number of free checked bags will vary based upon which of the airline’s co-branded credit cards that you have. The waived checked bag benefit ranges from one to eight companions, depending upon the card.

Some airline credit cards don’t offer this benefit at all. If you aren’t paying an annual fee for your airline credit card, you won’t get to check bags for free.

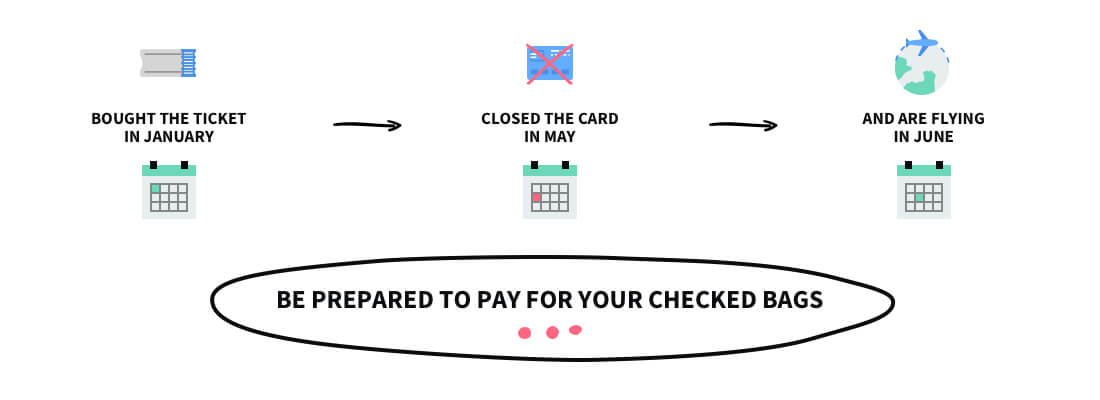

6. You closed the credit card that paid for your flight

Another restriction is that your airline co-branded credit card must still be open when you take your flight. If you bought the ticket in January, closed the card in May, and are flying in June, be prepared to pay for your checked bags.

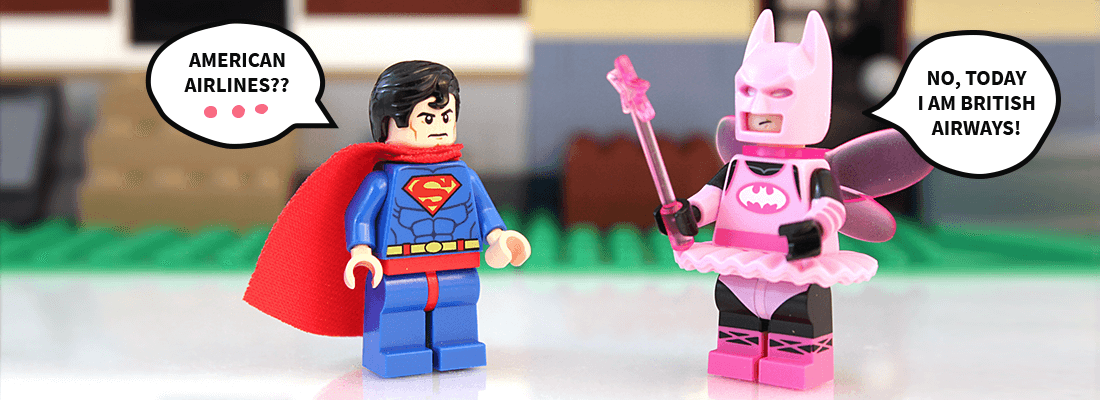

7. You’re flying with a partner airline

Just because you bought a ticket from one airline, it doesn’t mean that you’ll actually be flying on that airline. Airlines partner with each other to reduce costs and increase sales. This is known as a “codeshare flight.” If you bought your ticket with a Citi AAdvantage Platinum Select World Elite Mastercard, watch out because “(t)his benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline.”

8. You’re flying internationally

International flights can also hit you with unexpected fees. I chose to fly American Airlines for a business conference in the Bahamas. It was at an awesome resort, so I brought along my drone to take some video. Flying home, I was forced to check my bag because you can’t have both the batteries and the drone with you.

When I checked my bag, I expected the bag to be free because I paid with my Citi AAdvantage Platinum Select World Elite Mastercard. But, the ticket agent said no, the free checked bag benefit does not apply when flying internationally. Sure enough, when I got home, I looked at the credit card fine print and saw that the benefit is only “when traveling on domestic itineraries.“

9. You’re flying a discount airline

Discount airlines are notorious for charging you for everything imaginable. Checked bags are no exception. Whether you’re flying Spirit or Frontier in the United States or Norwegian or RyanAir overseas, be prepared to pay to check your bags.

How to Avoid Paying for Checked Bags

Unfortunately, just because your credit card offers free checked bags as a benefit, it doesn’t mean that the checked bag fees will be waived. The good thing is that there are still many ways to avoid paying for checked bags. I try to pack light and only bring a carry-on, but there are still times when you need to check a bag. Although I have several airline co-branded credit cards, I always have my Capital One Venture Card with me when I fly in case the airline tries to hit me with a checked bag fee.

How do you avoid paying checked bag fees? Let us know in the comment section below.